Kenya must quickly exit FATF grey list

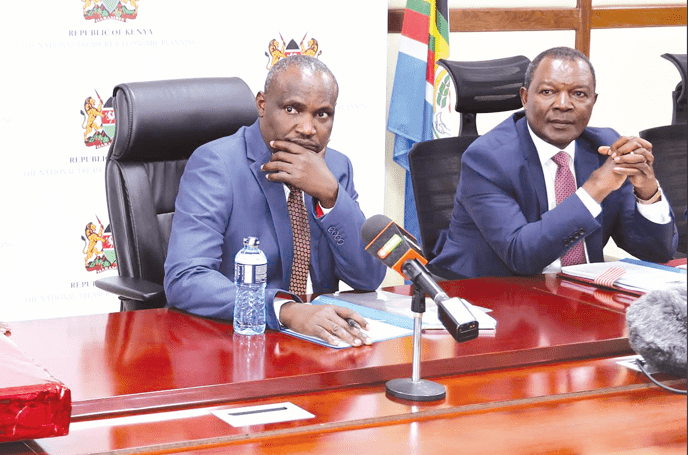

Former Treasury Cabinet Secretary Njuguna Ndung’u’s call for a swift exit from the Financial Action Task Force (FATF) grey list highlights the urgent need for Kenya to address its deficiencies in anti-money laundering (AML) and counter-terrorism financing (CTF) frameworks.

His concerns, based on his deep understanding of Kenya’s financial landscape as former Treasury CS serve as a critical warning that the administration must heed. The anti-money laundering watchdog placed the country on its grey list for the second time on February 23, 2024, having first found itself on the list back in 2010.

The greylisting on the FATF is more than just a bureaucratic designation; it poses severe risks to Kenya’s economy, international reputation and development.

According to Global Financial Integrity (GFI) research, Kenya loses billions of shillings annually due to due illicit financial flows. These losses deprive the nation of crucial revenue.

This also means the country’s financial system is now under heightened international scrutiny, signalling to the global community that Kenya’s AML and CTF measures are inadequate. This perception can have profound implications, particularly in deterring foreign direct investment (FDI).

Investors are often reluctant to engage with countries labelled as high-risk, fearing potential financial instability and regulatory complications. As Kenya strives to attract investment to fuel its economic growth, the greylisting becomes a formidable barrier.

The financial sector in Kenya also bears the brunt of this greylisting as banks and financial institutions face increased due diligence requirements when interacting with international partners, which raises the cost of doing business.

Moreover, the grey listing underscores Kenya’s ongoing struggle to combat illicit financial flows (IFFs) effectively. The country loses billions of shillings annually due to IFFs, depriving the government of crucial revenue needed for development.

Kenya must take immediate and comprehensive action, including bolstering the institutional capacity of financial regulators, improving coordination among relevant agencies, and ensuring that robust legal and regulatory frameworks are in place and effectively enforced.

Exiting the grey list is not just a financial necessity but a national call that requires the concerted effort of all stakeholders for posterity.