Why Gen Zs wants State to stop road levy review

The youth, popularly referred to as Gen Z (Generation Z), organised a nationwide protest that saw millions demonstrate over the high taxes imposed on Kenyans by President William Ruto’s regime through the Finance Bill 2024.

Despite the president withdrawing the “punitive” Bill after public pressure, the Gen Zs have vowed to continue with protests, calling on the government to reduce more taxes and improve the cost of living for Kenyans. A top emerging concern identified by the Gen Z movement is a notice of the proposed increase in taxes on Fuel Levy charges from Sh18 to Sh25 per litre.

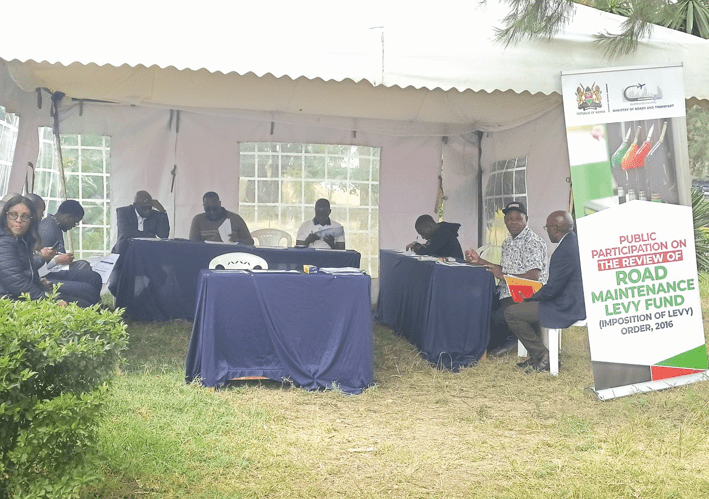

“The Ministry of Roads and Transport proposes an amendment to [the order] by increasing the road maintenance levy on petrol and diesel,” read the notice in the dailies. The ministry has organised various public participation forums in Nairobi, Nyeri, Eldoret, Nakuru, Isiolo, Machakos, Kisumu, Garissa, and Mombasa on July 8.

Regional offices

The meetings, as per the notice, will take place at the ministry’s headquarters and regional offices of the road agencies (Kura, Kerra, and Kenya Roads Board).

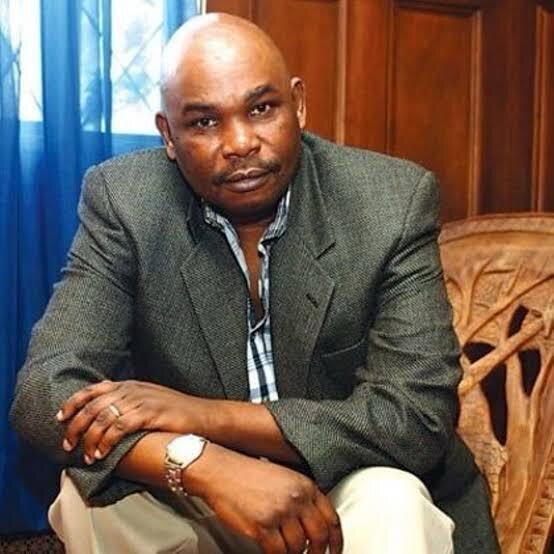

Yesterday, Roads and Transport Cabinet Secretary Kipchumba Murkomen noted that there has been a considerable increase in the country’s road network from 166,451km in 2016 to the current 239,122km which requires regular maintenance from the Sh18 provided for by the Road Maintenance Levy that has been in place for the last eight years.

He said that from the views received from the ongoing public hearings, many Kenyans are worried that an increase in the levy will result in a rise in the cost of living.

“With this in mind, we will analyse the reports received on email and social media platforms as well as the submissions made today, and come up with a decision that corresponds with the recommendations from the public,” Murkomen said in a statement yesterday. According to the CS, the ministry will explore ways of getting the resources needed to maintain roads, as expressed by Kenyans in their numbers, without raising the cost of living through an increase in petroleum prices.

“As suggested by Kenyans, we will only make this decision when we are certain that any revenue measures adopted will not result in a rise in the cost of living,” he added. Coming just as the dust over the withdrawn Finance Bill 2024 begins to settle, the push by Murkomen puts the ministry in the spotlight for trying to increase the levy on petrol and diesel.

However, the Gen Z activists are pushing back against the government’s move, arguing that it will have far-reaching negative impacts on Kenya’s economy, affecting the daily lives of many people, especially those of low-income groups.

Petroleum fuels are the major source of energy in Kenya mostly used by commercial, agricultural and industrial establishments. Due to its prominent position in these sectors, petroleum is a major driver in boosting the country’s gross domestic product (GDP).

Fuel is necessary for machinery, irrigation, and transportation of produce in industries like agriculture. In transportation, fuel prices determine daily travel and transportation costs. Statista, a global data and business intelligence platform, estimates that Kenya’s fuel consumption dropped to 5.13 million tonnes compared to the previous year’s 5.19 million tonnes, majorly attributed to high pump costs which decreased consumer demand.

Should the proposed changes become law, increased fuel levy on petrol and diesel prices means that new prices will lead to a spike in transportation costs, hitting Kenyans who rely on vehicles for daily commute hard.

The cost of transportation for goods and services will have a direct impact on cost-push inflation. Industries that heavily rely on fuel for production are likely to increase production costs which will be passed down to the consumers, increasing the Consumer Price Index (CPI).

Household budgets

This will affect household budgets, increasing the cost of living for Kenyans who are already grappling with a dire economy, reducing disposable income and household purchasing power.

Agriculture, manufacturing, transportation, and logistics sectors which rely heavily on fuel will also be affected. The high fuel prices will increase production and operation costs which can reduce their competitiveness.