Why ‘soft life’ paycheck from brand deals is no longer looking secure

The emergence of Kenya’s digital space as a key economic driver where online hustles and side gigs reign supreme, has forced the taxman to lurk in the shadows.

Kenya Revenue Authority (KRA) has intensified its game, casting a wider net to bring in digital entrepreneurs, from Instagram influencers to online traders. Suddenly, that “soft life” paycheck from brand deals or YouTube ads isn’t looking so soft anymore.

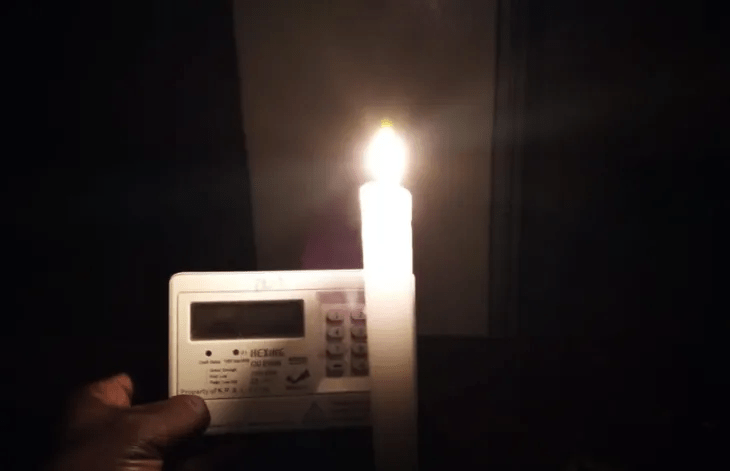

With the Digital Service Tax (DST) now slicing off 1.5 per cent from the gross transaction value of earnings through digital platforms, the informal sector is feeling the pinch.

Even Maria, a social media star who once popped bottles after landing her first major partnership, admits the reality check hit hard.

“I didn’t think about taxes when I signed the deal,” she says. “Now, the DST and other deductions leave me with way less than expected.”

And it’s not just the glitzy world of influencers taking the hit. Small businesses pulling in between Sh1 million and Sh25 million annually are now dealing with a 3 per cent Turnover Tax (TOT) — triple what it was before. That’s revenue, not profit, by the way. For micro-entrepreneurs barely scraping by, it’s like taxing the flour before the chapati’s even cooked.

KRA Commissioner General, Humphrey Wattanga, is clear about the mission: Bring the informal sector into the tax bracket. And why not? The sector employs around 15 million people and makes up 83 per cent of Kenya’s workforce — a goldmine of untapped tax potential.

The push includes tracking transactions through partnerships with banks and mobile money providers, plus a sprinkle of AI and data analytics magic to sniff out underreporting.

Still, it doesn’t end there. The Finance Act 2023 stirred a VAT hike on fuel—8 per cent to 16 per cent—sending a ripple effect through the cost of living. The new Housing Levy skims off 1.5 per cent from employees’ gross salaries, adding yet another slice to the ever-shrinking pie of disposable income

“We’re taxed at every turn and corner,” sighs Brian, an accountant juggling PAYE, NHIF, NSSF, and now the Housing Levy. “Making ends meet feels like running on a treadmill.”

It’s a delicate call by the taxman—clamping down on tax evasion without squeezing small businesses into extinction. Promises of simplified tax policies sound good on paper, but for traders like Mary Wanjiku, an online retailer, actions speak louder than tax summits.

“Simplifying taxes is a great idea,” she says. “But what we need is less red tape and fewer penalties—not just talk.”

As digital surveillance tightens and tax audits ramp up, tax consultants urge side hustlers to get their financial records in order and stay ahead of the game. Proactive compliance, they say, is the new way to flex, they say.