Pressure mounts on MDAs as State seeks Sh470 billion

The government will whip Ministries, Departments, and Agencies (MDAs) to hike levies and introduce new ones to help supplement ordinary revenue collection, which has been falling short of the target.

In the Medium-Term Revenue Strategy (MTRS), between 2024-2027, Treasury has directed MDAs to collaborate with it to review tax laws and comply with the proposed strategy that seeks to increase Appropriation-in-Aid (AiA) collections by an extra Sh167.5 billion to Sh486.9 billion in the 2024/25 budget.

Printed AiA estimates were initially placed at Sh319.4 billion in the current 2023/24 budget cycle, but projections have since been raised upwards to Sh470.8 billion as the government eyes extra levies, fines, and charges across ministries.

Ministerial AiAs which mainly comprise revenues derived directly from State agencies through levies, charges, and fees, and higher collections mean reduced reliance on exchequer funding which uses ordinary tax revenues collected by the Kenya Revenue Authority (KRA).

Review of tax laws

“The MDAs will comply with the tax policies and laws proposed in the Strategy; collaborate with the National Treasury on review of tax laws; [and] work with KRA to build capacity on collection of withholding tax payable by the Ministry,” says treasury in the MTRS.

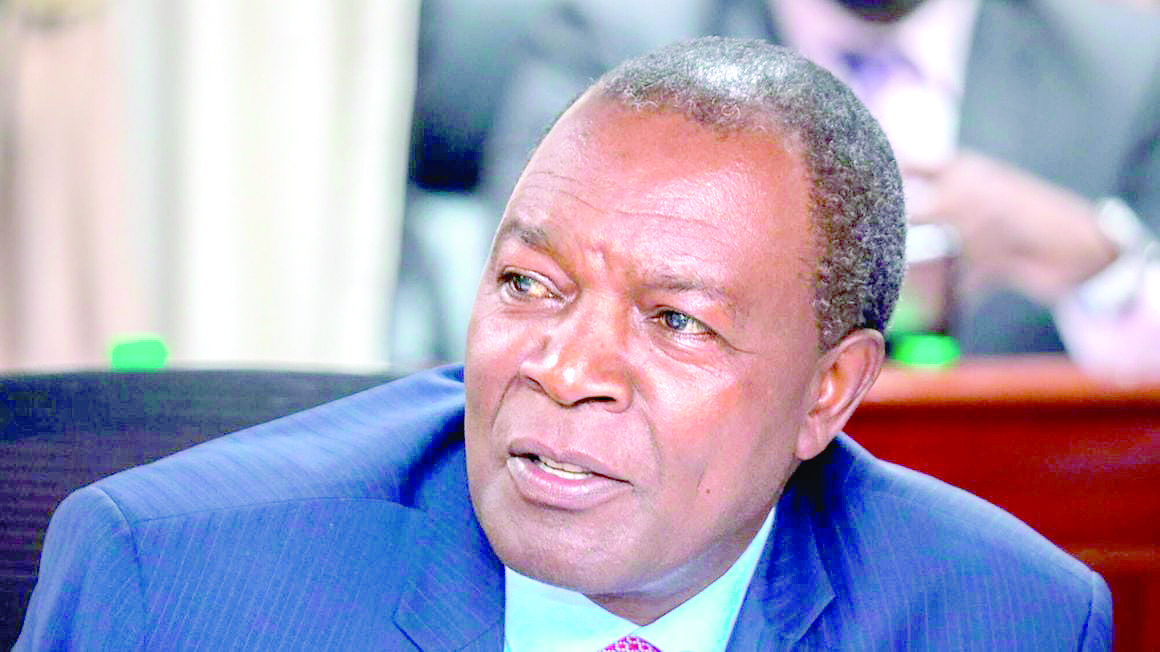

National Treasury Cabinet Secretary Njuguna Ndung’u has defended the move, arguing that levies and non-tax revenues as a share of gross domestic product (GDP) have largely remained constant in the past six years hence the need for review.

“Some of the factors affecting the performance of non-tax revenue include lack of a coherent policy, long period between reviews of fee/levies and semi-automated collection system,” he argues.

President William Ruto’s administration is under pressure to raise revenues through other alternatives as new direct taxes and hikes continue to face backlash from the opposition leaders and the private sector.

Most of these tax and levy reviews are being pushed by the World Bank and the International Monetary Fund (IMF) as part of structural reforms to help Kenya pay off burgeoning debt without default.

Raising levies by these ministries could, however, contribute to even a higher cost of living, exacerbated by weakening shilling, steep fuel prices, and tightening of the monetary policies. Kenya Roads Boards has, for instance, proposed an increase of road maintenance levy by Sh5 per litre in its 2023-27 strategy, something that Transport Cabinet Secretary Kipchumba Murkomen has supported but signals a rise in pump prices.

Treasury has equally indicated the possibility of introducing an Environmental Levy on imported raw materials by manufacturers to help address waste management from factories.

Imposition of new levies this year will be a continuation of the Finance Act 2023, which introduced the highly-contested Affordable Housing Levy that Ruto’s administration is trying to shield from being scrapped completely by the court.

Ministry of Trade and Investment also successfully pushed for an export promotion levy that was also infused in the Act.

The pressure from the Treasury explains why some ministries have raised levies, charges, and fees for various government services while others could follow suit by making similar proposals in the upcoming Finance Bill 2024. There are 20 ministries, but less than half had collected levies as AiA by the end of June 2023, when total proceeds reached Sh71.3 billion, an increase from Sh41.8 billion previously collected in June 2022.

These included the petroleum development levy fund paid by motorists at the pump under the Ministry of Energy, Railways Development Levy Fund (RDLF), and the Roads Maintenance Levy Fund (RDLF).

Decrease in receipts

Others were collected by the Ministry of Foreign Affairs, State Department of Broadcasting, State Department of Tourism, and State Department of Sports.

“There was a significant decrease in receipts from transit toll collected by Kenya Roads Board and remitted to the State Department for Roads. This was as a result of reduction of their allocation by the Kenya Roads Board,” Treasury says in the latest consolidated financial statements of MDAs.