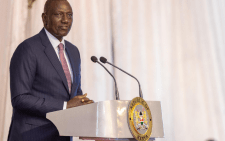

Ruto faces Sh133b revenue shortfall despite tax hikes

President William Ruto’s administration is bracing itself for Sh133.5 billion shortfall in ordinary revenue in the full year ending June 2024 despite concerted efforts to hike tax rates and seal revenue leakages.

The estimated revenue risk is higher than the Sh104.3 billion shortfall realised by Kenya Revenue Authority (KRA) in the concluded 2022/23 fiscal cycle, indicating the target misses could suppress agenda implementation. The taxman has been given a collection target of Sh2.571 trillion in ordinary revenue by the end of the 2023/24 fiscal year (FY).

National Treasury has not explained why it is expecting the Sh133.5 billion shortfall but maintains the overall resource envelope is within the 2023 fiscal programme.

For instance, ministerial Appropriation in Aid (A-i-A), earned from county governments and other State entities, has been revised upwards to Sh431 billion to reflect the outturn of financial year 2022/23 and include collections from the newly introduced 1.5 per cent housing levy.

“Therefore, the overall baseline expenditure ceilings for spending agencies will largely be retained at the same levels as per the 2023 BPS. Any adjustments would be to reflect changes in priority across sectors,” says Treasury says in its draft 2023 Budget Review and Outlook Paper.

But by the end of July, the Kenya Kwanza administration had already suffered a setback as revenue collection for the full year kicked off with a dwindle, with KRA collecting Sh155.06 billion in July from Sh220.6 billion that was collected in June 2023.

The anticipated full-year revenue shortfall will come as a surprise given that the economy is expected to improve in the medium term while the government is also introducing new taxes. Treasury says the economy will expand by 5.5 per cent in 2023 and 5.7 per cent in 2024, allowing KRA to collect more, especially from buoyant services sectors like financial and insurance, transport, and wholesale and retail trade.

However, like other experts, the Parliamentary Budget Office (PBO), an advisory unit on budget and fiscal issues, recently warned, ambitious collection targets might be missed, especially if the taxes alter consumer behaviours and hamper economic activity.

“Slower economic growth and the possibility of the reversal of some of the measures contained in the Finance Act 2023 might result in the National Treasury failing to meet the set revenue targets,” says PBO in its latest dispatch released this month.

The Finance Act 2023 introduced higher tax bands of 35 per cent for high-income earners, a 17.5 per cent Export and Investment Promotion Levy, and a doubling of value-added tax (VAT) to 16 per cent to boost collections.

onsequently, the Treasury has raised its borrowing target to meet budget expansion, which will now hit Sh3.9 trillion from the Sh3.68 trillion expenditure plan approved in June, according to the draft 2023 Budget Review and Outlook Paper.

The expansion, arising from financial year 2022/23 carryovers amounting to Sh77.5 billion, has pushed upward net borrowing targets to Sh860 billion from Sh718 billion. External financing has gone up from Sh131 billion indicated in the initial budget plan, to Sh448.7 billion as stated in the outlook paper, while domestic borrowing eased marginally to Sh415.3 billion from Sh586.5 billion.

“The government has, however, affirmed its strong commitment to its fiscal consolidation plan,” says the treasury. Mobilising enough tax revenue through new taxes and expanding the tax base is one of Ruto’s main targets to shore up revenue to fund the budget amid the debt repayment burden.