The purported “deal” between the Kenya Airports Authority and Adani Airport Holdings Ltd of India could soon become a major scandal.

Public outrage has erupted over the lack of transparency in the proposed Sh230 billion public-private partnership between the government and Adani to upgrade Jomo Kenyatta International Airport (JKIA).

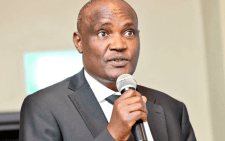

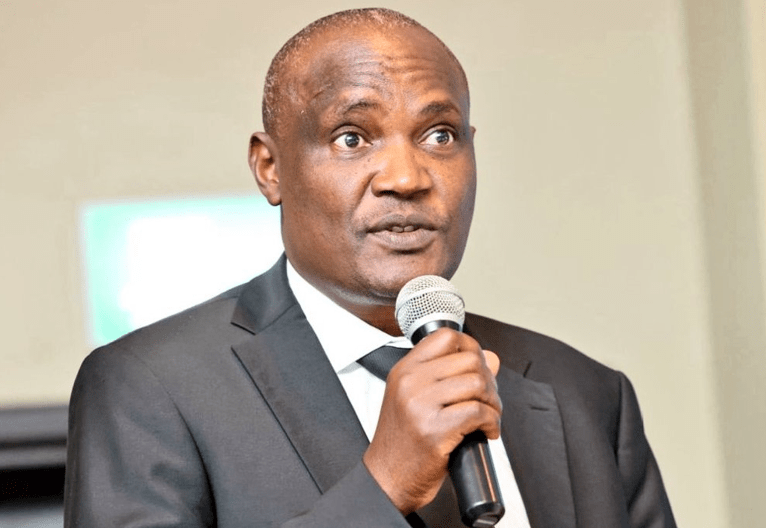

Matters reached the boiling point when Roads and Transport Cabinet Secretary Davis Chirchir appeared before a Senate committee to answer questions on the opacity and integrity issues surrounding the deal.

Chirchir was hard-pressed to respond to queries relating to the planned takeover of JKIA, a strategic national asset. Before the matter reached the Senate, public uproar had reached a crescendo.

There is increasing alarm from the public and financial experts over suspected shady dealings and the whiff of corruption involving billions of shillings in national coffers raised from taxing citizens.

Such has been the intensity of the concerns in the wake of the previous controversial Goldenberg, Anglo Leasing and Eurobond scandals, with Indian billionaire Gautam Adani’s firm now threatening to join that list.

For all its supposed “great benefits for a modernised facility to balance capacity leading to operational excellence and regional competitiveness as an aviation hub,” to the public, the Adani “deal” reeks of a scandal!

Last Wednesday, the High Court temporarily blocked the proposed deal to lease JKIA to Adani for 30 years in exchange for expanding it. The Law Society of Kenya and the Kenya Human Rights Commission had told the court Kenya could independently raise the Sh230 billion required to upgrade the airport.

They argued that the “deal” did not include public participation, was unaffordable, threatened job losses, was a fiscal risk and did not offer taxpayers value for money.

The controversial Adani bid invokes sharper scrutiny and accountability of President William Ruto’s management of the economy and privatisation of State assets.

Chirchir put up a spirited defence of the planned takeover of JKIA, denying the existence of a concession deal with Adani.

However, Senators Edwin Sifuna, Ledama ole Kina, Okiya Omtatah, Ali Roba and Richard Onyonka poked holes in his argument, saying the plan lacked merit, had flouted procurement laws and that no proper due diligence was conducted.

They called for the cancellation of the plan due to the many integrity issues, including money laundering, raised over the Adani Group’s activities across many countries and in its native India.

Senator Cherargei was more categorical, asking Chirchir to cancel the deal as Adani denied fresh allegations that Swiss authorities had frozen $310 million in the group’s bank accounts, adding that President Ruto would understand the reason.

Chirchir earlier angered senators when he first appeared before the committee on Thursday and failed to produce the necessary documents on the proposed leasing of JKIA to Adani.

He, however, provided the documents when he appeared before the committee on Friday after a ruling by its chairman Karungo Thangwa.

One senator sensationally claimed there were contractual agreements between Adani and the government to supply power through the Kenya Electricity Transmission Company, acquire Kenya Electricity Generating Company (KenGen) and run the new Social Health Insurance Fund.

The Adani-JKIA controversy continues this week when Treasury CS John Mbadi and Public Procurement Regulatory Authority Director-General Hasnat Ahmed Qureshi are expected to appear before the Senate committee.

Chirchir’s predecessor, Kipchumba Murkomen, a key player in the saga, could also be summoned.

-The writer comments on economic affairs; [email protected]–