Oil marketers express worry over VAT changes

Plans to increase Value-Added-Tax (VAT) is set to hit hard the petroleum industry hard due to increased capital costs, the sector lobby group Petroleum Association of Kenya (PAOK) has warned.

The group argue that they already operate under thin margins which will be significantly slashed if the VAT increase from the current eight per cen to 16 per cent as slated in the Finance Bill 2023 is ratified. Also, considering that the Energy and Petroleum Regulatory Authority (EPRA) is expected to reinstate caps on wholesale fuel prices from mid this month, big players could see their profit margins squeezed further. The wholesale market has a maximum margin of about one per cent yet withholding VAT on petroleum products is charged at two per cent per litre of fuel sold, signalling an additional cost since the players will be required to hold more than the collected profit. Under withholding VAT, selected agents are required to hold a portion of VAT and remit it to the Kenya Revenue Authority.

Cost of supply

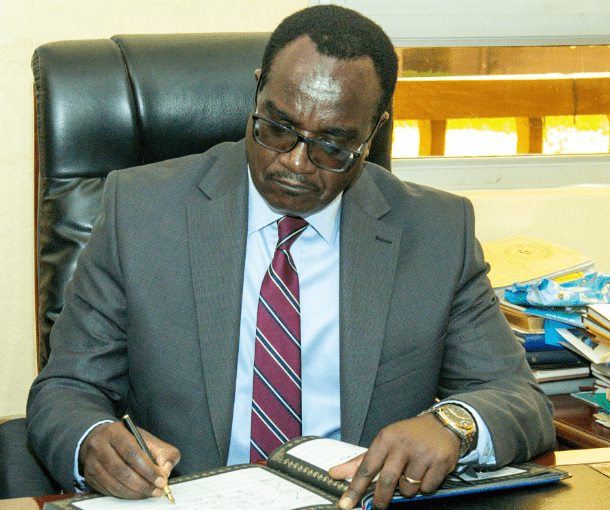

“Our margins are simply not enough to support supply of petroleum products. They need to be reviewed urgently to reflect the actual cost of supply,” says said POA chair Martin Chomba.

“We have with us a petition that all industry players have signed to demand a solution on this problem (withholding VAT),” he adds. The prices of fuel are hugely regulated and capped by the authority and oil marketers always rely on selling huge volumes to make a considerable profit.

For instance, capping wholesale prices, which is often Sh8 off the printed retail rates, offers small dealers a chance to remain profitable. Caps on wholesale fuel prices were scrapped in 2021.

The industry will be forced to either absorb the additional tax costs or pass them to end consumers at the pump.