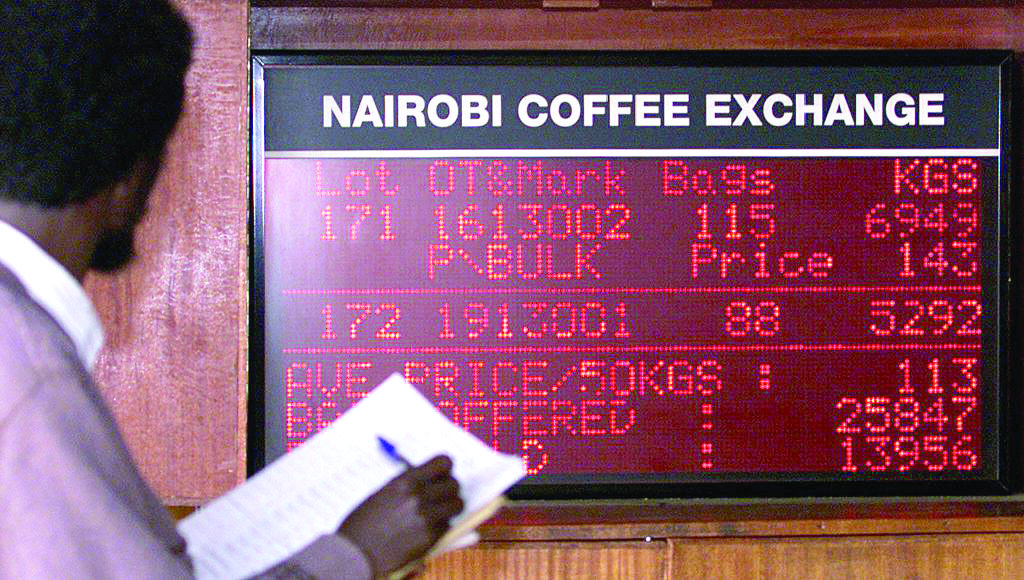

Nairobi Coffee Exchange stares at tough new rules

Capital Markets Authority (CMA) has approved Nairobi Coffee Exchange Limited (NCE) Trading Rules, 2024, heralding a new tradeoff regime coupled with tough penalties in the event of violating the rules. In a move aimed at taming malpractices at the NCE trading floor, principal users, mainly the brokers and buyers, risk losing their licenses should they interrupt the sanctioned regulations under the specified period.

Lisper Ndung’u, NCE chief executive has through a circular copied to all principal users of the auction, directed that all transactions going forward will be undertaken under the new rules. The publication of the new trading rules, Ndung’u confirmed followed an extensive engagement with the stakeholders and subsequent agreement of the same.

“The exchange hereby wishes to notify the principal users of the trading floor that after the stakeholders’ engagements and review of the comments submitted by the stakeholders on the revised trading rules of the exchange, the CMA has granted an approval on the NCE Trading Rules 2024,” said Ndung’u.

Regulations 2020

She added: “Please note that henceforth trading at NCE will be under trading rules already issued. The trading rules are anchored on the Crops (Coffee) (General) Regulations, 2019 and Capital Markets (Coffee Exchange) Regulations 2020.

The CMA Exchange Regulations were put in place following recommendations by the 2016 Prof Joseph Kieyah-led National Task Force on Coffee Sub-sector Reforms appointed by the then President Uhuru Kenyatta.

Under the new regulations, the exchange will be managed by a board of directors established under Memorandum of Association and Articles of Association Part III section 3 and appointed in line with the provisions of the Capital Markets Authority Act Cap 485(A) Part II Clause 10.

She assured of the exchange commitment to promoting continued engagements with all stakeholders to ensure the effective implementation and operation of the rules. “Your feedback and collaboration are invaluable as we strive to enhance the market,” Ndungu added.

Coffee millers, roasters and buyers will pay an auction levy, a few charges per 60-kilogramme bag of coffee or other less volume of coffee sold at a coffee exchange.Ndung’u explained that the direct settlement system (DSS) of payment of coffee proceeds has been put in place and it will be charged with managing a settlement account where all coffee buyers will deposit the coffee sales proceeds and shall settle the growers and their obligations in accordance to these rules.

On August 8,2023 NCE appointed the Co-operative Bank of Kenya as the provider of DSS to coffee value chain players after every sale in the country. Since then more than 13 billion has been remitted to the farmers through the system.

“Any bank charges incurred by the buyer or roaster upon making payment shall be settled by the buyer or roaster, grower or broker. A buyer or roaster who will not have settled his payments in full by the prompt date shall be considered a defaulter,” the regulations state in part.

Outstanding payments

It adds, in the event of default by a buyer or roaster to pay by the prompt date, the direct settlement bank shall immediately issue a notification of the outstanding payments and the interest rates chargeable to the defaulter with a copy to the broker and to the Exchange and the buyer or roaster shall be automatically suspended from participating on the trading floor until the buyer or roaster pays the outstanding amounts in full and the interest.