NCBA Group’s shareholders will pocket an interim dividend declaration of Sh2.25 for every ordinary share, a Sh0.50 increase from the Sh1.75 the previous year.

Profit of the Nairobi Securities Exchange (NSE)-listed firm surged 5 per cent to Sh9.82 billion in the six months ended June 30 from a year earlier, with return on equity crossing the 20 per cent mark.

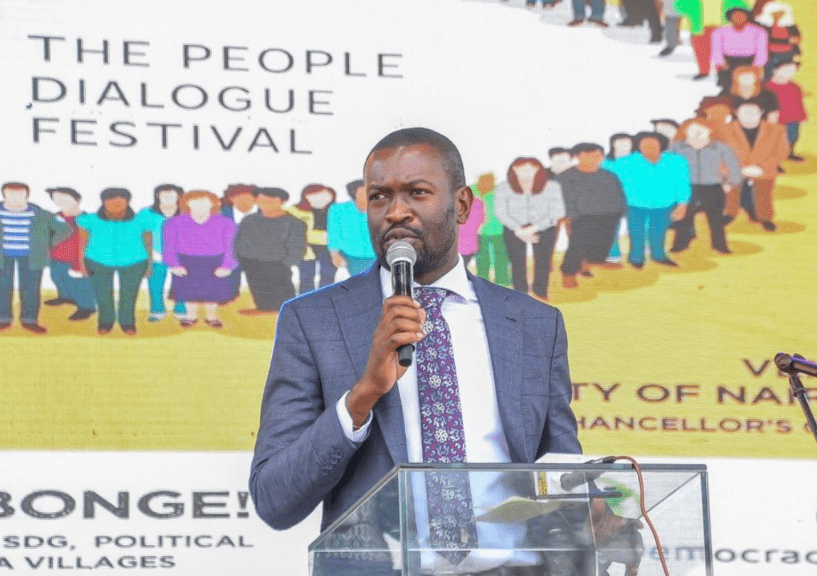

NCBA also recorded a positive operating income of Sh31.4 billion even as the lender saw a decline in loan impairment charges of 38.3 per cent year-on-year. Making the announcement in Nairobi yesterday, Group Managing Director John Gachora said the results for the first half of 2024 emphasized the lender’s resilience amid a tough economic environment.

“Despite some headwinds presented by the current operating environment, our diversified business model continued to demonstrate resilience. Our banking business across the group delivered a collective profit before tax (PBT) of Sh11.7 billion in the period,” Gachora said.

Non-banking subsidiaries, including Investment banking, bancassurance and leasing firms contributed Sh0.6 billion in profitability, achieving an impressive 56 per cent year-on-year growth.

“The growth in these units underscores the enduring strength and versatility of our brand in unlocking substantial value for both our customers and shareholders,” he added.

NCBA accelerated and promoted financial inclusion across the region by disbursing Sh478 billion worth of Digital Loans. This accompanied by innovation on digital platforms services such as the ability to invest on the bank app, instant digital loans and additional pay bill features ensured that NCBA empowered over 60 million customers across Africa and enabled them achieve their financial goals.

Additionally, NCBA played a critical role in economic progress by creating additional job opportunities driven by expansion in the Group`s smart network comprising 115 branches and a focus on enhancing digital skills development for a future-proof digital at the core organization.

The acquisition of AIG Kenya further strengthened NCBA’s position in the financial services industry by tapping into the Sh309 billion insurance industry.

NCBA held a minority shareholding in AIG Kenya for over 18 years, and the takeover will allow the financial institution to offer general insurance services to corporations, SMEs, and individuals. AIG Kenya joined six other subsidiaries, including NCBA Investment Bank, NCBA Leasing LLP, NCBA Bancassurance Intermediary Ltd., NCBA Bank Uganda, NCBA Bank Tanzania, and NCBA Bank Rwanda.