State proposes Sh268b for key export products

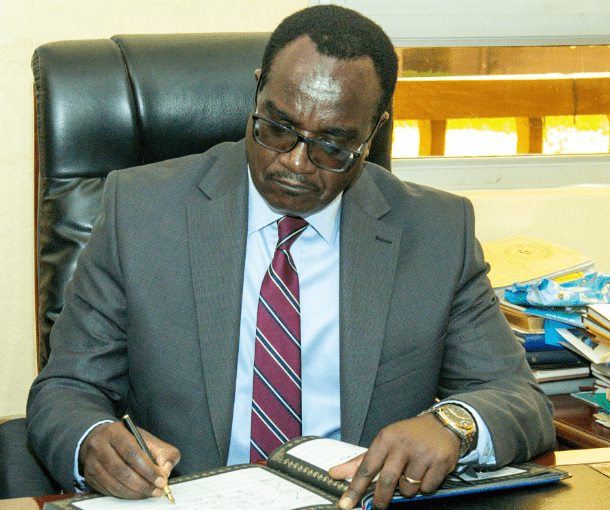

The government is proposing to splash Sh267.7 billion in the upcoming 2023/24 financial year to support the production of key products currently being prepared for exports markets.

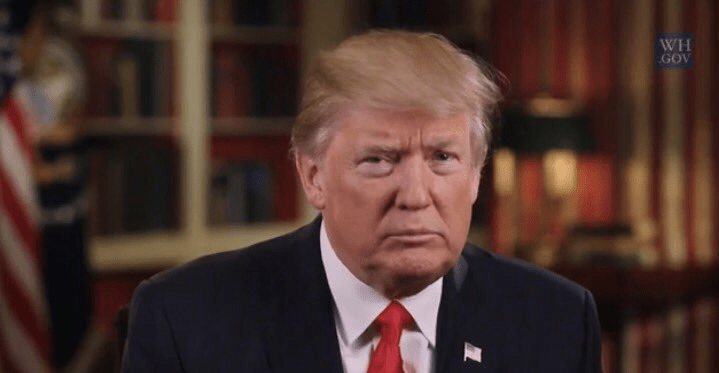

The move targets to bridge the country’s widening trade deficit. The amount will be split into nine value chains prioritised by President William Ruto’s Kenya Kwanza administration to rectify a battered economy compounded by both domestic and global uncertainties.

These value chains comprise cotton to textile and apparel, edible oil crop production, dairy, leather and leather products, rice production, and tea. Others include blue economy, minerals and tree planting, and construction and building material value chains.

Kenya is already witnessing domestic shortage, save for tea, in the volumes of the above targeted products, leaving the country hugely dependent on importations to bridge the gaps.

The brands, except for construction and minerals, are currently being positioned for the international market, especially the European Union (EU) and the United States by Kenya Export Promotion and Branding Agency (Keproba), the state agency mandated to promote Kenya’s products.

“The value chain approach allows mapping the production process throughout the value chain to the final market transaction. The resource allocation on the value chain approach to budgeting ensures efficiency by eliminating gaps and duplications,” reads in part a cabinet memo released yesterday about the 2023/24 budget.

Having a special budget for the above value chain lines signifies pressure to first fix the local production constraints and improve volumes before dreaming about serving the external market, whose success largely demands sustainability and competitiveness in terms of pricing and quality. A periodic milk shortage has, for instance, forced Kenya to severally get extra supplies from Uganda.

External markets

A similar concern is evident with edible oils whose production volumes have always fluctuated based on the availability of raw materials from external markets such as Malaysia and Indonesia, leading to hiked prices.

On the other hand, despite a marginal increase in exports over the past few years, Kenya’s textile industry still remains widely untapped, with the influx of cheap second-hand clothes (mitumba) also threatening to crowd out local players.

Countries are always keen on building surplus production before eyeing export markets. For Kenya, this has largely been saddled by taxes, shortage of raw materials, and cheap imports. The situation has been worsened by the recent difficulties in sourcing foreign exchange to facilitate international activities.

To address this, President Ruto’s regime has proposed the Finance Bill 2023 to exempt from Value-Added-Tax (VAT) tea purchased from factories or the auction centre for the purposes of export to promote local processing.

There is also an assessment around offering tax incentives to manufacturers of vaccines and bio-pharmaceuticals and packaging materials for the tea export industry. Imported fish and furniture will be slapped with excise duty to shield local players. An investment allowance will equally be extended to telco players involved in construction and maintenance of key infrastructure like telco towers.

The law allowing the implementation of inflationary adjustments by KRA’s Commissioner General will be scrapped to enable predictability of the excise duty rate. The last inflationary adjustment that was effected last October triggered a public outcry among manufacturers, citing operation burden and risks of cutting the workforce.