Why taxpayers lose billions annually in stalled projects

Kenya’s failure to conduct sufficient due diligence before securing State contracts is causing a financial hemorrhage after several firms went bust soon after gobbling up billions of shillings from the National Treasury.

As a result, a number of mega projects have stalled while others were executed after painfully paying off costly damages, leaving taxpayers to absorb billions in losses as new contractors were called upon to finish the job.

Business Hub has established that some rogue foreign firms that collapsed soon after receiving faith deposits and midpoint payments from the Treasury to undertake projects could have been saved if the agencies dug deeper into their backgrounds.

Went bust

In the recent past, firms that went bust with taxpayers’ money include Italian firm CMC di Ravenna, India’s IVRCL Ltd and Spanish infrastructure firm Isolux Corsán, collapsed after gobbling up billions of public funds.

CMC di Ravenna was paid Sh18 billion to build the Arror and Kimwarer dams but was soon discovered to have bee declared bankrupt, with only 26 per cent of work completed.

Isolux Carson on the other hand was paid Sh11.96 billion of the Sh28.9 billion for the construction of the 435-kilometre Loiyangalani-Suswa transmission line, before the contract was terminated – having completed 57 per cent of work.

India’s IVRCL, hired to complete construction of the Bura Irrigation Scheme sunk with taxpayers’ money even as KCB Bank and National Irrigation Board (NIB) wanted to cash in on Sh1.1 billion guarantees obtained by the contractor.

Recently, shares of Tullow Oil plunged to a 16-year low after the firm surprised investors by slashing its production forecast, scrapping its dividend and announcing that its chief executive and exploration director had left causing jitters in Kenya. University of Nairobi Economics lecturer Samuel Nyandemo warned that due diligence is thrown out of the window in State contracting, especially when the projects involve billions.

“The government has enough intelligence, what happens here is a case of internal mechanism that facilitates collusions between the cartels and the purported contractors,” he said.

Good percentage

“The only reason some projects don’t take off despite money having been paid is because a good percentage of those funds have gone into people’s pockets.”

On recovery of funds when a firm collapses, he said the process is not straightforward. For instance, he warned that in the Itare dam saga, taxpayers stand to lose billions should the government walk out of the contract.

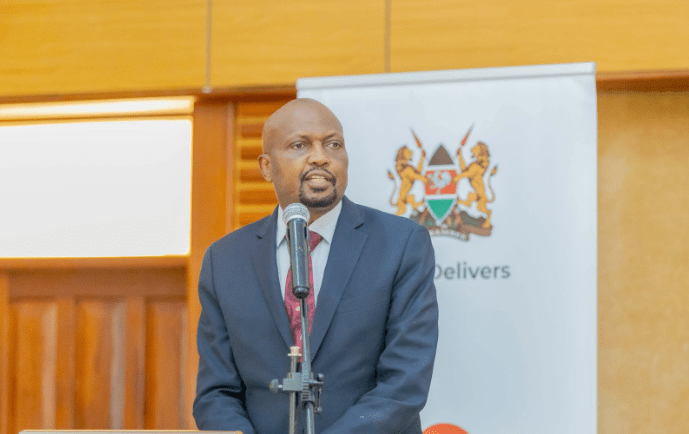

But despite stalled projects, Transport Cabinet Secretary James Macharia has in the past insisted that his ministry will give all road construction tenders to foreign firms citing consistent disappointment by locals. But 2020 is set to renew push by Parliament and various sector stakeholders for the government to be conducting comprehensive due diligence to ensure public funds are not lost.

The government went ahead to award CMC di Ravenna despite warning from National Assembly’s Environmental and Natural Resources Committee to do sufficient background checks on the contractors before awarding them tenders.

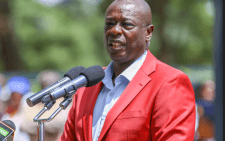

Kareke Mbiuki, the committee chair urged the government to, upon engaging a contractor, do continuous checks to evaluate the capacity of contractors to complete work. When a firm sinks, a trustee is often appointed to liquidate its assets and money is used to pay off the debt, which may include debts to creditors and investors.

For recovery of government funds, however, the process is complicated and the funds can be lost completely.