Populous counties to receive Sh8 billion more in BBI deal

Forty counties are set to receive higher allocations of up to Sh8.1 billion if the Building Bridges Initiative Bill sails through in its current form.

The new formula for revenue sharing proposed in the Bill will lead to the remaining seven counties collectively lose a similar amount because they are sparsely populated.

This is because the formula for revenue allocation proposed in the BBI document favours population density over land mass.

The new figures are contained in a report of the Parliamentary Budget Office (PBO) which conducted an analysis of the cost implications of the BBI Bill for consideration by the joint Justice and Legal Affairs committee of the National Assembly and the Senate.

The simulations by the PBO use the proposed allocations of Sh370 billion for the FY 2021/22 which are the last audited reports approved by the National Assembly.

“In computing the per capita using the proposed allocation of Sh370 billion for the Financial Year 2021/22, it is noted that there are seven counties which have a per capita three times above the lowest per capita,” reads the report.

It lists the seven counties as Tana River (Sh2.3 billion), Samburu (Sh1.12 billion), Marsabit (Sh1.23 billion), Lamu (Sh1.2 billion), Isiolo (Sh1.19 billion), Turkana (Sh435 million) and Taita Taveta (Sh368 million).

“As shown above, the total amount to be realised from reducing the per capita for the above seven counties is Sh8.1 billion.

This amount will be shared among the remaining 40 counties in which the county with the lowest per capita gets the highest additional and the highest per capita gets the lowest additional allocation,” it further explains.

The gaining counties include Nairobi with Sh345.49 million, Kiambu Sh326.99 million, Nakuru Sh280.51 million and Meru Sh275.87 million.

Others are Mombasa Sh271.11 million, Bungoma Sh 266.46, Machakos Sh263.98 million, Kakamega Sh 256.46 million, Murang’a Sh250.10 million and Homa-Bay Sh246.14 million.

Report disowned

The Parliamentary Budget Office is a non-partisan professional office of Parliament whose primary function is to provide professional services in respect of budget, finance and economic information to House committees.

Yesterday, a section of members of the Joint Committee appeared to disown the report, claiming they never commissioned it.

Committee co-chair Muturi Kigano denied assigning the Budget Office to conduct the analysis.

“In fact it is not our mandate to look into the cost effect of the BBI. Our role is to look at whether the law has been adhered to,” Kigano said.

