State begins next year’s budget making process

Lewis Njoka @LewisNjoka

The National Treasury yesterday invited stakeholders and the general public to submit proposals on economic policy measures to be considered in preparation for financial year 2022/2023 budget.

In a statement, Treasury said it decided to begin the process of preparing Finance Bill 2022 early considering that next year will be an election year, hence, the need to fast-track the national fiscal budget process to ensure smooth government operations.

Next year, Kenya will hold its General-Eelection slated for August. Additionally, there is a possibility the country could hold a referendum on the constitutional changes proposed by Building Bridges Initiative (BBI).

Invitation for proposals

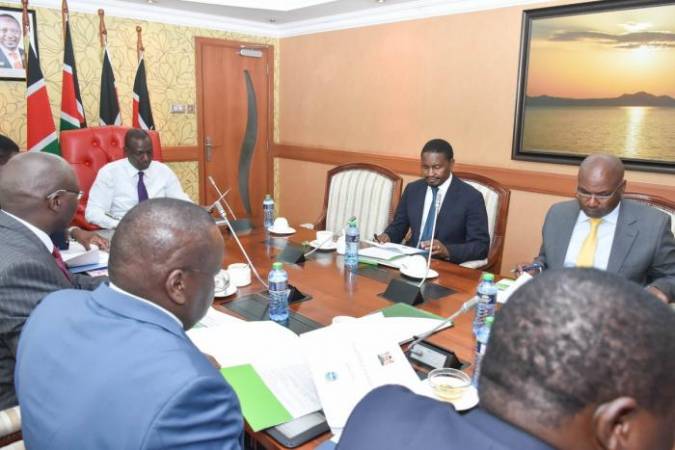

“In pursuit of openness and accountability in financial matters as spelt out in article 201 of the constitution, the National Treasury hereby invites government departments and agencies, the private sector, non-government organizations, and individuals to submit proposals on economic policy measures,” said Treasury CS, Ukur Yatani in a statement.

“It is therefore imperative that the process of preparing the Finance Bill 2022 begins early enough to ensure that the Finance Act 2022 is enacted before Parliament breaks in preparation for the General elections,” he added.

According to the CS, preparation of the Finance Bill 2022 will commence next month with the completion and submission of the Bill to the National Assembly slated for January 2022.

The proposals, Yatani said, should resonate with the Economic Recovery Strategy as well as the Building Back Better theme which informed the preparation of the current financial year’s budget.

They could include measures on regulatory reforms, revenue administration reforms, and any other measures that will enhance macro-economic stability.

All interested persons and organisations have until August 30 to send their proposals for consideration.

But even as Treasury calls for proposals on next year’s budget, Kenyans are already feeling the pinch of tax adjustments made recently via Finance Bill 2021 as Covid-19 pandemic shocks continued to bite.

Bretton Woods Institutions

This includes austerity measures imposed on the country by its development partners. Kenyans are now paying higher for cooking gas after a VAT on the product introduced in 2020 kicked in this year.

Additionally they now have to pay more on phone calls, internet and betting after exercise duty on the three was increased.

Imposition of 25 per cent excise duty on imported tomatoes, onions and potatoes could see the price of the commodity in the country rise.

“The increase was mainly driven by rise in prices for commodities under: food and non-alcoholic beverages, housing, water, electricity, gas and other fuels and transport between June 2020 and June 2021,” said Macdonald Obudho, the KNBS Director General, in a statement.

Kenya which is heavily indebted, is expected to service its external debt to a tune of Sh35 billion this month after the expiry of the debt holiday under the DSSI program.

Analysts are however predicting that Kenya will post impressive economic growth this year with the World Bank estimating it at 4.5 per cent and while NCBA puts it at 4.9 per cent.

“We expect the East African Economic activity to pick up in 2021 with a three per cent growth in comparison to 0.9 per cent in 2020.

This will be mainly driven by private consumption and domestic demand,” said Deloitte East Africa Financial Advisory Leader, Gladys Makumi.

She, however, warned that recurrence of lockdowns, slow vaccine rollout, restrictions in movement and budgetary pressures could impact the growth negatively.