Sacco assets defy Covid-19 restrictive protocols to rise 13pc

Financial co-operatives performed relatively well despite the economic slowdown induced by the Covid-19 restrictive protocols.

Data from the Sacco Societies Authority (Sasra) indicated that the Saccos recorded impressive growth in loan disbursement, assets and deposits.

Co-operative Alliance of Kenya (CAK), the umbrella body of co-operative societies, explained that gross loans advanced to customers by the savings and credit co-operative societies (Saccos) increased by 13.2 per cent to Sh474.8 billion as at the end of 2020.

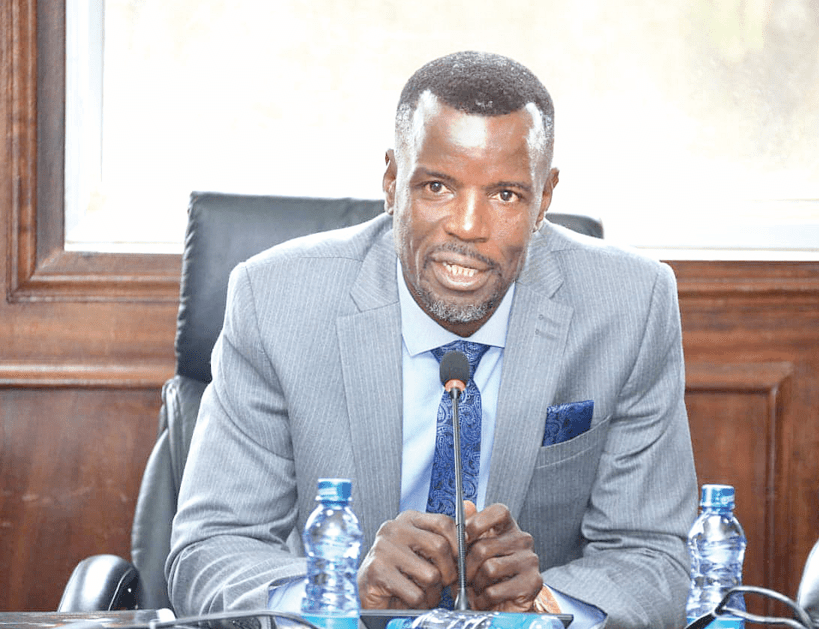

“Loans increased from Sh419.6 billion recorded in the 2019 financial year during the Covid-19 period,” Daniel Marube, CAK chief executive said.

Co-operatives Day

He was speaking during a media conference on the upcoming International Day of Cooperatives celebrations in Nairobi yesterday.

The celebrations set to be help on July 3, 2021 will be marked virtually owing to the Covid-19 protocols.

Marube said that deposits held by deposit taking Sacco’s (DTS) grew by 13.4 per cent to Sh431.5 billion by the close of 2020, from Sh380.4 billion recorded in 2019.

Total assets at the end of 2020 increased to Sh627.7 billion, compared to Sh556.7 billion at the end of 2019, accounting for 12.7 per cent increase.

However, non-performing loans portfolio (NPL) for DT Saccos increased to Sh36.1 billion in 2020, representing 8.4 per cent of the total portfolio. This is a sharp rise from 6.15 per cent or Sh25.8 billion recorded at the end of 2019.

Restructured loans grew to Sh7.7 billion as at December 31,2020 from Sh2 billion recorded in March 2020 before the emergence of the Covid-19, according to Marube.

He noted that the impressive growth followed intensive product development and heavy investment in Information C=ommunication Technology.

“Where most members used to flock the halls to access loans, repay loans and even seek their account balances, today these services are available through ICT platforms,” said Marube

He added that adoption of modern technology has enhanced efficiency in service delivery and prudent use of human and other resources, with some working from home, the spiral effect of which is increased efficiency in service delivery.