Buy-now-pay-later offers credit alternative for cash-strapped consumers

The Buy-Now-Pay-Later (BNPL) model is emerging as a financial lifeline for young consumers struggling with rising living costs amid shrinking disposable income.

As economic challenges persist, BNPL presents an alternative to traditional credit by allowing consumers to buy goods and services upfront and pay later, often without interest or with minimal fees.

This financing model, typically offered by banks and fintech firms, enables individuals to access essential goods and services without immediate financial strain.

Data from the FINACCESS household survey conducted by the Central Bank of Kenya (CBK) shows that youths aged 26 to 35 have significant financial access, with only 3.1 per cent experiencing financial exclusion, down from 5.2 per cent in 2023.

On the other hand, those aged 18 to 25 face the highest exclusion rate at 23 per cent, primarily due to lacking essential documents such as national ID cards.

Avoiding debt traps

By leveraging modern financial solutions, consumers can avoid falling into high-interest debt traps while maintaining financial stability.

Most BNPL options are structured as short-term loans with no hidden costs, making them a safer borrowing alternative compared to conventional credit facilities. Additionally, financial institutions benefit from increased customer loyalty by providing this value-added service.

Craft Silicon Group chief executive Kamal Budhabatti estimates that the BNPL sector is expected to grow by 13.6 per cent in 2025, reaching $1.18 billion (Sh152.2 billion). This growth is driven by the increasing demand for flexible payment solutions and the rapid expansion of digital financial services.

He said Craft Silicon’s BNPL product, Spotit, has processed transactions worth Sh200 million within just a year of entering the market, highlighting the model’s rising popularity.

“Our unique approach, where customers are pre-approved by their banks, ensures a seamless payment experience. Customers can confidently walk into approved stores knowing they have an available spending limit from their bank,” Budhabatti stated.

For many Kenyans, especially those in the middle- and lower-income brackets, BNPL offers a practical solution to managing everyday expenses. With limited job opportunities and many individuals reliant on wage employment, the ability to spread payments over time without hefty interest charges provides much-needed financial flexibility.

Dealing with financial constraints

Players in the sector claim that the model allows consumers to prioritize urgent needs such as rent and school fees while accessing essential goods through affordable instalment plans.

Kenya National Bureau of Statistics (KNBS) data estimates that wage employment in the modern sector grew by 4.1 per cent, adding over 122,000 new jobs. Despite this growth, financial constraints remain a challenge, making BNPL a timely and effective solution for many households.

However, alongside its advantages, digital financing solutions also pose risks. Reports from the Competition Authority of Kenya (CAK) indicate a rising trend in consumer protection issues. In the 2023/24 financial year, the authority recorded 63 cases related to digital financial services, a significant increase from the 16 cases reported in the previous financial year. This surge underscores the importance of ensuring consumers fully understand loan terms before committing.

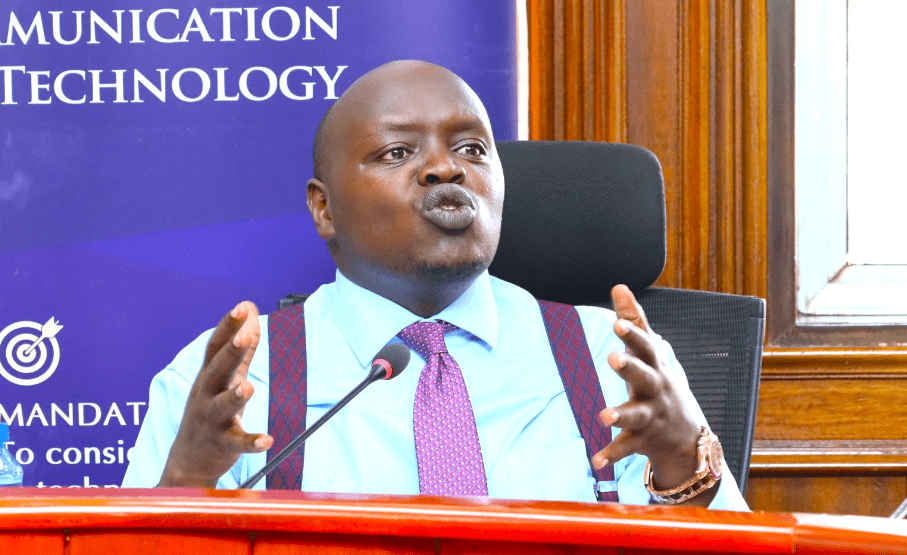

Boniface Kamiti, Manager of Consumer Protection at CAK, highlighted the issue, noting that many consumers fail to read or comprehend loan agreements due to complex legal language. “There are loans accessed through digital platforms that have exploitative terms. Consumers often enter agreements without fully understanding the policies,” he explained.

A recent financial sector report also emphasized the need for heightened consumer awareness, noting that digital lending platforms continue to proliferate, sometimes at the expense of consumer rights. The ease of access to quick loans has led to increased cases of unfair lending practices, further necessitating regulatory intervention.

While BNPL is seen as a game-changer by industry stakeholders, it also presents potential challenges for financial institutions.

Banks, in particular, face an increased risk of rising Non-Performing Loans (NPLs), which currently stand at 16.5 per cent, according to the Central Bank of Kenya (CBK). The accessibility of BNPL services could lead to higher default rates if borrowers are unable to meet their repayment obligations.