Upwork freelancers in Kenya face new tax obligations

By John Otini, July 28, 2023Kenyan freelancers employed in the gig economy will cough more to the Kenya Revenue Authority (KRA) after the regulator issued a demand letter to US-based global freelance platform, Upwork to subject them to Value Added Tax (VAT).

This means that freelancers will now be subjected to VAT deductions on their earnings made through the platform. “Kenya requires Upwork to collect VAT and remit the tax to the Kenya government, when we charge tax, it is because your government requires us to,” Upwork said in a statement.

This move by the KRA comes as part of their efforts to expand the tax base and ensure that online businesses and self-employed individuals contribute their fair share to the country’s revenue. With the rising popularity of freelancing and the growth of the gig economy, the tax authority views this as an opportune moment to tap into the earnings of Kenyan freelancers who provide services to clients across the globe.

Upwork, being one of the largest and most widely used freelance platforms worldwide, hosts a considerable number of Kenyan freelancers who offer their expertise in various domains such as web development, graphic design, writing, digital marketing, and more.

VAT deductions will be pegged on 16 per cent of earnings generated through the platform, impacting the income streams of these freelancers.

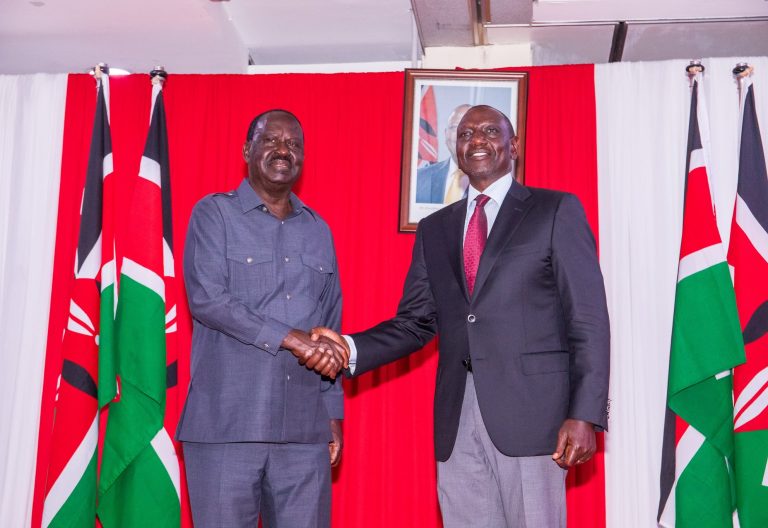

This comes after President William Ruto dropped the 15 per cent tax on content creators to 5 per cent and it is not clear whether this will affect those subscribed to Uptown.

More Articles