Tie new debt to aiding economic recovery

Kenya faces tough economic choices after failing to secure favourable terms with the International Monetary Fund (IMF) for a new loan programme.

The switch from reviewing the $3.6 billion Extended Fund Facility (EFF) and Extended Credit Facility (ECF) loan programmes to requesting fresh financial help shows how urgent Kenya’s money problems are. It also reveals the challenge of fixing the economy while keeping social peace.

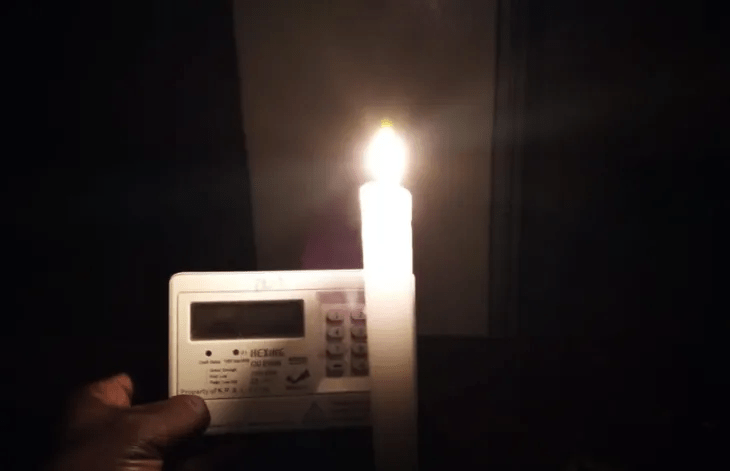

After protests against higher taxes blocked planned revenue sources, the IMF’s decision to abandon the the EFF and ECF programmes raises worries about Kenya’s ability to pay its debts, collect taxes, and control spending.

The previous IMF programmes, meant to strengthen reforms and economic management, faced strong public opposition because of their strict spending cuts. When the government withdrew its 2024 Finance Bill after widespread protests, it showed how hard it is to raise taxes and cut spending without causing unrest.

Despite these problems, the IMF says Kenya’s economy remains strong, with growth above regional averages and a stable currency buoyed by external inflows. However, Kenya’s debt has reached Sh11 trillion, including $6.3 billion owed to China and expensive loans from private lenders, putting pressure on the national budget.

While loans from groups like the World Bank provide temporary help, depending on short-term debt creates high risks. Too much foreign borrowing without better governance could make the debt crisis worse.

Kenya must focus on getting low-interest, long-term financing while implementing policies that promote sustainable growth, improve tax collection, and reduce wasteful spending.

As talks with the IMF continue, Kenya needs terms that support long-term economic recovery rather than just fixing immediate money problems with local bonds that hurt private businesses.

Kenya’s economic future depends on the government’s ability to manage these financial challenges wisely. Achieving stability requires smart debt management, more transparent governance, and economic policies that build investor trust while addressing public concerns.

The government must ensure that budget cuts don’t unfairly burden citizens already struggling with high living costs. The coming months will determine whether Kenya can move toward economic stability or fall deeper into financial trouble.