Kenya mulls new bonds to diversify financing sources

National Treasury Cabinet Secretary Njuguna Ndung’u says the government plans to slow down the uptake of new external commercial debt and undertake liability management operations through debt swaps and other innovative solutions.

This is as the government considers diversifying sources of financing through the issuance of Panda, Samurai and Sukuk bonds in financial markets in China, Japan and the Gulf regions, respectively.

Ndung’u said the government will maximise the use of concessional financing from bilateral and multilateral institutions to improve debt sustainability and boost Kenya’s credit rating position.

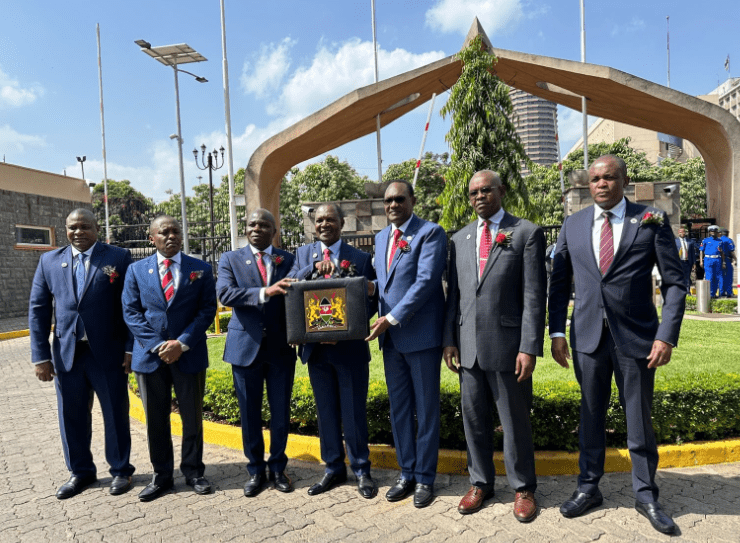

“Our Medium-Term Debt Management Strategy aims at lowering the costs and risks in the debt portfolio,” he said while reading the budget statement yesterday.

By March 2024, Kenya’s debt portfolio had hit Sh10 trillion with total public debt stands at an estimated 68 per cent of gross domestic product (GDP) for fiscal 2023/24, and is expected to fall to 64.8 per cent in 2024/25, according to the World Bank. Despite several measures that the government has taken to curb the escalating public debt, World Bank has warned that it will cost Kenya a slowed economy of about 5 per cent this year.

Similarly, the International Monetary Fund (IMF) said on Tuesday that core inflation in Kenya remains persistent adding that refinancing risks associated with the June 2024 Eurobond have dissipated following a successful partial buyback from the proceeds of a new Eurobond issuance in February.

IMF reported: “Despite these positive developments, a significant shortfall in tax revenue collection and deterioration in the primary fiscal balance in FY2023/24 relative to programme targets is expected to keep domestic borrowing needs elevated. As a result, interest payments have increased, putting pressure on public debt even after the latter benefited from a strengthened shilling.”

The Fund emphasized that steadfast implementation of a comprehensive package of mutually reinforcing policies is crucial to maintaining macroeconomic stability, ensuring debt sustainability, and bolstering market confidence, for Kenya to achieve its medium-term prospects.

Alternative strategies

In its 2024 Medium Term Debt Strategy, National Treasury said that several financing options were evaluated based on costs and risks underlying various alternative strategies. The Ministry said that the most optimal cost-risk trade-off was determined by considering a range of financing alternatives including potential sourcing from domestic and foreign financial markets intending to minimise costs and risks.

“The 2024 MTDS has been prepared on the background where the economy has been facing major shocks, among them, the geopolitical conflicts that disrupted global trade leading to increased fuel, fertiliser and food prices; the lingering of the post Covid-19 pandemic effects; and a severe drought witnessed in the region and most parts of the country associated with climate change which exerted more strain on the country’s resources,” Ndung’u said. According to the CS, the strategy is cognisant of the fact that a diversified debt structure and development of the domestic debt market is necessary to mitigate against exchange rate risks on a country’s external debt.

Therefore, the government successfully implemented the Central Bank of Kenya’s DhowCSD treasury bills and bonds trading system to broaden the Kenyan market to include retail investors hence mobilising domestic savings to support development and inclusive growth.

Kenya’s debt stock has continued to soar as the office of the Public Debt Management Director General remains unoccupied four months after the exit of the former office holder, Haron Sirima.

The vacancy was among 68 high-ranking government positions that were advertised by the Public Service Commission in February this year.