Shilling expected to lose more ground against US dollar

The shilling’s weakening trend is expected to extend to the end of year, falling to Sh150 against the US dollar, according to Investment Bank EFG Hermes.

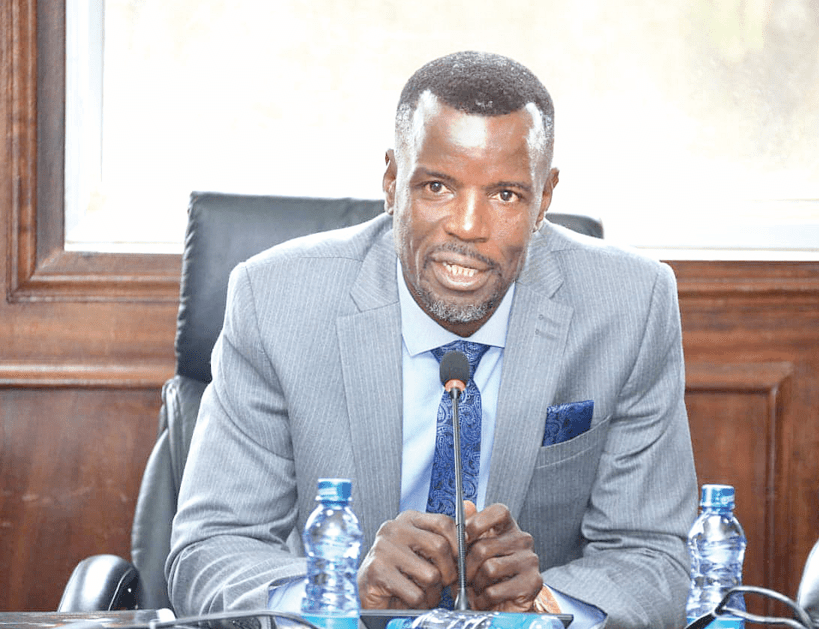

Insufficient dollar supply has dragged the shilling 15 per cent lower so far this year to 142.44 by yesterday. A series of rate increases over the last couple of months has failed to lift the currency even with 100 basis points rate rise by new Central Bank of Kenya (CBK) Governor Kamau Thugge (pictured).

The shilling has lost 1 per cent since Thugge took office.

“We are still seeing some pressure on the shilling; the current account has narrowed, but still remains quite significant,” Ronak Rasiklal Gadhia, director of frontier banks at EFG Hermes Research, told Bloomberg in Nairobi. The Sh150 exchange would be a crisis as imports will be very expensive with oil prices rising as drugs, fertilizers and food prices rise too.

Gadhia said a number of depositors are holding on their dollars despite rate rise by the new governor over uncertainty in the market.

“We haven’t seen that dollarisation reverse because there’s still some uncertainty as to whether the shilling has stabilised,” he said. “A lot of depositors are still playing it safe.”This is despite a recent increase in central bank reserves which should help boost confidence in the market.

The usable foreign exchange reserves remained adequate at $7,377 million (4.03 months of import cover) as at July 27. Kenya is short of dollars first to service her debt and then to buy oil and food imports.Major inflows of foreign currency from a syndicated loan, funding from the World Bank and the International Monetary Fund (IMF), as well as a potential new Eurobond issuance have raised enough cash and more is expected to help settle Kenya’s maiden $2 billion Eurobond that’s maturing in June 2024, Gadhia said.

“It’s absolutely critical they pay it up because that would send a strong signal that Kenya’s dollar situation isn’t as bad as it was perceived to be earlier this year,” he said. A default will raise borrowing costs, resulting in losses for local-currency investment portfolios. There would also be an increase in deposit rates leading to further margin pressure that would cause higher lending rates and non-performing loans, Gadhia said.

Debt vulnerabilities

Last month, IMF said it had approved almost $1 billion for Kenya to help the country reduce debt vulnerabilities and tackle climate change. Antoinette Sayeh, deputy MD called on CBK to continue taking appropriate steps to strengthen its reserves position and develop the foreign exchange market while allowing exchange rate flexibility as a shock absorber. – John Otini