Why Yatani is walking an economic tightrope

The National Treasury will remain overstretched like it has never been in many years, as it seeks to plug the financial hole that has been deepened by the negative impact of the Covid-19 pandemic.

Faced with a projected loss of Sh172 billion in revenue with the tax incentives put in place to mitigate the effects of Covid-19, the Exchequer is literally scratching the bottom of the barrel to shore-up the nation’s finances and economy.

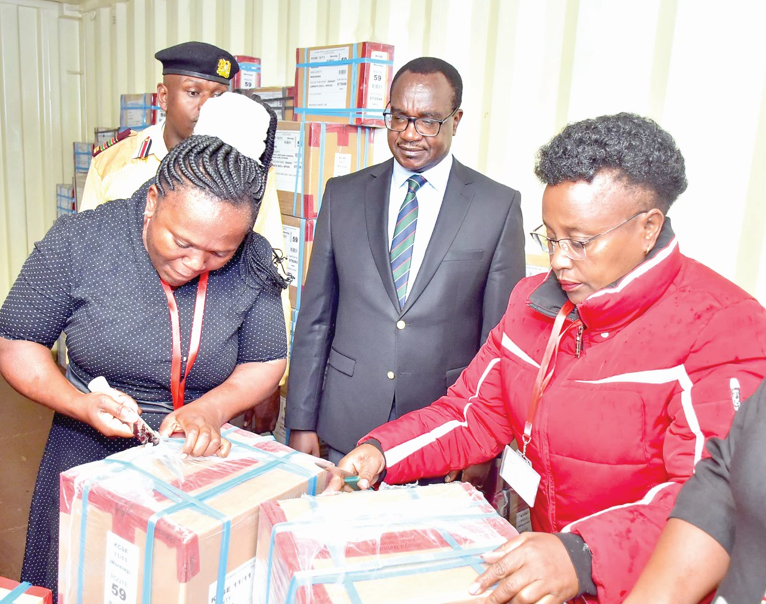

Speaking during the virtual launch of the financial year 2021/22 and medium-term budget preparation process on Friday, National Treasury Cabinet Secretary Ukur Yatani said growth in 2020/21 is expected to be below the initial projections.

“Indeed the Covid-19 pandemic is likely to cause a major economic shock and underperformance of the economy since independence,” he added.

Yatani said the current situation calls for a critical review of existing programmes and policies to ensure they are not only consistent with development agenda but also informed by emerging realities of the pandemic and other economic shocks in the future.

The coronavirus pandemic which hit on March 13 forced the State to reengineer the economy to enable it survive the tough times ahead.

To increase liquidity in the economy, the government lowered the Value Added Tax (VAT) rate from 16 per cent to 14 per cent, to help firms save on taxes.

Corporate and personal income (PAYE) tax rates were also reduced from 30 per cent to 25 per cent to put more cash in the hands of employers and employees.

A 100 per cent tax relief for persons earning a gross monthly income of up to Sh24,000 was also mandated by the State as reduction of turnover tax rate reduced from 3 per cent to 1 per cent, capping the fiscal measures which now deny the exchequer the Sh172 billion cache.

Business environment

On the back of the challenging business environment wrought by the Covid-19 shocks, the cumulative revenue including appropriation in aid (A-i-A) for financial year 2019/20 hit Sh1.73 trillion against a revised target of Sh1.86 trillion as per the Budget Review Outlook Paper (BROP).

“This represented a revenue shortfall of Sh131.2 billion. Ordinary revenue collection amounted to Sh1.57 trillion against a target of Sh1.62 trillion with tax revenues falling below target in all broad categories,” reads the report in part.

Released last week,the report says the shortfall is mainly attributed to the fiscal measures implemented by the government to cushion Kenyan. However, revenue performance represented a 1.9 per cent year-on-year growth.

Treasury says there was a Sh89.2 billion appropriation in aid (A-i-A) shortfall attributed to a difficult operating environment, especially in the fourth quarter.

Even before the first Covid-19 case was reported in Kenya, according to the report, measures instituted internationally to curb the spread of the disease such as cancellation of international flights and lockdowns by some countries were having an adverse impact on import related taxes and sectors such as tourism and hospitality.

The emergence of Covid-19 in March complicated the situation and negatively affected both the domestic and import related revenues especially in the fourth quarter of financial year 2019/20.

Yatani said the economy recorded growth of 5.4 per cent in 2019, a slight dip from 6.3 per cent recorded in 2018.

However, he said the economy remained resilient in the first quarter of 2020 and grew by 4.9 per cent.