NSE admits new online forex trader

Online foreign exchange trading broker Scope Markets Kenya has joined the Nairobi Securities Exchange (NSE) on a derivative contract to help its clients diversify their trading portfolio on leading stocks.

The admission comes after NSE granted it the operating licence yesterday to trade derivative contracts at the bourse as stipulated under the Capital Markets, Derivatives Markets Regulations, 2015.

Scope Markets Kenya, a subsidiary of SM Capital Markets, becomes the second non-dealing online foreign exchange-trading market participant to join the NSE Securities Derivatives Market (NEXT) after EGM Securities.

Seamless service

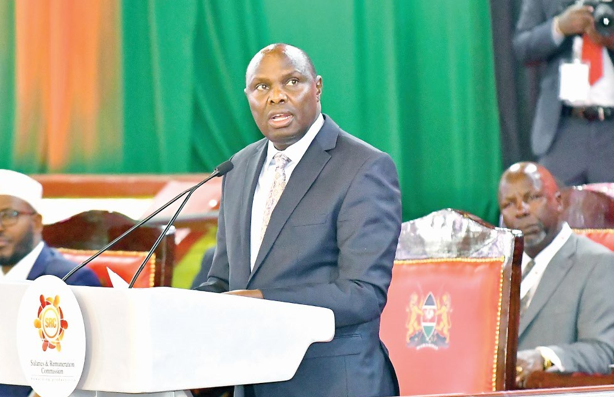

“’We commit to offer Kenyans a seamless service as we leverage our global affiliation and expertise to support diversification of our business and product offering,” Scope Markets Kenya CEO Alex Karanja said during the admission.

A derivatives contract is an agreement between two or more parties, usually a buyer and a seller, whose value is derived from that of an underlying asset such as currency, stock or commodity. When the value of the underlying asset changes, that of the derivates contract takes a similar course.

The move is expected to increase local integration of the Kenyan financial markets with international markets, thus helping traders manage increased volatility and uncertainties in asset prices both locally and internationally.

Derivative instruments are often used to hedge or reduce exposure to market fluctuations like bond prices, interest rates, currency exchange rates, and share values. The launch of derivatives markets back in 2019 was part of plans to boost liquidity on the bourse, which has about 65 listed firms.

Introduction of the derivatives market at the Nairobi Securities Exchange, dubbed “Next” three years ago, transformed the capital markets landscape in Kenya by offering investors an opportunity to diversify their investment portfolios. Next facilitates trading of futures contracts in the Kenyan market.