Big win for developers as Bill seeking to repeal incentives is scrapped

Developers in the specialised construction sector will now have to up their game and deliver more projects if they are to continue enjoying tax incentives provided to them by the government.

This comes after legislators scrapped a bill that was seeking to repeal the current provision, which incentivises investments in specialised constructions such as affordable housing, Special Economic Zones and specialised health institutions.

One of the factors that legislators look at before approving or scrapping a bill is its viability and the impact on the sectors in which they are being proposed.

If the policies are bearing fruit or are on the path to doing so, then they will allow their extension. If not, it gets repealed.

In the Finance Bill 2025, which is set to take effect on July 1, 2025 (pending presidential assent), one provision specifically targets taxable goods directly and exclusively used in constructing and equipping specialised hospitals. To qualify, these hospitals must have at least 50 beds, and the exemption must be approved by the Cabinet Secretary of the National Treasury based on recommendations and eligibility guidelines from the Cabinet Secretary for Health.

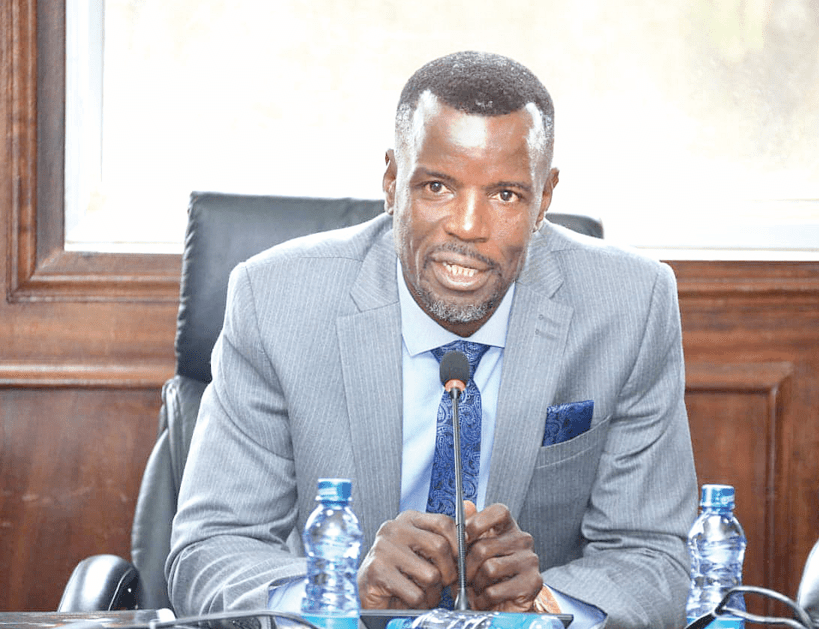

In a report presented to the National Assembly by the Committee on Finance and National Planning chairperson, Kimani Kuria who is also the MP for Molo, in regards to the findings from the public participation on the bill, the MP stated that repealing the proposal would be of great significance to the economy as it would boost investor confidence.

Earlier contention

“The proposal to eliminate the 15 per cent corporate tax rate granted to companies engaged in the local assembly of motor vehicles and the construction of at least 100 residential housing units, the committee, after engaging with stakeholders, resolved to withdraw the proposal,” he said.

The preferential tax rate, MP Kimani says, was considered crucial in supporting strategic sectors that significantly contribute to employment creation, industrial development, and the delivery of affordable housing.

The bill had been contested by a couple of stakeholders, among them was the Kenya Private Developers Association (KPDA), which had argued that the bill would not only affect the developers, but also the healthcare sector in the country.

Speaking during public participation on the finance bill 2025/26 conducted by the committee at a Nairobi Hotel, KPDA General Manager, Rose Kananu, argued that specialised hospitals serve as referral centres and are often the only providers of critical care for serious conditions.

Essentially, such hospitals include the Spinal Injury hospital and Mathari National Teaching and Referral Hospital, among others.

High building cost

“VAT exemption on construction and medical equipment for these facilities directly reduces capital costs, enabling more institutions to scale and improve the quality of healthcare offered,” she argued.

