Government to hunt down Hustler Fund defaulters, says CS

The government plans to start tracing down the financial inclusion fund popularly known as the “hustler fund” defaulters to help recover the disbursed funds which it says can be used by borrowers with good credit score.

This comes as 94 per cent of the 22 million borrowers defaulted in making their payments resulting in the government’s disbursements decreasing drastically by 93.3 per cent in 2024, to fall at Sh800 million. This data is however according to a recent report by the national treasury.

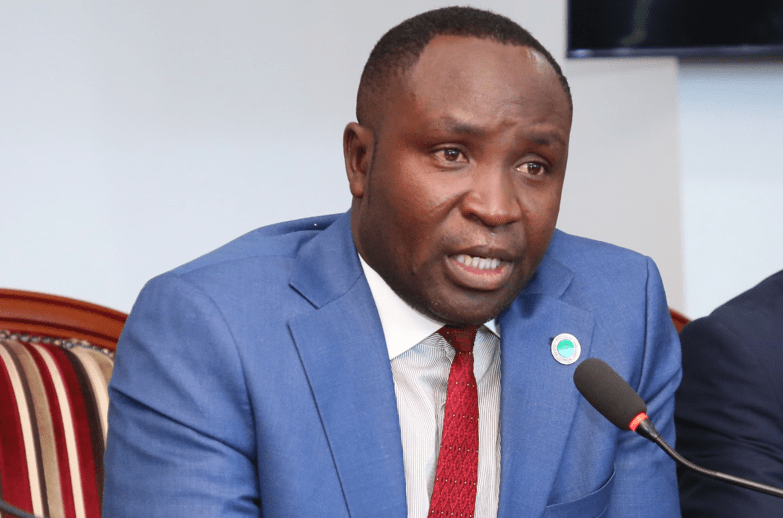

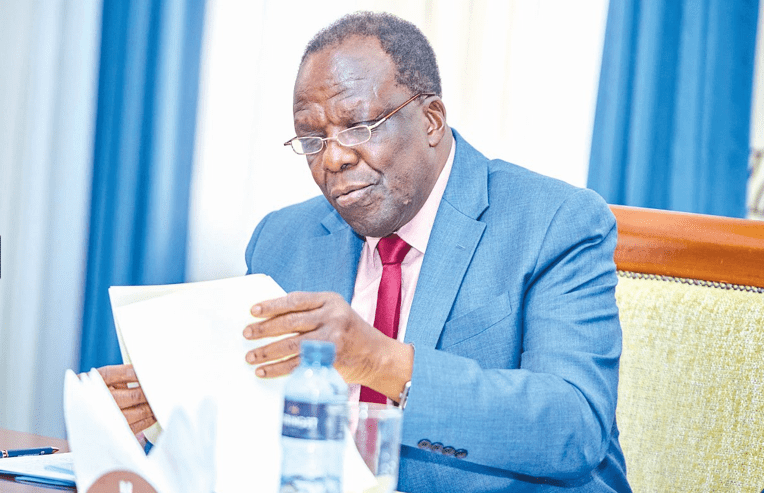

According to Co-operatives and Micro, Small and Medium Enterprises (MSMEs) Cabinet secretary, Wycliff Oparanya, the default has resulted in limited access to short term loans by small businesses in the country hence slowing down their growth.

“For those 19 million people, I am coming for you to make sure that you pay so that other borrowers can benefit too,” he said in a statement.

The fund in November 30,2023 had received a high uptake with the government reporting a disbursement of Sh39.7 billion to 21.8 million people and mobilizing Sh2 billion in savings. Total repayments then stood at Sh28.75 billion.

In December last year, President William Ruto had announced that the fund had disbursed Sh60 billion to Kenyans since its launch in 2022.

The impressive 2023 performance prompted Ruto during the launch of the funds’ first anniversary to announce the increase of the borrowing limit to up to 100 per cent.

“For those who have demonstrated a commitment to saving, and your savings exceed your loan limit, we will double your credit limit,” he said.

In August of the same year, he had urged defaulters to clear their debt in order to get access to the “Hustler Group Loan” which had just been launched.

“We know that there is a percentage of Kenyans who are yet to repay their debts, but I can tell you, you will not run far. We have put money in the business loan account but you will not get the loan until you have cleared the arrears,” Ruto said.

“We have added another 10 billion for business loans. Groups will get between Sh20,000 and Sh1 million, but before you get the loan, you must first pay the amount you borrowed.”