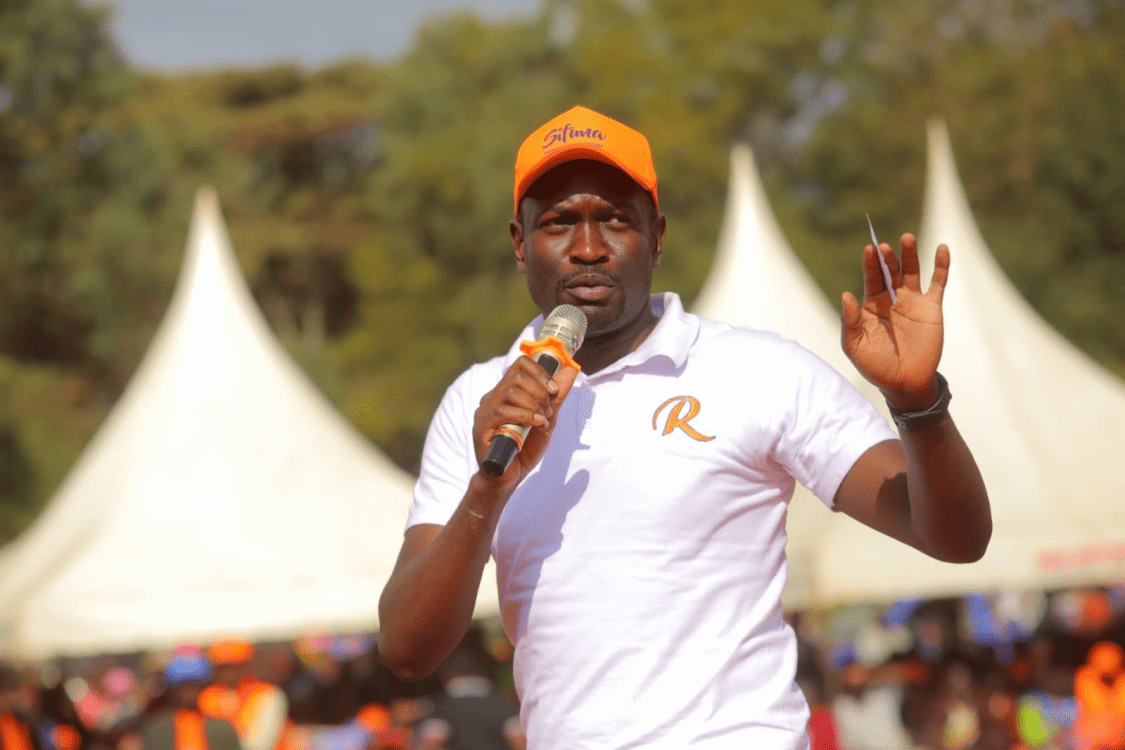

His sentiments were echoed by another committee member, Peter Kaluma, who said it was not the mandate of the joint committee to look into the cost aspect of the BBI Bill.

“Our mandate is to look into the legal aspect and ensure that the law is followed before the Bill is passed.

We never bothered about the cost. The BBI is for the people and it is them who pay their leaders, so the cost should be their concern not anybody else’s,” Kaluma said.

He claimed that “some elements” opposed to the BBI Bill could have approached the Budget Office to prepare the report.

Per capita

According to the findings, the simulations are based on the Senate formula passed by Parliament in September last year which uses eight parameters, namely, Health, Agriculture, Basic Share, Land, Urban Services, Roads, other county services (population) and poverty.

“However, it is important to note that the amendment Bill is introducing a per capita adjustment parameter for sharing resources which is not in the resolution made by Parliament,” warns the Budget Office.

The office recommends several options to the joint committee for consideration and their implications.

One of the options is to accept the Bill as drafted which will imply that seven counties will have their allocations reduced significantly by reducing their per capita as recommended while 40 counties will get slight increments in their allocations by increasing their per capita as recommended in the Bill.

The other option is to accept the Bill with amendments if possible within the legal limits allowing the committee to make any changes deemed appropriate.

The final alternative would be to reject the Bill and allow the status quo to remain.

Former Mandera Senator Billow Kerrow, in a Facebook post, criticised the Bill, saying it is intended to “rob the poor to pay the rich”.

“The BBI is amending Article 203 of the Constitution that sets out criteria for allocation by revenue to limit resources that can go to several counties,” Kerrow explains.

He says that even without the amendment, BBI proponents fought hard in the Senate to reduce revenue allocation to 19 counties because of low population, disregarding the pertinent factors that affect cost of delivery of services.

“For instance, they opposed use of expansiveness of a county which significantly affects cost of service delivery. Marsabit County, for example, is six times the size of five counties in Central Kenya combined,” Kerrow says.

According to him, it is much more expensive to deliver services to its population however small.

Samuel Nyandemo, a senior Economics lecturer at the University of Nairobi, says the government should strive to sustain poor counties.

Audited accounts

“The BBI proposal is a misplaced strategy; you need to plough resources where poverty is. We have seen government ploughing resources without making a follow-up, with the resources landing in private pockets and the government not taking keen interest in legal redress,” said Nyandemo.

The BBI Bill proposes to amend Article 202 (Equitable sharing of national and other financial laws) to provide that, where any revenue sharing in the Constitution is to be based on audited accounts and the National Assembly has not approved such accounts, the most recent audited accounts of revenue submitted by the Auditor General shall be used as the basis of revenue sharing.

Further, the Bill states the need to ensure that the average amount of money allocated per person to a county with the highest allocation does not exceed three times the average amount per person allocated to a county with the lowest allocation.