Treasury moves to squeeze more cash from parastatals

State corporations are now under close watch on matters of expenditure and revenue mobilisation as the national government targets to raise more funds to facilitate its projects while at the same time reducing the public debt.

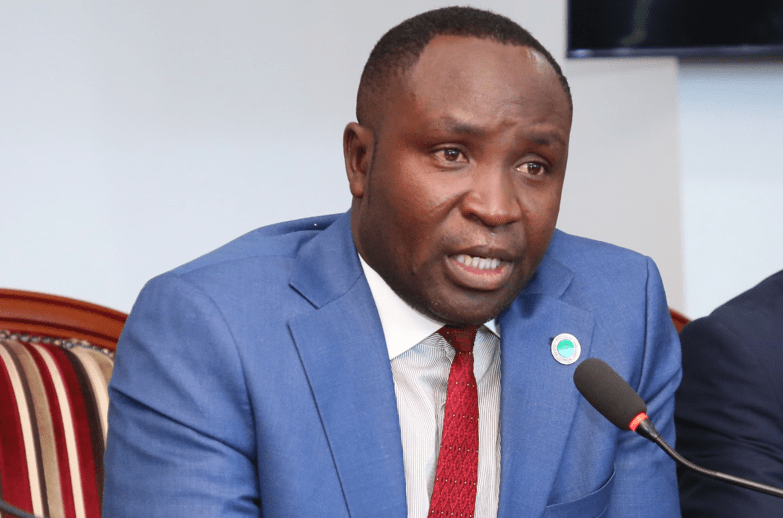

In the latest circular by the National Treasury Cabinet Secretary, John Mbadi, corporations’ heads have been advised to fully embrace austerity measures and devise more channels for revenue mobilisation to help achieve Kenya Kwanza’s Bottom-Up economic transformation agenda.

He said State corporations are required to entrench prudent financial management practices in their planning and enhance cost control measures with the aim of delivering services in the most cost-effective manner.

“Executive Officers/accounting officers of state corporations are reminded that incurring expenditures without approval by the line ministry and the National Treasury and Economic Planning is irregular and will be held personally liable for such expenditure per provisions of the Public Finance Management (PFM) act, 2012,” the circular warns.

They are also expected to significantly contribute to the exchequer in efforts to facilitate better service delivery to the public.

“All State Corporations are expected to generate reasonable returns, declare and pay dividends to the national exchequer and other shareholders. All commercial state corporations should revise their dividend policies and provide 80 per cent of profit after tax for payment of dividends,” the circular directs.

The treasury further wants regulatory authorities to remit 90 per cent of the operating surplus reported in the audited financial statements to the national exchequer. Under the new provisions, the Kenya Revenue Authority has been mandated to collect the 90 per cent of the operating surplus on behalf of the National Treasury.

This comes amid concerns by the National Treasury that some regulatory authorities are failing to meet their obligations.

“It has been noted with concern that some regulatory authorities are adjusting operating surplus by providing for capital expenditure to determine the 90 per cent to be remitted to the national exchequer. No state corporation should provide for capital expenditure from operating sur plus without a written National Treasury approval,” the ministry warned.

To further seal the loopholes and limit pending bills accumulation, the National Treasury has prohibited the implementation of new projects before the pending ones have been cleared.

“In accordance with the PFM Act 2012, accounting officers are reminded that accumulation of confirmed and verified liabilities is prohibited and may invite punitive actions against those responsible,” the circular stated. According to a report by the Controller of Budget, state corporations appeared to be the highest contributors to the pending bills leading with Sh410.69 billion which represents 78 per cent of the total Sh528.36 billion as of September 30, 2024.

“The State Corporations’ pending bills include payments due to contractors/ projects, suppliers, unremitted statutory and other deductions, and pension arrears for Local Authorities Pension Trust.

The highest percentage (Sh249.79 billion as of 30 September 2024) was for Contractors/Projects (Development), at 61 per cent, followed by Consumables and General Supplies, at 10 per cent,” the report reads in part. The corporations have also been warned of taking loans or any form of credit from financial institutions without the approval of the cabinet secretary, line ministry with the concurrence of the treasury CS. “The National Treasury and economic planning will not give concurrence for borrowings or, where applicable, grant guarantees for state corporations which are in default of loan repayment and pending bills,” the ministry warned.

In addition to this, they are also expected to get approval from the treasury when seeking to open and operate bank accounts. Moreover, employees at the facilities will be remunerated after approval from the Salaries and remuneration commission (SRC).

This move will help tame the tendency of splurging on salaries and other remunerative benefits by the said government officials. According to the report, a significant amount of funds was splurged on Salaries, Allowances and Miscellanies (SAM) during the period under review.

“The total expenditure on SAM in the first three months of FY 2024/25 was Sh945.55 billion, representing 22 per cent of the annual estimates, compared to Sh812.48 billion (20 per cent) recorded in FY 2023/24,” the report indicates.

“A comparison of the SAM’s budgetary allocations for FY 2023/24 and FY 2024/25 indicated significant variations on budgeted salaries and allowances despite the remuneration of the constitutional office holders being public information, having been gazetted by the Salaries and Remuneration Commission.”