State borrows Ksh562.7 million daily to finance development

President William Ruto’s administration borrowed Ksh562.7 million daily, between September 1 and December 31, 2024, bringing the total amount borrowed in the said period to Ksh68.65 billion to finance various development projects.

A document presented to Parliament by Treasury Cabinet Secretary John Mbadi shows that the loans totalling 18 were contracted between the Government of Kenya and bilateral and commercial creditors and had been disbursed by the time the report was submitted to parliament.

The new loans now bring the total amount borrowed by the government between May and December 2024 to Sh327 billion after Ruto’s government borrowed 11 loans totalling Sh258.4 billion between May and August this year.

New loans

Reads the report: “This section of the report contains 18 new loans contracted between the Government of Kenya and bilateral and commercial creditors. Three of the loans are from bilateral lenders and 15 are from China Development Bank. The total value of the 18 new loans signed is equivalent to Sh68,652,152,404. One of the loans had been disbursed by the time of submitting this report.”

The tabling of the report is in line with the Public Finance Management (PFM) Act that mandates the National Treasury to periodically update Parliament on the country’s debt status.

The report indicates that the proceeds of the loans will be used to finance various government projects in the energy sector, roads sector as well as support the budget.

The report comes at a time when Ruto has called for proper use of public resources to enable it to pay off the huge loans that have grown since 2013 when former President Uhuru Kenyatta’s Jubilee administration came to power.

Reads the report: “This report on new loans is prepared in accordance with section 31 (3) of the Public Finance Management Act, 2012 and covers the period from September 1, 2024 to December 31, 2024. Section 31(3) requires that “the Cabinet Secretary shall submit a report to Parliament stating the loan balances brought forward, carried down, drawings and amortizations on new loans obtained from outside Kenya or denominated in foreign currency, and such other information as may be prescribed by regulations.”

Stable national system

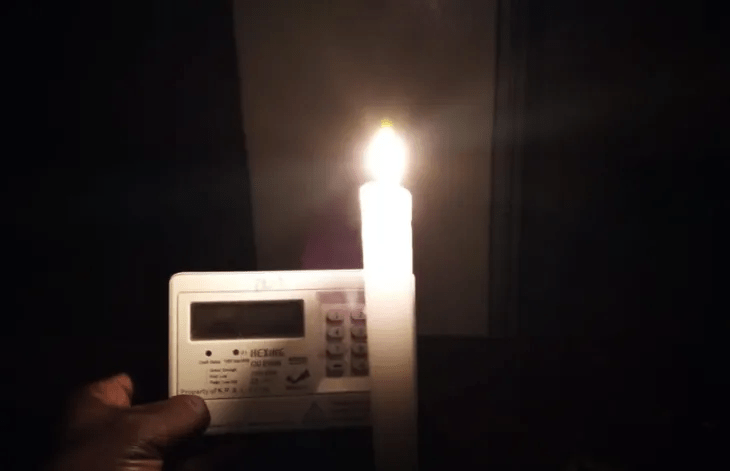

The document shows that of the said funds, Sh4.59 billion was signed on October 3, 2024 between the French Government as the lender and Government of Kenya as the borrower to finance the construction of a stable national system control centre that is also resilient to physical and cyber security challenges.

The loan will be repaid in 30 equal successive half-yearly instalments from July 15, 2030 through to January 15, 2045.

To finance reform-oriented expenditures of the Kenyan budget to promote the transition to a more resilient, greener and more inclusive economy in line with the ‘Bottom-Up Economic Transformation Agenda the government signed a loan of Sh8 billion on September 11 last year with the Federal Republic of Germany.

To deal with greenhouse emissions, the government secured a loan of Sh20.3 billion from the government of Italy whose repayment period will be from December 31, 2032 through to December 31, 2045.

Reads the report: “To support the budget the of Kenya for the sustainable development of the Kenyan economy with reduced greenhouse gas emissions and Kenya’s achievement of its climate targets through institutional reforms and government programmes relating to, or connected with, any of the Policy Actions comprised within Pillar 3, and namely (a) urban transportation, (b) forest and land use and (c) climate finance.”

To improve Cess (Nghonji) Rekeke Lake Jipe Road in Taita Taveta County, the government signed a loan of Sh1 billion from China Development Bank as the lender, which will be repaid in 8 instalments from October 15 2027 through to April 15, 2031.

Finance price

Reads the report: “The purpose for the loan is to finance up to 80 per cent of the Sinosure Premium and financing of up to Sh50.72 per cent of the contract price.”

To support the upgrading to Bitumen Standard and Maintenance of Kiambu-Raini, JNCT, Kaspat Road, Nduota, Gathanga, Kiguaro, Karuri High School, Gachie, Kabuku and Loop Road, the government secured from China Development Bank a loan of Sh 2.29 billion that will be repaid in eight instalments from October 15, 2027 through to April 15 2031.

To upgrade to Bitumen Standard and Performance Based Routine Maintenance of Tawa-Nguluni Road, the government borrowed Sh 1.84 billion from China Development Bank that while to enable the upgrading to Bitumen Standard of Timboroa – Meteitei – Kopere, Ainapng’etuny JNC – Ainapng’etuny Secondary – AIC Tindiret Primary School, Setek JNC – Setek Dispensary and Access to Public Institutions Roads in Nandi County, the government secured a loan of Sh 2.57 billion from the same bank.

In the case of the Kinyach-Arror-Kapsowar Road that is being upgraded to bitumen standards, the government secured a loan of Sh 3.44 billion from Chiuna Development Bank that will be repaid from October 15 2027 through to April 156 2031 while to upgrade to Bitumen Standards JNCT C69 Engineer – Mbiginano – Gathara/JNCT C69 Tulaga – Gathara – Kianguyo – Ha Benjamin JNC C69 Engineer/Access Roads to Mwiteithie Primary & Secondary School/ Ha Kagiri – Ha Benjamin/ Access to Tulaga Farmers’ Cooperative Society / Tulaga River (CIONDO) Chege Muthambure Thinde/Chege- Muthambure- Mbirithi-Kanyugi & Mbirithi-Chuma the government secured a loan of Sh 1.173 billion from the same bank.

To upgrade to Bitumen Standard and Performance Based Routine Maintenance of Kanyuambora-Kamomo-Kageri/Muvakari-Kanyuambora/Gachoka Gachuriri/Kangeta-Kimbuini Roads in Embu and Kirinyaga Counties, the government signed a Sh 2.15 billion from China Development Bank that will be repaid between October 15 2027 and April 2031 15.