Modest economic growth, but jobs in short supply

Kenya continues to grapple with high levels of unemployment, with young people bearing the brunt of a sluggish job market despite modest economic growth.

In 2024, while the economy recorded a nominal GDP increase to Sh16.22 trillion, the number of new jobs created dropped to 782,300, from 848,200 in 2023, signalling a widening gap between economic growth and job creation.

This disconnect shows the growing challenge for policymakers to create an inclusive economic environment that delivers employment opportunities to a rapidly growing population.

The informal sector remains the backbone of job creation, accounting for 83.6 percent of new jobs in 2024. In contrast, the formal sector contributed only 16.4 percent.

Informal economy

While the informal economy plays a critical role by employing over 17 million Kenyans, its contribution to the GDP – estimated at 24 percent – remains constrained by limited access to credit, formal infrastructure, and social protection.

Many businesses in this space struggle to expand or scale up due to lack of collateral, formal registration, and restrictive financial markets. The situation is worsened by the government’s growing appetite for domestic borrowing, which has crowded out small enterprises from affordable credit.

According to the Kenya National Bureau of Statistics (KNBS), wage employment in the private sector grew by 2.1 percent in 2024, compared with 3.3 percent in 2023.

Manufacturing and agriculture remained the top contributors to employment, accounting for 15.9 percent and 14.1 percent of private sector jobs, respectively. The public sector recorded growth of 3.1 percent in wage employment, a drop from 5.9 percent in 2023.

“Formal manufacturing employment rose by 1.9 percent to 369.2 thousand persons, with the sector accounting for 11.5 percent of the share of formal employment,” the report says.

Public sector

Employment was heavily concentrated in education and public administration, which jointly accounted for nearly 80 percent of public sector jobs. Overall, the formal sector remains limited, with just 3.4 million people employed.

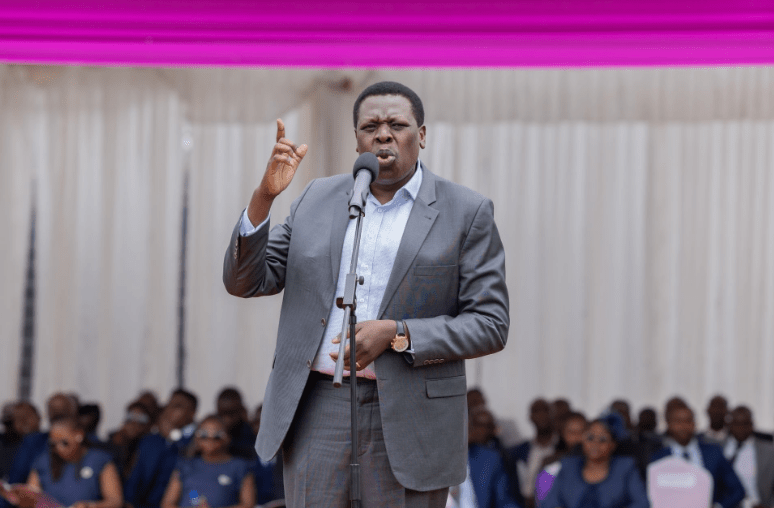

“We take note that … formal employment in Kenya constitutes 16.4 percent and that accounts for 3.4 million people. Then … formal employment has 83.6 percent, which accounts for 17.4 million people,” KNBS Director General Macdonald Obudho said when the reported was launched yesterday.

“[On] jobs, in 2024, we had 782,000 new jobs … created, and the majority … 90 percent … are coming from the informal sector.”

Manufacturing showed some promise, growing at 2.8 percent from the previous year’s 2.2 percent, contributing 7.3 percent to GDP. This modest improvement was sufficient to spur demand for labour, with employment rising by 1.9 percent to 369,200 people.

Agriculture, buoyed by favourable weather and strong output, registered a 14.1 percent growth in employment. However, the gains in these sectors were partly offset by a slump in construction, which contracted by 0.7 percent compared with a 3.0 percent growth in 2023.

Corporate exits

Loan facilities to the construction sector declined sharply from Sh602.7 billion to Sh528 billion, reducing job creation capacity and undermining ongoing infrastructure projects.

“Private employment in the sector registered a downward trend, decreasing from 226.3 thousand in 2023 to 223.4 thousand employees in 2024,” the report says.

The shrinking construction sector saw private employment fall from 226,300 in 2023 to 223,400 in 2024. Public employment in construction marginally increased, buoyed by government-backed projects under the Affordable Housing Programme.

Yet, this small uptick could not offset the broader negative trend. The private sector as a whole continued to face a difficult business environment, marked by high taxation, weak demand for goods and services, and soaring production costs.

Many businesses scaled down or closed altogether, unable to cope with shrinking margins and a lack of affordable financing due to high interest rates.

Several high-profile corporate exits and collapses marked the year, further highlighting the strain on Kenya’s job market. Blue Shield Insurance was ordered into liquidation, weighed down by debt liabilities exceeding Sh855 million.

Startups struggling

Kansai Coatings Kenya Ltd, known for producing Sadolin paints, announced its voluntary liquidation, while e-commerce firm Copia shut down after a decade of operations due to an inability to raise fresh capital.

These closures sent a chilling message to potential investors, particularly in the tech and innovation spaces where startups continue to struggle with access to growth capital and investor confidence.

The automotive sector also faced headwinds, with Mobius Motors folding operations due to financial and production challenges.

In the fast-moving consumer goods space, Procter & Gamble announced its exit from Kenya, citing high operational costs and inflation. These exits reflect a broader trend of declining investor sentiment and waning competitiveness in the Kenyan market.

Export Processing Zones (EPZs), once considered engines of export-led job growth, also suffered setbacks. Employment within EPZs fell by 8.8 percent, while domestic sales dropped by 34 percent, indicating a contraction in both export and local market demand.

The decline in EPZ performance further illustrates the challenges faced by manufacturers amid global supply chain disruptions and domestic economic constraints.