Farmers set to pay tax in State’s search for Sh2.9tr

Coffee, tea, and maize farmers are among the informal sector players who will start paying taxes through their co-operatives from July 2024 as the government makes good its threat to expand the tax base and nab billions of untaxed monies.

This will happen if the agriculture produce tax, which has been set at not more than 5 per cent of the value of the produce, is adopted in the upcoming 2024/25 financial year (FY) when ordinary revenue is projected to hit Sh2.9 trillion from current Sh2.571 trillion target.

Just like other tax agents, it implies registered co-operatives or associations will enter into an agreement with the Kenya Revenue Authority (KRA) to deduct and withhold taxes based on the volumes of produce sold and set rate.

The proposals have been made by the National Treasury seeking to strengthen the country’s revenue levels. If effected, several cooperatives in the 31 coffee-growing counties in Kenya and over 612,000 tea farmers are likely to be nabbed.

For instance, Kipkelion District Cooperative Union (KDCU), which made the first direct coffee export to South Korea in March 2022 at a cumulative double price of $908 160 (Sh132.6 million), has 64 primary coffee cooperatives drawn from the counties of Bomet, Kericho, and Nandi.

Co-operative societies

“Develop a simplified regime to facilitate compliance by the sector players, including exploring the possibility of taxing the players through their co-operative societies/associations,” says Treasury in the Draft medium-term revenue strategy.

Farmers of tea, coffee, and other cereals often sell their produce through cooperatives, helping them cut costs on milling, warehousing, and marketing while sharing the profits generated based on agreed terms.

They also have the advantage of saving, getting loans, or other farm inputs such as fertilizers, whose costs are consequently deducted from their returns but not things such as taxes or statutory deductions for social or health coverage.

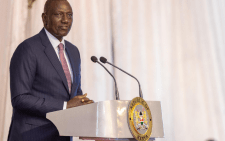

Small-scale agriculture is among the sectors President William Ruto’s administration is desperate to tax, together with Jua Kali, street vendors, and independent subcontractors, among others. Kenya National Bureau of Statistics (KNBS) estimates informal sector accounts for 83.3 percent of total employment in Kenya, indicating the huge revenue potential going untaxed.

Treasury reckons the agriculture sector has unique challenges, including being weather dependent, perishability of the produce, the subsistence nature of the sector, and inadequate tax literacy, which makes the taxation of this sector difficult.

Agriculture dependent

“In addition, the sector is highly informal, cash-based, and characterised by the notion that the incomes generated from the sector are meagre and should not be taxed,” says Treasury. Kenya’s economy is agriculture dependent, contributing an average of 21.2 percent of the Gross Domestic Product in 2022, but its contribution to tax revenues is less than three per cent.

As agriculture receives big State support with the Treasury allocating Sh5 billion for the fertilizer subsidy in the current FY to improve food production, the government is equally keen to reap through taxes other than addressing the food security in the country.

Double taxation

Sector players are, however, likely to reject the agriculture produce tax on the basis of double taxation, costly fuel, and depressed weather amid the high cost of living that has forced Kenya to turn on food imports to bridge production gaps.

“That will be fought very strongly. It will be unreasonable. These taxations are already attached to the existing laws,” says Francis Ngone, chairman of the National Coffee Cooperative Union (NACCU).

Taxing the farmers through co-operatives is one of the seven ways the government has outlined to address the challenges of raising revenues from the informal sector, including the use of technology, customs data, and the introduction of sector/location-based presumptive tax.