Watchdog fines steel firms Sh338m for cartel conduct

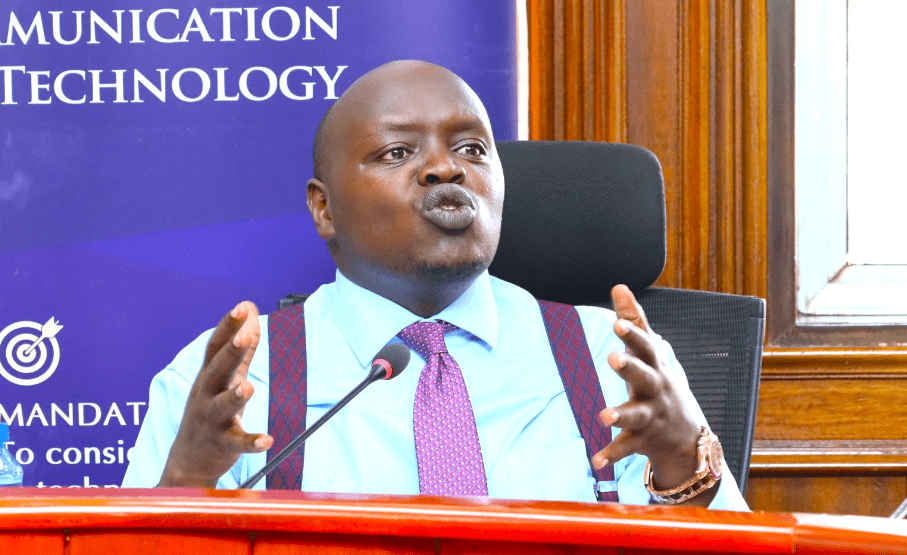

Competition Authority of Kenya (CAK) has fined nine steel companies, among them Devki Steel Mills, a total of Sh338.8 million for price fixing and output restriction.

Price fixing and output restriction are two forms of collusion that has harmful effects ac the economy. Price fixing occurs when firms agree to charge the same price for their products, while output restriction is when the firms agree to limit the quantity of goods they produce.

“The Authority has pursuant to an investigation, penalised nine (9) steel manufacturers a total of Sh338,849,427.89. The companies engaged in cartel conduct whose effect was to increase the cost of construction of homes and infrastructure by artificially inflating the prices of steel products,” CAK acting Director General Adano Wario said.

Steel products including bars, pipes, beams, and sheets, account for over 20 per cent of the total cost of constructing a house.

Also fined alongside Devki were Nail and Steel Products Ltd, Brollo Kenya Ltd; Blue Nile Wire Products Ltd; Tononoka Rolling Mills Ltd, Doshi & Hardware Ltd; Corrugated Steel Ltd; Jumbo Steel Mills and Accurate Steel Mills Ltd.

Further, the firms, except for Accurate Steel Mills, have been penalised for output restriction by agreeing to limit imports of certain steel components, thereby causing an artificial shortage that raised prices, Wario said. He added: “Price fixing and output restriction are illegal under the Competition Act since they hinder competition in markets (business-customer environment).”

“Competitive markets benefit consumers through lower prices, increased choice, and quality of goods and services. Business rivals are also motivated to innovate.”

Wario said the penalty is the highest-ever imposed by the Authority and it should send a clear message that cartel conduct is illegal under the Competition Act. “In a liberalised market like ours, the forces of supply and demand should signal prices, free from manipulative business practices. Agreements between competitors seek to defeat this fundamental facet of a free economy,” he stated.

According to CAK, the misconduct of the companies directly contributed to high steel prices which has increased the cost of construction in the country. The regulator detailed that the investigations into the allegation of price fixing began in 2020 after developers filed several complaints. It carried out a series of raids in specific companies during the period in between to determine if the allegations were true.

Meanwhile, the Authority has approved the proposed acquisition of 100 per cent shares in Kopo Kopo Inc. by Moniepoint Inc. unconditionally, noting that the merger is unlikely to negatively impact competition in the market for digital credit, neither would it elicit negative public interest concerns.

Moniepoint Inc., is incorporated in the US with subsidiaries in Nigeria and the UK, (Teamapt Limited and Moniepoint Microfinance Bank) and the United Kingdom, while Kopo Kopo Inc., is also incorporated in the US with operations in Kenya under the brand Kopo Kopo Inc.

“Given that Moniepoint does not have current operations in Kenya, the firm had no turnover or assets in the preceding year to lodging the merger application (2022),” Wario said.