With stock markets reeling from virus put money into shares – analyst

Zachary Ochuodho @zachuodho

For nearly three consecutive months, the share prices of some of the companies listed at the Nairobi Securities Exchange (NSE) have shrunk considerably.

Analysts are advising investors to take advantage of the low prices to buy shares.

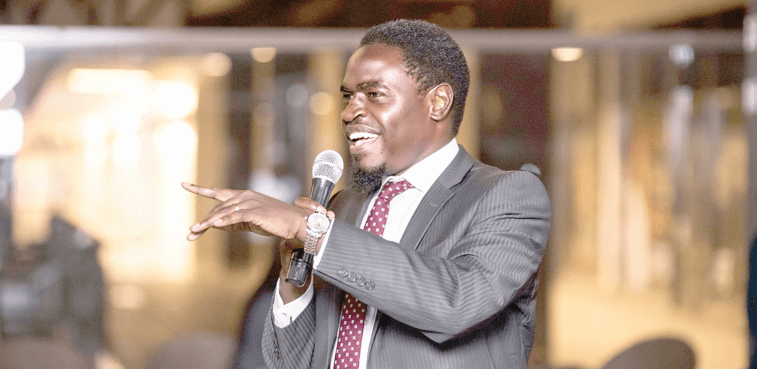

Gerald Muriuki, an investment analyst at Genghis Capital Ltd agrees the best time for a savvy investor to buy shares in the stock market is when the prices are low.

Muriuki argues that since the goal of buying shares is to make profits, it is always advisable to sell at a higher price and buy when the prices are low.

He further pointed to potential counters such as Carbacid Investments Plc, Longhorn Publishers, Kenya Power and KenGen—all whose share prices have since January shrunk—as potential investment options.

Sterling Capital director John Kirimi says while some counters have shed share prices, it is always advisable to know why you want to buy.

“There are two reasons why people want to buy shares. There are classes of people who buy shares on counters for the purposes of speculation while others are investing to own a chunk of the company in the long term,” he adds.

Specific company

Kirimi says in the context of the stock market, speculation refers to buying shares of a specific company in hope the shares will rise in price, allowing the investor to sell them for a profit.

Speculation is generally a short-term type of investing, which comes with a great degree of risk.

“Don’t just buy the shares because its price is cheap and don’t avoid firms whose share price is high. The cost of a share does not matter. Sell the shares when you think the price of the shares will not increase in the near future,” he advises.

Kirimi says one needs to study the firm they are interested in and buy shares when they think the price will increase.

He advises that although the share prices of some counters have declined, buying them now may not make any sense even in the longer time.

“Counters such as Mumias Sugar, Uchumi Supermarket and Deacon – may not help so much even if you invest in them,” he says.

He also says investing in the agricultural counter now would also not be wise because a lot of people have been sent home and the work is not going on in the sector including auctions at the port.

“So when you buy those shares when things normalise, it will not be easy for the share prices to increase,” he says.

According to Muriuki, the need to buy Safaricom and NSE Ltd shares is informed by their resistance to deep price depreciation observed across the market.

Strong support

“In our view, this works to anchor a super strong support at the Sh20 to Sh23 levels. We may see a drag on financial performance on effects of Covid-19,” he says.

Kirimi, however, admits that there are some counters such as the banking sector shares that will always rise even if the prices fall.

So it’s always good to own banking shares and retain them even when prices fall.

“We maintain our buy recommendation on Standard Chartered Bank and Absa Bank Kenya (formerly Barclays Bank of Kenya) to income investors with a long-term investment horizon.

The two banks maintain the highest yield in the banking sector, with cum-dividend yields,” he says.