Members of the National Assembly have rejected a proposal by the Ministry of Energy and Petroleum to lift a moratorium on new power purchase agreements, citing concerns about insufficient safeguards to protect taxpayers and national interests.

Officials had asked officials to lift the moratorium specifically on coal-fired power plants, stressing the urgency of expanding power sources to meet Kenya’s increasing energy needs.

They said anticipated growth in electricity consumption requires Kenya to diversify its sources, with coal plants positioned as a stable and cost-effective complement to existing hydroelectric power.

But MPs strongly objected to the proposal, arguing that the ministry had not explained how the interests of consumers would be protected.

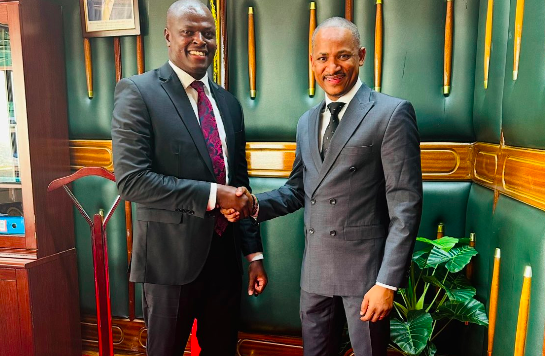

National Assembly leaders are on a retreat in Naivasha and they spoke when they met with Energy and Petroleum Cabinet Secretary Opiyo Wandayi.

They insisted that the ministry must first implement stringent measures to prevent projects from disproportionately favouring investors at the expense of the public interest.

They said that no relaxation of the moratorium should proceed until sufficient protections are established to ensure that any new agreements prioritise taxpayers’ welfare and national interests.

Energy Committee chairman Vincent Musyoka (Mwala) said the ministry’s safeguards were inadequate and there was no substantial basis for lifting the moratorium on power purchase agreements.

He said Parliament, as the people’s representative, must be fully involved in related decisions.

Tariff changes

He cited the recent shifts in tariffs as an example, noting that “the indicative tariffs gazetted in 2012 for wind power stood at Sh12/kWh.

But shortly after, he added, the Lake Turkana Wind Power project secured a purchase deal for Sh16/kWh over a 20-year term – higher than the forecast tariffs intended to provide long-term savings.

“Recently, tariffs for wind were gazetted at Sh5.8/kWh, illustrating that earlier contracts could have been three times cheaper,” Musyoka said.

He also criticised the handling of the Lake Turkana Wind Power project, intended as one of Kenya’s Vision 2030 flagship projects, revealing that 20 motions were initially tabled on power shortages through this initiative.

The director overseeing Vision 2030 projects later became chairman of the Lake Turkana Wind Power project.

Musyoka proposed that if the moratorium were to be lifted, independent power producers with existing wind and solar installations should be required to add backup energy storage to harness excess energy produced during the day for peak demand.

Before Parliament could consider lifting the moratorium on purchase agreements, the ministry must disclose those agreements, said Robert Pukose (Endebess).

“The ministry must first reveal how much they are paying for the power purchased from various power producers, such as KenGen and the rest. How much are you paying per unit? Are you able to give us this so that we can have an involved decision?” he said.

Expensive and hidden

The reason the moratorium was put in place, said Omboko Milemba (Emuhaya), was that purchase agreements were so bad they were making Kenyans pay more for electricity.

“How do you expect the Parliament to go and remove this moratorium? Unless you deal with the power agreements with this, which have been looked at as things that were never exposed clearly,” he said.

“They are very expensive, they are hidden, and they are not talked about. You must demystify the whole power.”

But Kenya Power Managing Director and CEO Joseph Siror said the most recent power purchase agreements were the cheapest.

What drives the cost of power, he said, is the technology used.

The most expensive energy source now, he added, is thermal power, with Kenya’s priciest power generated at the GT plant in Muhoroni, costing around seven US cents per kilowatt-hour (kWh).

“Interestingly, the cheapest thermal power in Kenya, at 6.97 cents per kWh, isn’t Kenyan[-owned] – it’s sourced from geothermal energy, specifically from Olkaria,” Siror explained.

“In this cost breakdown, 4.9 cents go to the developer and two cents cover operational expenses.”