Organisations and individuals holding unclaimed assets deemed free at the end of June 30, 2024, had up to yesterday to surrender the same to the Unclaimed Financial Assets Authority (Ufaa).

Acting CEO Caroline Chirchir stated that the organisations have up to October 30, 2024, and failure to submit the untaken assets will attract stiff penalties as enshrined in the Unclaimed Financial Assets Act, 2011 No. 40 of 2011 Section 33.

She stated recently that the organisations and individuals are expected to remit Sh4 billion cash of unclaimed assets and properties deemed to have been declared available at the end of the 2023/24 financial year. At the same time between 300 million to 500 million units of unclaimed shares are expected to be surrendered to UFAA so that the same can be united with their rightful owners.

“We have Sh65.2 billion approximate value of unclaimed assets remitted to date, 30,874 total numbers of claimants paid to date and Sh2.13 billion total payouts made to date. We expect more from the holders as the deadline approaches,” said Chirchir.

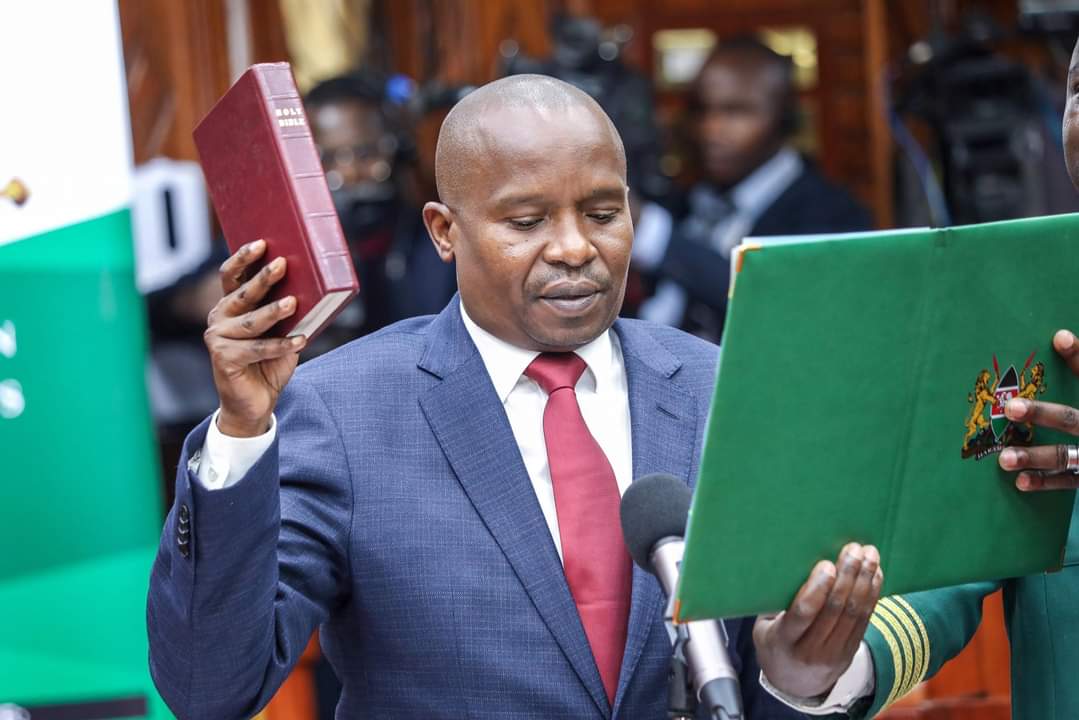

National Treasury and Economic Planning Cabinet Secretary John Mbadi while paying a courtesy call to the institution’s Wetlands office, pledged to support it to enhance reunification of the unclaimed assets.

He emphasised leveraging on technology to boost holders’ compliance and reunification of assets.

Deliver assets

UFAA Act 2011 provides rigid penalties to organisations and persons who fail to pay or deliver assets to the authority. Francis Njenga, UFAA chairman confirmed that the authority has grown the Unclaimed Assets Trust Fund portfolio to Sh32 billion and 1.7 billion units of unclaimed shares. “The Authority has reunited an estimated Sh2.3 billion and other non-cash assets with 33,923 rightful owners and to increase the reunification rate, to about 20 per cent annually, of unclaimed financial assets with the rightful owners as indicated in the Strategic Plan 2023-2028.

“The authority is considering options for converting non-cash unclaimed assets such as shares and contents in declared safe deposits to cash equivalents. Other plans include finalising the development of the National Policy on Unclaimed Financial Assets jointly with the National Treasury,” he added.