Customer alert as KDIC lists banks with insured deposits

Kenya Deposit Insurance Corporation (KDIC) has published a list of banks and deposit-taking microfinance institutions whose customer deposits are insured at a time when the financial sector is facing a test of Sh1.63 trillion in bad loans.

The announcement comes two months after the corporation said banks have not paid Sh5.5 billion in insurance premiums on customer deposits amid Covid-19 pandemic.

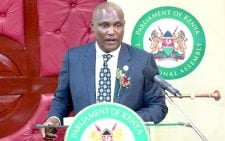

“In accordance with the Kenya Deposit Insurance Act, we notify all that the following institutions deposits are insured by Kenya Deposit Insurance Corporation,” the CEO of KDIC Mohamud Mohamud said in the latest Kenya Gazette notice reads in part.

Banks use customer deposits to issue loans to other customers, meaning that if borrowers have defaulted on Sh1.63 trillion, then deposits worth a similar amount cannot be repaid as per the loan schedule.

Analysts say the move could see customers shift their banks in a bid to secure their life savings.

Important move

“I have never seen them do this before, it is a very important move because then it puts the onus on customers to make sure their savings are safe,” said John Kirimi, former head of Sterling Capital.

Kenyans in the recent past lost money in failed banks and some are still struggling upto today for being unable to access their deposits lost in banks such as Imperial Bank, Chase Bank and others.

“Every time I go for my money at my bank they ask me if I can take a small fraction of my money, I just decided to forget everything,” said a frustrated customer.

“This is the time for customers to double-check that all their deposits, including interest, are well secured,” said Kirimi.

Bank deposits rose rapidly during the pandemic, hitting record levels as customers sought to keep their money safe due to a bad business environment.

High net worth individuals and big companies saved Sh1.4 billion daily in commercial banks over the six months to September as Covid-19 containment measures prompted business shutdowns and job cuts.

Deposits rose to Sh3.9 trillion in September up from Sh3.68 trillion in March, adding Sh259 billion to the lenders’ vaults.

Mohamud in a past interview said banks will now be required to pay deposit insuranbce premiums based on the risk they carry and not a flat rate as before.

The National Treasury in November said KDIC gave banks six extra months to pay premiums and postponed application of a new model that would see weak lenders pay more to insure deposits.

More powers

He said the institution has been given more powers to ensure banks are sound by playing a more vigilant role in early preparedness and crisis management.

Commercial banks are hoping that improved business outlook in 2021 will help unwind the string of bad loans rocking their balance sheets.

KDIC’s mandate is now threefold – deposit insurance, risk assessment and resolution.