Ease our tax burden, Mombasa residents tell MPs

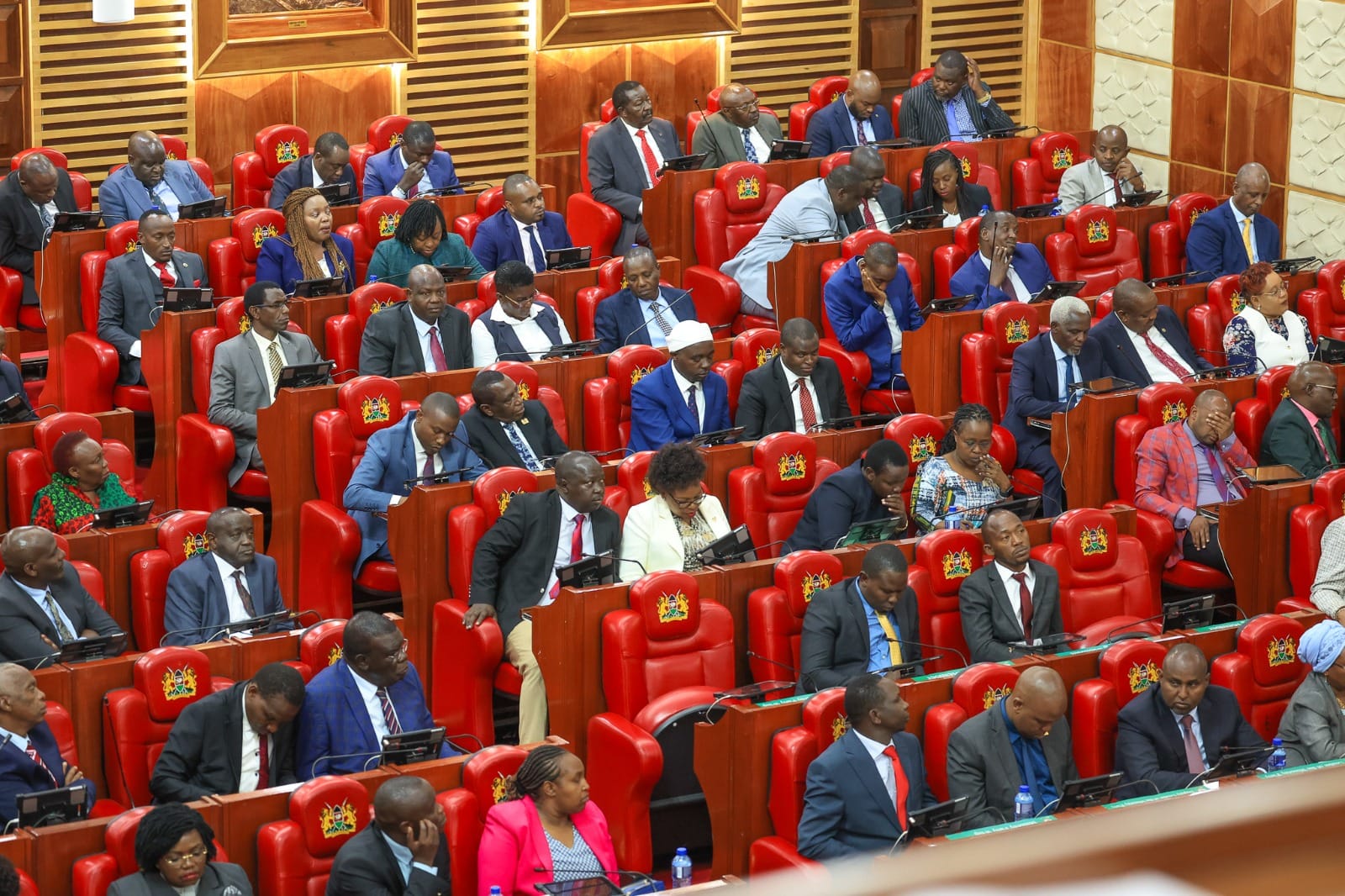

The National Assembly Departmental Committee on Finance and National Planning, led by Molo MP Kuria Kimani (inset), faced intense public scrutiny during a public participation forum in Mombasa.

Residents passionately called on the government to save them from over-taxation, pointing to its crushing effects on the average Kenyan.

“Countries like the US and UK, whose national debts are four times ours, tax their citizens an average of 23 percent of their salaries. Here, it’s 35 percent. Why?” Adil Abdulwahid from Majengo, Mvita constituency said, decrying the “unprecedented taxation yoke”.

The public participation forum deliberated on several proposed Bills, including the Public Finance Management Act, 2024, the Public Procurement and Asset Disposal (Amendment) Bill, 2024, and the Tax Laws (Amendment) Bill, 2024.

Anthony Omwandu, a representative for persons with disabilities, criticised the government for taxing donations.

“Donated wheelchairs often get stuck at the port because of taxes. Why are you taxing aid for unemployed people with disabilities?” Omwandu questioned.

Tourism sector

Some residents raised concerns about the lack of accountability, questioning the value for money from taxes imposed on Kenyans.

“Kenyans don’t object to paying taxes. The problem is value for money. If the government ensures transparency and integrity in using taxes, people will not complain,” Ali Mashua from Likoni argued.

Said Mohamed from Tononoka warned against taxing aircraft and tourist vehicles, pointing out that a proposed 16 per cent VAT on locally-assembled tourist transport vehicles would undermine efforts to promote tourism.

Jomvu resident Alfan Sudi criticised a proposed excise duty waiver on spirits, beer, and wine made from local crops, saying it contradicted the government’s fight against alcoholism. Youth unemployment also emerged as a critical concern.

Kuria Kimani assured the public that the bills aim to create a favourable environment for local manufacturers and emphasised the need to incentivise private businesses.

He also defended proposed taxes on imported building materials, arguing that they would give local manufacturers a competitive edge.