How KRA plans to rope in more Kenyans into tax net

Taxpayers will have to wait a bit longer to experience relief from the burden of the current high tax regime even as the government eyes more deductions from the formal sector through increased deductions in the existing revenue sources such as the National Social Security Fund (NSSF) among others.

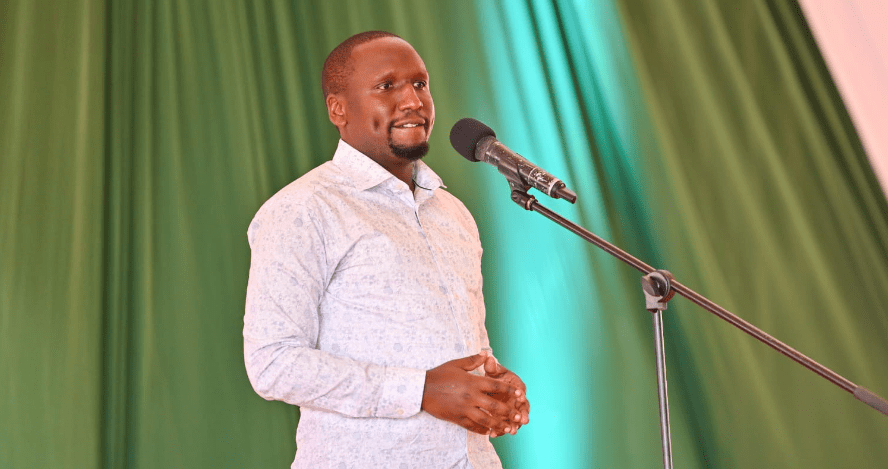

According to Kenya Revenue Authority (KRA) Chairman, Ndiritu Muriithi, for this to be achieved, the country must stick to its policy of expanding the existing tax base, an initiative it is currently trying to implement by leveraging technology.

Muriithi said the government is also seeking to leverage technology to reach those in the informal sector. The reality, he said is that taxation in the country and many other countries, has focused on what is referred to as the formal sector, perhaps because these sectors are easier to identify and to work with in terms of taxation.

“However, that is history, the future is to rely on technology to allow all citizens to contribute taxes and ultimately contribute to the financing of the republic,” he said in an interview.

Muriithi expressed hope that as the country expands the tax base, what each individual in the formal sector contributes will come down.

Expand the base

“What we need first, is to expand the base and bring in more Kenyans, I believe in this because I saw it in Laikipia that when you make it easier for people to pay, they will pay,” he added.

Citing Laikipia County’s growth, the chairman explained that they first increased the tax base by doubling the number of single businesses in the respective tax register, which enhanced tax compliance leading to the authority collecting more compared to when the register was somewhat shallow.

He believes that this strategy if well implemented in the country will be able to help the government achieve its revenue targets without pumping pressure on the already struggling Kenyans.

“We were able to double the collections. How did we do it? We started with incentives of course. Today it is not necessary for you to be incorporated for you to be a KRA client, working and building on technology is practical for all Kenyans from all walks of life to be able to take part in the process,” he explained. In reality, this might not be the case, as employed Kenyans who are technically business owners are unable to get enough capital for their businesses as a result of the high fiscal obligations by the Kenya Kwanza government which ultimately makes them opt for tax evasions. The former governor, however, remains optimistic that the ambitious plan can still work for the country.

“We intend to make the number of people who are paying taxes voluntarily bigger by simplifying the process on our digital platforms. Etims already has data on the respective businesses in the country.” Muriithi added.

“In the informal sectors, these businesses are also on the platform and the employed Kenyans in this category can be able to make their contributions,” he added.

What perhaps needs to be first addressed in order to relieve Kenyans from the burden according to experts in and outside the government, is for the government to go heavy on the austerity measures as the country raises a considerable amount of revenue to facilitate its projects.

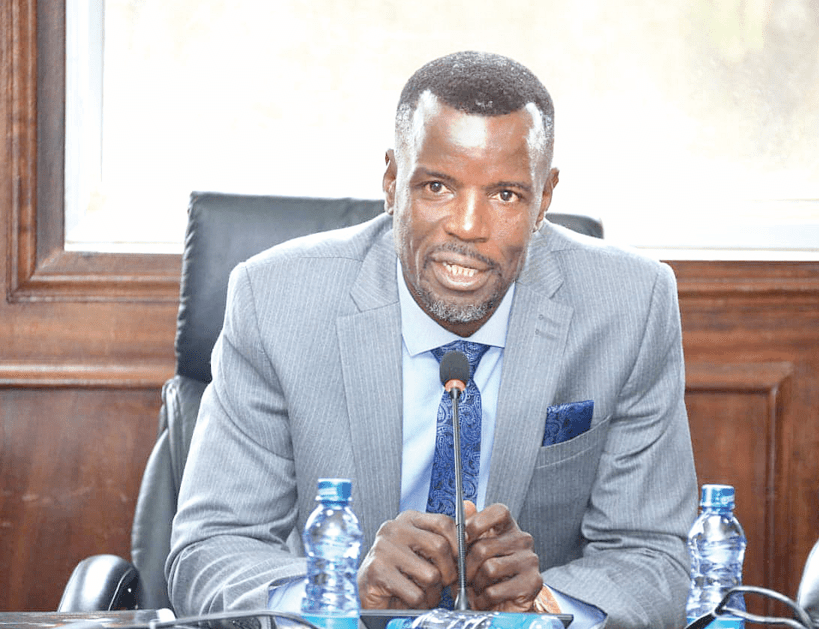

Speaking to the Business Hub, Prof Samuel Nyandemo, a lecturer of economics at the University of Nairobi, said the government needs to identify its priorities when allocating funds and even lower the tax policies in the spirit of creating a wider tax base.

“We must agree that the tax regime is not effective, it is punitive. Even if we tap technology, Kenyans, are very smart people, they will definitely find ways to default on taxes unless we create a tax regime that is favourable for all,” he said.

As per the numerous reports by the Office of the Controller of Budget (COB), the government generally, from the cabinet to the counties has been splurging on non-essentials resulting in low development projects which the government in turn has to go back to the taxpayers to raise.

Value for money

On the issue of value for money, Nyandemo said: “What is ailing us is the fact that we have wrong priorities, you see the government releases funds to the wrong areas of attention and as a result, the money gets wasted.”

He noted that the same government again goes back to taxing more in order to complete the same projects hence finding that the burden to the ordinary citizen continues to increase.

“This factor has also led to the public debt experiencing a trajectory, which experts term as ‘precarious’, he added. Nyandemo said the government raises enough revenue that can be able to sustain the economy even without the need of borrowing but the main challenge is the issue of priorities.

“The government in the spirit of lowering the tax policies should do an inhouse sweeping, identify what comes first then the issue of technology though not a bad move can come in,” Nyandemo stated.