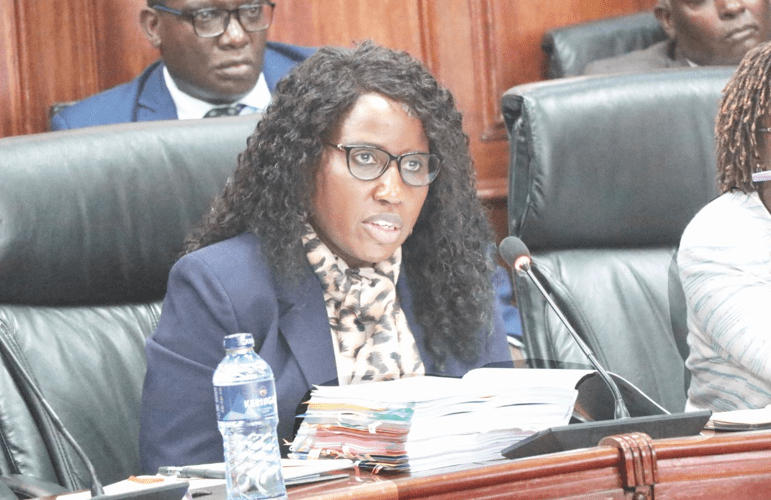

Treasury CS proposes one-year amnesty for tax defaulters

Treasury Cabinet Secretary Njuguna Ndung’u has vouched for a one-year tax amnesty for defaulters, as part of efforts to meet the Sh2.57 trillion ordinary revenues the Government intends to collect in the 2023/24 Financial Year.

Tax amnesties benefit taxpayers by reducing their tax liabilities and giving them criminal immunities. They also provide benefits for the tax administration, particularly in terms of tax revenues they bring in the future.

Njuguna, in his budget speech on Thursday last week, urged the National Assembly to amend the Tax Procedure Act 2015 to introduce a one-year tax amnesty on penalties and interest on the accrued tax debts up to December 31, 2022.

“In order to benefit from the amnesty, taxpayers will be expected to clear principal taxes between September 1, 2023 and June 30, 2024. I urge taxpayers to take advantage of the one-year amnesty to clean their tax ledgers by paying all tax arrears,” Njuguna said.

Parliament is expected to debate the new Budget measures that will raise the prices of food and other basic commodities, even as civil servants demand higher pay to cope with rising living costs Kenyans are currently experiencing.

The CS has doubled Value Added Tax on fuel from eight to 16 per cent, a move that will increase prices on all commodities.

The Kenya Revenue Authority (KRA) is yet to release the comprehensive tax collected for the Financial Year ending June 30, 2023.

However, as of the quarter ended December 2022, the taxman had collected 49 per cent of taxes in ordinary revenue of the projected revenue.

“Though robust, it was below the 50 per cent to be collected for the full amount,” Ronny Chokaa, a macro-economic analyst at Investment banker Genghis Capital said.

Chokaa attributed apathy to tax amnesty largely to lack of extensive education which led to lack of understanding for individuals remitting their taxes.

By close of March 2023, KRA said its average collection averaged 95.1 per cent on the original target of 93.4 per cent on target, representing a collection of Sh1.554 billion and eight per cent year on year growth.

In July last year, the taxman was given authority under the Finance Act 2022 to dispose properties of tax defaulters’ through public auction or private treaty within two months of notifying the taxpayer in a bid to increase revenue collection.

Specifically, KRA said it would target land, building, aircraft, ship, motor vehicles, or property that the authority deemed sufficient to serve as security for unpaid taxes.

Other amendments to the Act Njuguna requested the National Assembly to consider included the requirement for all trustees administering trust to maintain and avail records required by the authority to ascertain the tax payable on the income paid to beneficiaries of Trusts.

Proposed new Act also requires tax payers to issue electronically generated tax invoices that can be traced through an electronic tax invoice management system.