Kenya’s external debt service projected to skyrocket – Treasury CS

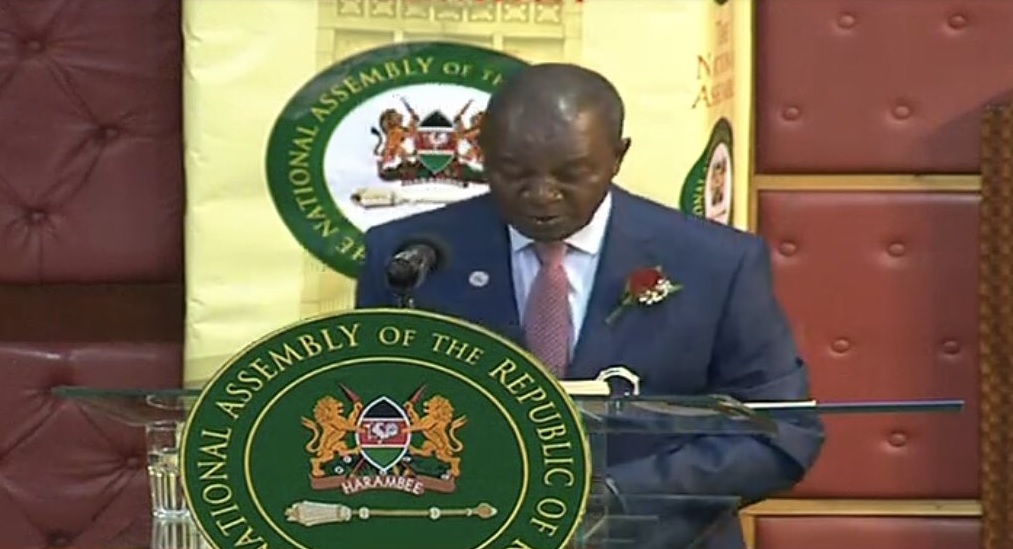

The Cabinet Secretary for National Treasury & Economic Planning, Njuguna Ndung’u announced that Kenya’s external public debt is set to increase from Ksh242.1 billion in the 2022/2023 financial year to Ksh475.6 billion in 2023/2024.

Speaking during the Budget reading in Parliament on Thursday, June 15, 2023, Njuguna said that the sharp increase is as a result of the existing Euro Bond which requires servicing of an amount totalling Ksh241 billion, with the current exchange rate.

“The external debt service is projected to increase from Ksh242.1 billion (2022/2023) to Ksh475.6 billion (2023/2024) in preparation for the redemption of the 2.0 billion US Dollar Euro Bond, which is equivalent to Ksh241 billion current exchange rate,” Njuguna announced.

In his address, Njuguna also stated that the existing Euro bond will mature in June 2023. He stated the timeline as the reason the public debt is expected to increase.

The Treasury CS also noted that the ‘fiscal space has been affected by persistent global shock, the rise of interest rates and the depreciation of the currency.

Despite the hike in the stated figures, CS Njuguna stated that the ‘public debt has not accumulated debt arrears. He explained that ‘the increase has resulted majorly from the global inflation and the appreciating exchange rate between the Kenya Shilling and the United States of America Dollar’.

Njuguna mentioned that ‘the debt ceiling that was approved by the national assembly of Kenya is Ksh. 10T’. However, the CS announced that the government will embrace a different system of borrowing in order to manage public debt, “The government will embrace a system where we will borrow based on what the country can be able to pay,” Njuguna added.

Advisor on Liability Management

As he proceeded with his reading, CS Njuguna also said that the government plans to have an expert to advise on debt management. This he said came as a proposition by the National Treasury and Economic Planning Ministry.

“In preparation for the redemption of this maturing bond, the National treasury and economic planning issued an expression of interest, to bring on board a lead manager, to advise the government on liability management options, towards the resolution of the Euro bond 2023/2024,” Njuguna said.

As part of the debt management measures, CS Njuguna also mentioned that the Public Finance Management Bill was going to give the goal an extra push.

“The Public Finance Management 2023 bill was brought to Parliament and went through public Participation. I urge the members of this house to consider the bill favourably,” Njuguna urged.

Debt repayment

CS Njuguna took the chance to affirm the position of the Kenyan government regarding the existing public debt. He then assured investors and Kenyans in extension, that the country’s fiscal position is strong.

Njuguna also cited the plans to service the Euro bond that is set to mature next year, as the government’s commitment to manage and reduce the debt ceiling.

“I wish to assure Kenyans and investors that our fiscal position remains strong and the government remains committed to meeting all maturing obligations as and when they fall due, including the maturing Eurobond for June 2024.

Government partnerships

The Treasury CS talked about the partnerships that the government entered into with the private sector firms. He explained that the partnership’s goal is to ensure that government projects are well executed in line with the key pillars.

“Due to the limited fiscal space, the government has strengthened the Public-Private Partnerships framework, to leverage on private sector expertise to deliver projects that have strong commercial and environmental benefits, that are also aligned to the National agenda of sustainability and climate change as key considerations and drivers,” he added.

As he read the budget, the CS clearly stated that the 2023-2024 Budget requires a collection of Ksh2.96 trillion total revenue which is equivalent to 18.2% of Gross Domestic Product.