IMF approves combined disbursement of Ksh78B to Kenya

The International Monetary Fund (IMF) Executive Board has completed its review of Kenya, unlocking Ksh78 billion (USD 600 million) to the country.

In a statement shared by IMF on Wednesday, October 30, 2024, the Executive Board indicated that it had completed the seventh and the eighth reviews under the Extended Fund Facility (EFF) and the arrangement under the Extended Credit Facility (ECF), approved in April 2021, and a review under the Resilience and Sustainability Facility (RSF) arrangement, approved in July 2023, with Kenya.

The board’s decision allows for the immediate disbursements of Ksh62 billion (about USD 485.8 million) under the EFF/ECF arrangements and Ksh15.4 billion (about US$120.3 million) under the RSF arrangement.

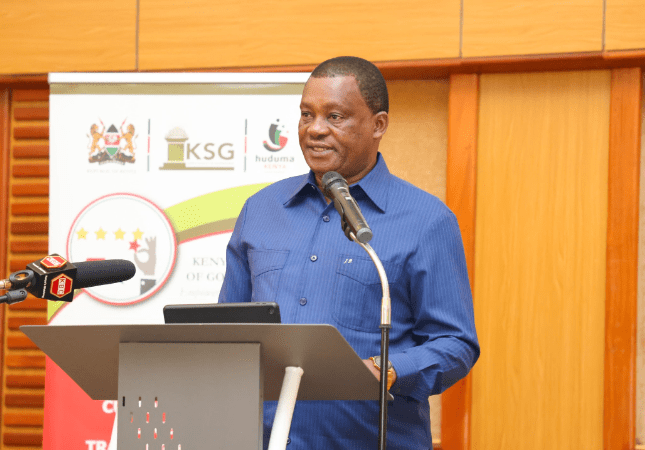

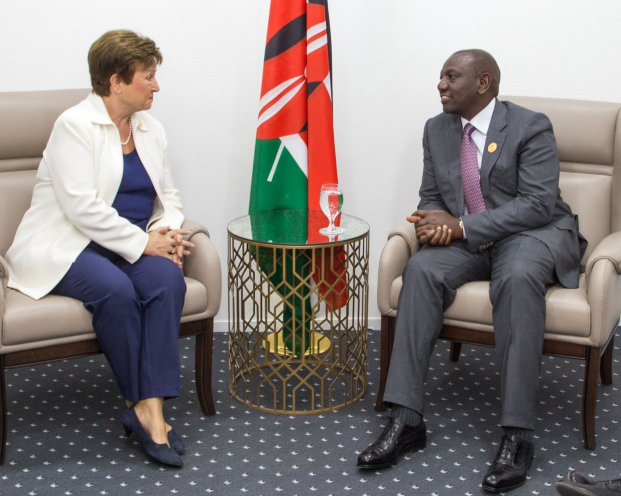

The approval comes days after Treasury Cabinet Secretary John Mbadi held a series of meetings with IMF and World Bank officials in Washington DC.

Mbadi was accompanied by the Governor of the Central Bank of Kenya Kamau Thugge and other officials from the Treasury.

Mbadi noted that the meeting was held to help unlock financing for critical areas in the country’s economy.

Proposed expenditure

According to the IMF statement, the money is supposed to help the country address the debt issue. The board indicated that the facility should go a long way in helping President William Ruto’s administration build resilience to shocks, improve governance and support broader economic reforms.

Moreover, the IMF outlined that the arrangement aims to reinforce Kenya’s strong efforts to address climate-related challenges and catalyze further private climate finance.

The Board emphasized that sustaining progress requires improving the quality of fiscal adjustment, addressing fiscal and financial sector vulnerabilities, advancing governance reforms, and implementing the structural agenda, including climate-related reforms.

It further added that continued efforts to support the vulnerable population, broadening the socio-political support for reforms, and ensuring agile policymaking would be necessary.

“Kenya’s economy remains resilient, with growth above the regional average, inflation decelerating, and external inflows supporting the shilling and a buildup of external buffers, despite a difficult socio-economic environment.

“The EFF/ECF and the RSF arrangements continue to support the authorities’ efforts to anchor macroeconomic stability, reduce debt vulnerabilities, promote reforms, and mitigate climate-related risks,” Gita Gopinath, First Deputy Managing Director of the IMF, stated.

Gita further challenged the country to implement measures aimed at tackling in order to rebuild public trust and also address governance inefficiencies.

“Fast-tracking key reforms would raise medium-term potential. In particular, addressing deficiencies in governance, anti-corruption frameworks, and AML/CFT, including leveraging the requested governance diagnostic, is essential for garnering public trust and enhancing policy credibility, and for attracting fresh investments, including finance to build climate resilience,” Gita emphasised.

Kenya had already made a formal request to the IMF to conduct an assessment of corruption and governance issues.

The country is expected to use the data gathered to strengthen various institutions and address the issue of graft.