Will KPC end listing dry spell at Nairobi bourse?

The listing dry spell at the Nairobi Securities Exchange (NSE) may finally be coming to an end, with the Kenya Pipeline Company (KPC) poised for potential listing.

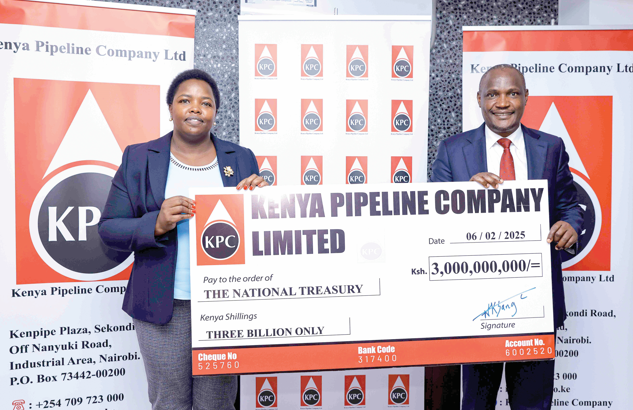

This move, which could breathe fresh life into the stock market, was hinted at by Treasury Cabinet Secretary John Mbadi while receiving a Sh3 billion interim dividend cheque from KPC board chair Faith Boinett.

This payout brings KPC’s total dividend contributions to the Treasury over the past year to an impressive Sh10.5 billion, solidifying its status as one of the government’s most profitable entities.

Experts say that the lack of activity at capital markets can be attributed to a combination of factors including economic challenges, regulatory hurdles, and shifting corporate strategies that have made public listing less appealing for firms.

Listing on the Nairobi bourse is set to charge KPC’s ambitious expansion into Liquefied Petroleum Gas (LPG), unlocking new opportunities and allowing ordinary Kenyans to own a stake in this energy powerhouse.

According to Mbadi, the stock market could provide the necessary liquidity and capital to fuel KPC’s regional expansion and diversification.

“We have this feeling that KPC needs to realise the benefits that will accrue from a listing at the Stock Exchange. Listing will be a good idea especially as KPC expands into the region because it will provide much-needed liquidity and capital for expansion and diversification into LPG, Kenyans will have a chance to own a piece of KPC,” Mbadi said.

As part of its strategy, KPC is gearing up to establish a trading hub in Mombasa for the receipt, trading, and distribution of petroleum products—an initiative that will bolster the region’s oil and gas industry.

Merger to be fast tracked

Adding to the momentum, the Treasury also pledged to fast-track the long-delayed merger of the Kenya Petroleum Refineries Limited (KPRL) with KPC. Mbadi assured that the government, in collaboration with the Ministry of Energy, would ensure a smooth transition within the current financial year.

This move aligns with the Government-Owned Enterprises (GOE) Bill 2024, which has already received Cabinet approval and is currently under review by the Attorney General. The bill seeks to enhance corporate governance, streamline operations, and grant state-owned firms greater autonomy, making them more competitive while reducing reliance on government funding.

With a record-breaking Sh10.5 billion in profit, the company has become a model for state corporations, proving that profitability and strong governance go hand in hand.

Over the last decade, KPC has contributed a staggering Sh63 billion in taxes and dividends. The company reported a Sh10.1 billion Profit Before Tax (PBT) for the 2023/24 financial year, a sharp rise from the Sh7.6 billion recorded the previous year.

Board chair Faith Boinett attributed this success to efficient operations and strategic diversification, particularly into Fiber Optic Cables (FOC) and LPG.

As part of its expansion strategy, KPC is now lighting up its extensive fiber optic network, a move aimed at tapping into the growing demand for high-speed internet.

This initiative promises to bridge the digital divide, particularly in underserved regions, while reinforcing KPC’s role in national development.

KPC’s regional dominance is also evident, with the company holding a commanding 90 percent stake in fuel transportation to Uganda and eyeing a similar market share in Rwanda. This aggressive push into regional logistics cements its leadership in East Africa’s energy sector.

“KPC remains steadfast in its commitment to regional competitiveness. We are proud to hold a 90 per cent stake in fuel transportation to Uganda and are on the brink of securing a similar share in Rwanda. This demonstrates our strategic efforts to cement our leadership in the regional energy and logistics sector,” she said.

Managing Director Joe Sang echoed this sentiment, highlighting the company’s resilience in a volatile operating environment. Operational efficiencies have significantly boosted flow rates on key pipeline routes, with the Mombasa-Nairobi and Nairobi-Western Kenya lines increasing throughput by 37 percent and 20 percent, respectively, without additional capital expenditure. To further enhance supply chain stability, KPC has optimized the Kisumu Oil Jetty (KOJ), enabling the loading of over 320 million liters of fuel to date.

Beyond financial gains, KPC is making strides in environmental sustainability. By transporting fuel via pipelines instead of roads, the company eliminates approximately 22,100 fuel trucks from the Mombasa-Nairobi route each month, offsetting an estimated 4.5 million tonnes of CO2 emissions annually. Its commitment to environmental conservation is further demonstrated through reforestation efforts, with over 600,000 tree seedlings planted across the country since 2017. Notably, its mangrove restoration initiative in Jomvu Kuu Creek, Mombasa, has seen more than 440,000 seedlings take root, thanks to collaborations with community groups, the Kenya Forest Service, and the Mombasa County Government.

In another landmark achievement, KPC’s Morendat Institute of Oil and Gas has been officially gazetted as a National Polytechnic. This recognition enhances Kenya’s standing in the petroleum and gas sectors, positioning the institution as a regional hub for specialized training and capacity building.

With solid financial performance, a bold expansion strategy, and a commitment to sustainability, KPC is redefining what it means to be a successful state-owned enterprise. If the listing at the NSE materializes, it could mark the beginning of a new era—one where state corporations thrive in the open market, delivering value to both the government and ordinary citizens.