Governors, KRA on collission course over county tax demand

The Council of Governors has protested a move by the Kenya Revenue Authority to impose Value Added Tax on own source revenue generated by the devolved units terming it unconstitutional.

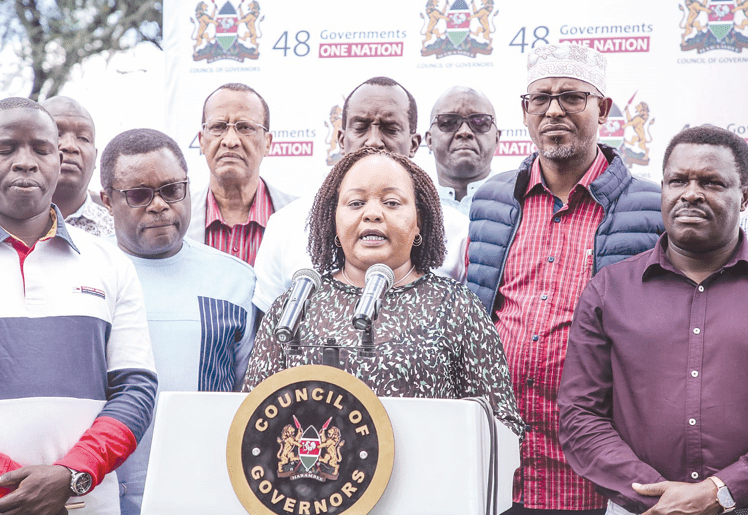

CoG chair Anne Waiguru in a statement said that the council has received reports regarding the persistent demands by the KRA requiring County Governments to pay Value Added Tax (VAT) on various counties’ revenue sources and attendant interest and penalties.

“We take greatest exception to these unwarranted demands which are unfounded and undermine the principles of Article 6(2) of the Constitution. Article 209 of the Constitution outlines the taxes and charges to be imposed by either level of government,” Waiguru noted.

According to the Kirinyaga Governor, the council found the demands by KRA on imposition of VAT on Counties’ Own Source Revenue (OSR) unconstitutional and an encroachment on the powers to impose taxes and duties of the Counties in contravention to Article 209 (3) and (4) of the Constitution.

Revenue raised

Citing the 2013 VAT Act and 2023 Finance Act, Waiguru said that services provided by Counties in performing their functions as set out in the Fourth schedule of the Constitution are exempt and therefore not subject to VAT.

“It is on this premise that we find that the KRA has no basis for these demands. We therefore maintain that Kenya’s constitutional architecture does not envisage that the National Government will impose taxes on revenues raised by the County Governments,” she stated.

Waiguru insisted that VAT is a consumption tax that is levied on the value added at each stage of a product’s production and distribution.

“Raising own source revenue by counties in its strict sense does not necessarily correspond with a service provided, neither does it fall under any stage of production,” Waiguru added.

While criticising KRA for introducing the new tax measure, CoG maintained that all finance laws enacted by counties do not load the revenue streams and sources with VAT as contemplated by KRA.

“There is no logic at all for counties to charge VAT on their own source revenue or to remit the same to KRA. We, therefore, demand that KRA ceases forthwith from making any such demands for VAT on Counties’ revenue sources as the same is bereft of any legal backing,” the statement read in part.

Amicable solutions

CoG went on: “The Council is however open to discussions geared towards reaching an amicable solution on this issue. We wish to state that if no action is taken and this unconstitutionality continues, we will be left with no option but to seek legal redress without any further reference to you.”

Sources at CoG indicated that KRA enacted the VAT on own source revenue of counties when the current government assumed office and after the new commissioners were appointed.

KRA is currently backdating money owed by counties under this new taxation.