Amended law comes to aid of cash-strapped suppliers

John Otini

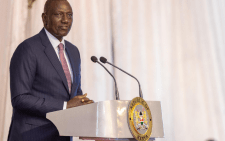

Buyers of goods and services will now be compelled to pay suppliers on time after President Uhuru Kenyatta signed into law a bill authorising the Competition Authority to tame purchaser’s abuse of power.

Delayed payments have led to acute cashflow challenges in various sectors, but Friday morning’s signing of the Competition (Amendment) Bill, 2019 into law will deal with the challenge.

The Act, which will address emerging issues in the economy, including delayed payments, also puts the national and county governments on the spot over pending bills to suppliers.

Unilateral termination

Both levels of government owe suppliers Sh227 billion which is equivalent to 2.5 per cent of the country’s gross domestic product (GDP) in pending bills.

Unpaid cash from the national government amounted to Sh96.1 billion as at the end of the fiscal year 2018/19, with other unpaid bills relating to prior years amounting to Sh42.7 billion for ministries, departments and agencies. Counties owed suppliers Sh64.2 billion as of October 28, this year.

The law also targets buyers accused of unilateral termination of commercial agreements without notice; transfer of costs; and buyer’s refusal to receive or return goods without justifiable reasons and in breach of contractual terms, among others.

“The Amended Act elucidates practices constituting abuse of buyer power. They include delayed payment by a buyer without justifiable reasons in breach of contractual terms,” CAK said in a statement.

Increased delays in payments affects liquidity and profits with the economy being the ultimate loser.

Apart from the primary supplier, it also affects the value chain including secondary suppliers, thereby exacerbating the multiplicity of the impact. This has a knock on effect on even farmers, transport providers and financiers in the ensuing domino effect.

Delayed payments are also rampant in the retail sector.

Naivas chief executive Willy Kimani said the issue arose because most suppliers did not have agreements with buyers in the first place.

“The code of conduct we signed earlier has really improved the situation,”he said.

He added that new entrants in the market started paying suppliers after 45 days as opposed to the market norms of 70 days making the existing buyers look bad.

Other delays were caused by poor documentation by suppliers that also arrived late.

“Prompt payments have been an issue for both the private sector and government in the recent past”, said Retail Trade Association chief executive Wambui Mbarire.

Retail sector

“We were working on retail sector relations with suppliers and we noticed that some of the aspects fall under the CAK and that is what informed the Bill,” she added.

The Act provides that all buyers and suppliers develop and adhere to an industry code of practice, which was signed at the beginning of the year. In instances where the code is breached by either party, the matter can be escalated to CAK.

Contracts between suppliers and buyers must now contain minimum requirements, including terms of payment, payment date, interest payable, mechanism of dispute resolution and conditions of contract termination or variation.