Kenya races against time to wriggle out of ‘grey list’

Dark clouds continue to hang over the financial sector as the government seeks a way out of the so-called “grey list” of countries whose anti-money laundering and financing of terrorism laws are not up to international standards.

Kenya is on the Financial Action Task Force (FATF) grey list due to a concerning rise in illicit financial flows (IFFs). The anti-money laundering watchdog placed the country on its grey list for the second time on February 23, 2024, having first found itself on the list back in 2010.

This designation brings international scrutiny to the country, highlighting significant issues related to money laundering and terrorism financing.

According to Global Financial Integrity (GFI) research, Kenya loses billions of shillings annually due to IFFs. These losses deprive the nation of crucial revenue, hindering development efforts. The grey-listing by FATF subjects Kenya to heightened scrutiny, placing it alongside other nations facing similar challenges.

Early this year, the country asked for more time to seal loopholes that landed it in the “grey list”, even as it promised a “swift exit” ahead of a review that was expected in April.

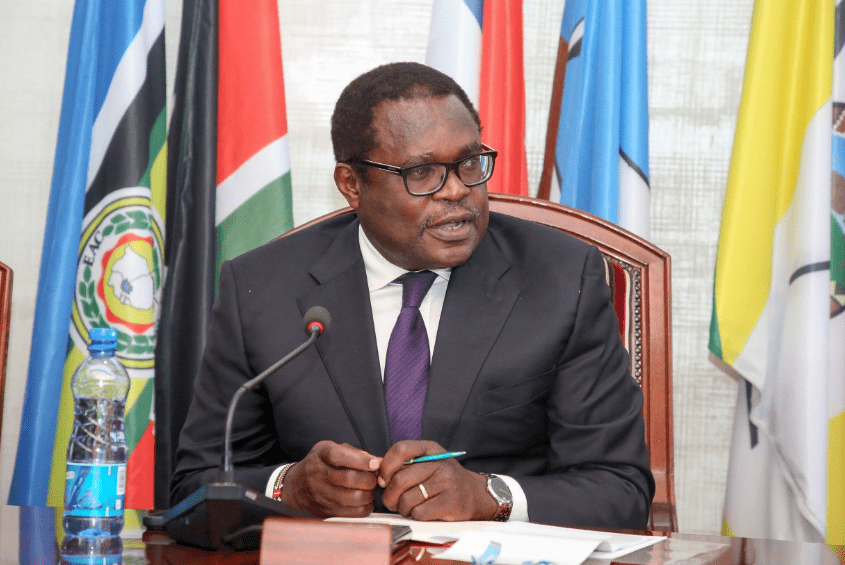

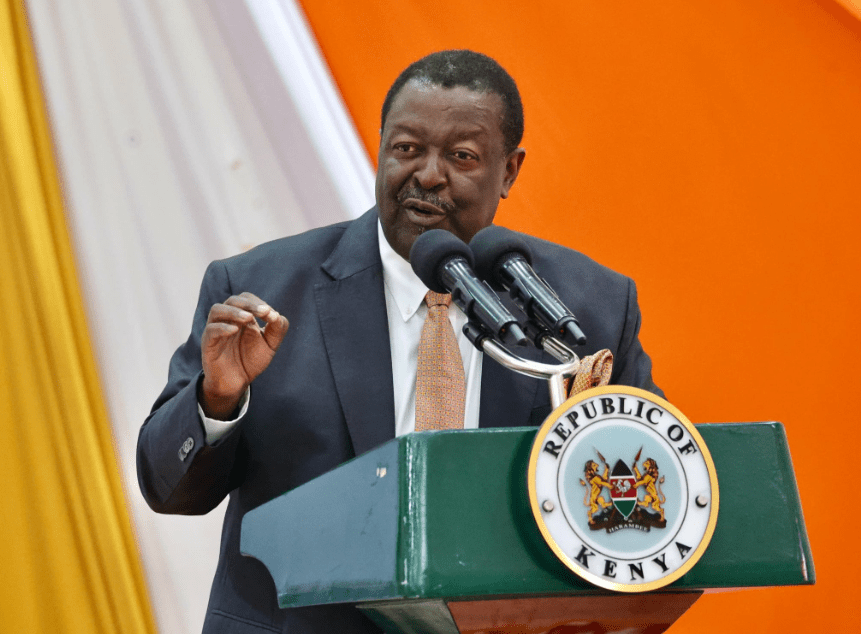

Prime Cabinet Secretary Musalia Mudavadi who is also Cabinet Secretary for Foreign and Diaspora Affairs told a meeting of European diplomats in March that Kenya had requested FATF for more time to completely tackle the deficiencies but hoping to exit the list soon.

He said while the government has put in place several measures to curb money laundering and financing of terrorism, it is still facing several challenges, for which it seeks the European Union’s help.

The National Risk Assessment on Money Laundering and Terrorism Financing of Legal Persons and Legal Arrangements in Kenya reveals that by December 2022, 690,222 private companies were registered in Kenya. Of these, 395 were linked to terrorism financing, and 10,733 were associated with money laundering.

Experts identify money laundering, corruption, tax evasion, and trade mis-invoicing as the primary drivers of IFFs in Kenya. Trade mis-invoicing, which involves falsifying the value of imported or exported goods, is a particularly prevalent issue.

Transfer of money

IFFs refer to the illegal transfer of money across borders, whether through corrupt practices, illicit sources, or unlawful uses. In Kenya, trusts and private companies are frequently used to launder money, outpacing public companies, foreign companies, partnerships, and other entities.

A report by the AU/ Economic Commission for Africa (ECA) estimates that Kenya lost approximately $1.51 billion (Sh194.7 billion) to trade mis-invoicing between 2002 and 2011. In 2020 alone, Sh384.3 billion was allegedly laundered through the Kenyan economy.

Another study funded by the Danish government highlights that Kenya’s tax loss due to trade mis-invoicing by multinational corporations and other parties could account for up to 8.3 per cent of government revenue, significantly hindering economic growth and resulting in billions of shillings in lost tax revenue.

The consequences of IFFs extend beyond stifling development efforts, with severe impacts on investment capital and revenue. In response, Tax Justice Network Africa (TJNA) and the African Union (AU) signed a memorandum of understanding (MoU) in 2023 to combat IFFs across the continent.

The MoU commits both organisations to advocate for common positions in global tax negotiations and IFF-related issues. For decades, the IMF has played a key role in international efforts to combat opaque and often destabilising transfers.

It also has longstanding concerns with flows that are not strictly illegal but are associated with tax avoidance.

The International Monetary Fund warns that illicit and tax avoidance related financial flows (ITAFF) have a significant impact on the economic stability of a country and the global financial system. They can drain foreign exchange reserves, distort competition, inflate prices for real estate and other assets, lower tax receipts, and reduce government revenue.

They divert resources from public spending and can cut into the capital available for private investment.