KPA stops credit terms in strategy to manage debt

Kenya Ports Authority (KPA) customers will no longer get credit services as all payments will be made in cash beginning next month.

The directive, which becomes effective July 1, means that KPA shipping lines and logistics firms must instantly settle all the port charges on a cash basis via bankers cheques, in a move that enables the authority to avoid credit-related liabilities going forward.

The move comes as the management of KPA takes measures to address the issue of outstanding debt owed by numerous customers, as the government prepares to lease key ports to the private sector.

Previously, the operators could pre-load money into their ledger-guaranteed accounts with KPA to cater for all port expenses like demurrage charges, freight costs, and storage fees, but still enjoyed the port services for weeks even when their accounts were depleted.

Ledger guaranteed accounts

KPA Managing Director (MD) William Ruto gave all customers up to the end of this month to settle outstanding debts and solve any dispute to avoid being denied access to port facilities and services.

“All customers with ledger guarantee accounts will automatically convert to cash accounts. Customers with ledger guaranteed accounts should ensure settlement of all pending or outstanding invoices before 30th June 2023,” Ruto said in a customer notice.

“The authority will recall all guarantees with banks after 30th June 2023. The management note that the outstanding debts have put a strain on its ability to continue meeting financial obligations.”

The new KPA’s directive will be clashing with the plans of the Public Sector Accounting Standards Board (PSASB) to have all the ministries, departments, and agencies (MDAs) transition from cash-based to accrual accounting, also from July 2023.

Domiciled under the National Treasury, PSASB wants the cash-based method to be phased out to enhance financial operations transparency, fiscal credibility, and tame corruption. Unlike accrual accounting, the cash method only tracks money that enters or leaves the account.

Change to cash

However, for KPA, experts sat that the new developmenty is likely to create more clogs at the port, especially over the weekends when the operators cannot access bank cheques, which can take up to three days to mature before port services are rendered.

This could leave importers facing more demurrage charges considering that most shipping lines dock over the weekend. The port of Mombasa, East Africa’s largest port, has been under intense competition from neighbouring Tanzania owing to its weak capacity.

Total cargo output at the Mombasa port shrunk by 2.9 per cent to 33.74 million metric tonnes as of December 2022 from 34.76 million tonnes a year before, pointing to increasing volumes through Dar es Salaam to the Central Corridor.

President William Ruto’s administration is now scouting investors to take over operations and management of five key ports through a public-private partnership (PPP) plan to shake off the threat from competition including Tanzania.

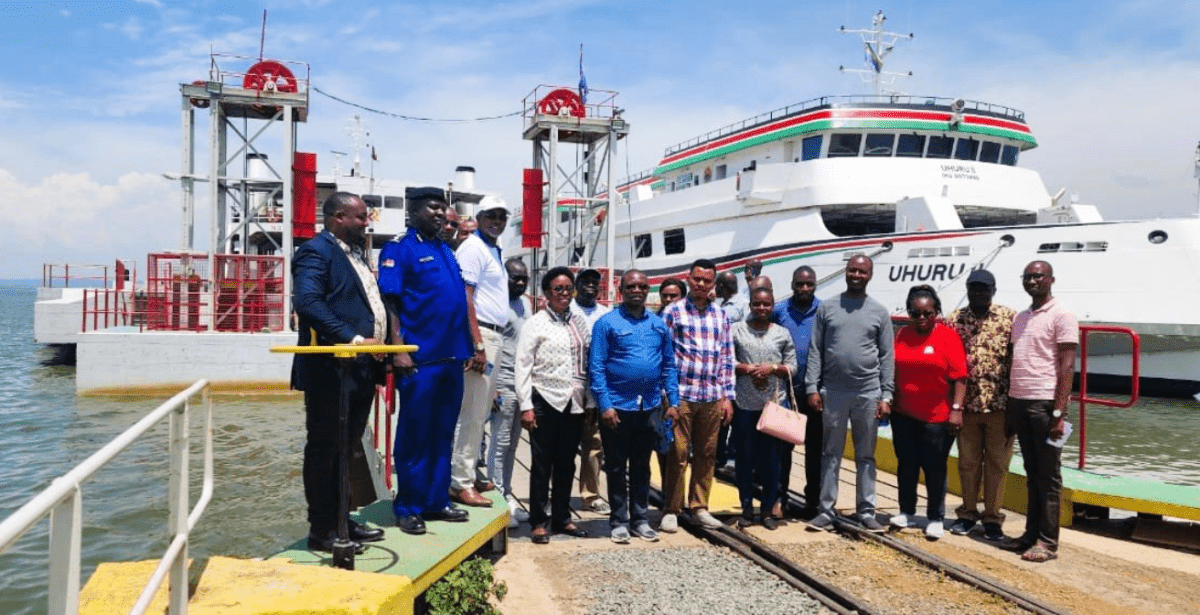

This will see private players run sections of Kilindini Harbour, Dongo Kundu Port, Lamu Port, Kisumu Port and Shimoni Fisheries Port to boost the transport and trading route in the Northern Corridor.

The Kenya Kwanza targets to raise $10 billion (1.39 trillion) through this PPP plan in what seems to be a U-turn from their stance during the election campaigns when the previous Jubilee regime also made a similar proposal but had not been implanted.

Ruto has committed to undertake numerous projects through PPP to create more revenue and ease pressure on the national exchequer.