The removal of this exemption, in her view, would have increased the cost of building specialised hospitals, undermining the Universal Health Cover (UHC) goals, which form part of the government’s Bottom-up Economic Transformation Agenda (BETA).

Ultimately, Kenyans seeking services from these institutions would have borne the brunt, as the additional costs would have been passed down to them.

“Given the significant disease burden in Kenya and the growing demand for specialised care, removing the VAT exemption would increase the cost of care, limit investment in underserved regions, and contradict the nation’s UHC goals,” Kananu cautioned.

The Institute of Certified Public Accountants of Kenya (ICPAK) had also drummed up support for the repealing of the bill, arguing that the increase in non-communicable diseases in the recent past has been a major challenge for most Kenyans due to the high cost of accessing treatment.

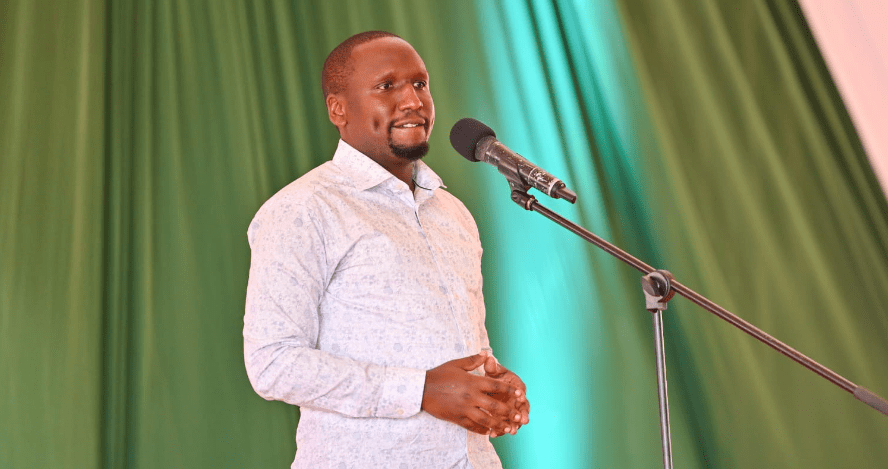

“To support the Government’s agenda on health, the exemption should be retained to encourage private players to invest in the sector at a slightly lower cost,” ICPAK director Public Policy and Research, Hillary Onami, stated during the same function in a separate session.

Additionally, if the bill had passed, property investments outside major cities such as Nairobi and Mombasa and towns would have recorded a dip, slowing down the efforts to realise regional balance. This would have also severely impacted investments made in a Special Economic Zone (SEZ).

Typically, what the incentive was aimed at was to foster regional development, alleviate urban congestion, and foster more equitable economic distribution. However, with the proposal, the congestion may still be a factor leading to higher rental fees due to high demand.

This may have also put much pressure on the amenities provided for the public.

Drive urbanisation

“Removing the incentive risks disrupting ongoing investments, diminishing investor confidence, and undermining national efforts to promote local manufacturing and reduce the housing deficit. As such, retaining the 15 per cent corporate tax rate was viewed as necessary to uphold policy stability, encourage long-term investment, and maintain momentum in these vital areas of the economy,” Kuria stated in the report.

Kiambu County demonstrates the efficacy of regional tax incentives, having attracted substantial private-sector investment that boosted its Gross Domestic Product to over Sh550 billion, second only to Nairobi County.

These investments, according to her, have driven urbanisation, employment, and infrastructure development and that repealing the incentive risks reversing this growth and redirecting investment to already congested urban centres.

Already, East African Community (EAC) member countries Uganda, Tanzania, and Rwanda have instituted targeted incentives aimed at promoting geographically balanced economic development.

ICPAK had also cautioned that the repeal of the preferential income tax rate of 15 per cent would slow down the progress in the government’s ambitious affordable housing plan.

“The repeal of the incentive goes against the housing agenda, which is a key economic agenda under BETA. The proposed amendment will disincentivise investment in the real estate sector,” Onami cautioned.

The incentive was aimed at encouraging developers to build at least 100 residential units annually, in support of the housing agenda.