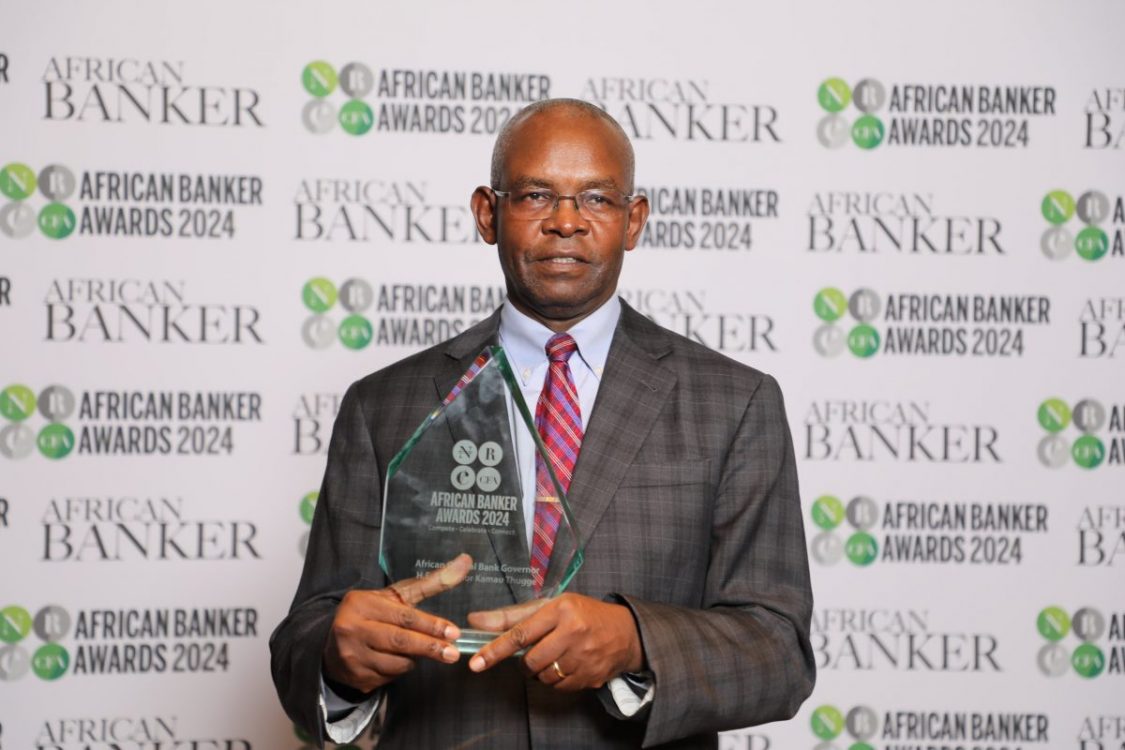

CBK Governor Kamau Thugge wins prestigious award

The Central Bank of Kenya (CBK) Governor Kamau Thugge has been awarded the African Central Bank Governor of the Year by African Bankers Magazine.

Kamau Thugge was presented with the award during the African Development Bank Annual Meeting held in Nairobi.

Speaking after receiving the award, Kamau Thugge stated that the award reflects Kenya’s comprehensive macroeconomic policies, adding that institutions he has worked with including the National Treasury, the President’s Council of Economic Advisors, banking sector colleagues, and development partners contributed to the realization of the award.

“When I was appointed CBK Governor in June 2023, the Kenyan economy was reeling from shocks such as a surge in global energy and food prices, and climate factors that were exerting upward pressure on food prices. Currencies in emerging and developing economies were on a free fall, due to the monetary policy tightening in advanced economies,” Thugge said.

“Capping all this, was our dysfunctional interbank foreign exchange market, with low liquidity and significant foreign payments backlog, which led to low investor confidence, especially for foreign investors.”

The CBK Governor further stated that the country’s overall inflation rose to 9.6 per cent in October 2022 and that it remained elevated at around 8.0 per cent through May 2023.

CBK Governor Dr. Kamau Thugge, CBS, receiving the Central Bank Governor of the Year award by African Bankers magazine. pic.twitter.com/H4oLizkYip

— Central Bank of Kenya (@CBKKenya) May 29, 2024

“As a result of these shocks, our overall inflation rose sharply to peak at 9.6 per cent in October 2022 and remained elevated at around 8.0 per cent through May 2023. The shilling also depreciated rapidly, exerting upward pressure on domestic prices, and contributing to a significant increase in the Kenya shilling value of foreign currency-denominated debt and debt service,” he explained.

Thugge on financial stability

Thugge disclosed that Kenya has continued to lead globally in digital financial services with an elaborate ecosystem that has expanded the accessibility of financial services in Kenya.

“The country has continued to be a global leader in digital financial services with an elaborate ecosystem. The Kenyan economy has also become more cash-lite due to the advent of mobile money payments, with currency in circulation as a percentage of GDP standing at 2.1 per cent in 2023, way below other countries,” he said.

Thugge says since the beginning of 2024, the shilling has appreciated by 17 per cent against the US dollar.

“The appreciation has led to huge savings in debt service and reduced debt stock in Kenya shillings our shilling-denominated debt declined by around 6 per cent of GDP within weeks. In addition, the Shilling has appreciated by 17% against the U.S. dollar since the beginning of 2024, making it the best-performing currency globally, against major currencies, “he stated.

For these and more credible stories, join our revamped Telegram and WhatsApp channels.

Telegram: https://t.me/peopledailydigital

WhatsApp: https://whatsapp.com/channel/0029Va698juDOQIToHyu1p2z