NOCK braces for Sh2.2b loss for year ended June

National Oil Corporation of Kenya (NOCK) is staring at a net loss of Sh2.2 billion for the full financial year ending June 2023 even as government dangles new capital-intensive programmes for a corporation that has severally failed in implementation.

The projected losses are linked to the hefty debts, pending bills, and mismanagement that have forced the oil marketer to depend on State bailout to remain afloat. According to documents presented before the parliamentary Budget and Appropriation Committee, the State agency is set to incur Sh1.5 billion financing costs arising from loan interest and default penalties alone.

The debts are owed to various suppliers and banks such as Stanbic Bank and KCB Group. “National Oil Corporation of Kenya is technically insolvent… In FY2022/23, the corporation is projected to make a loss of Sh2.2 billion with financing cost contributing Sh1.5 billion,” reads the report by MP Vincent Musyoka-led departmental Energy Committee.

NOCK currently has liabilities exceeding Sh10 billion against current assets of Sh1.95 billion. It is shouldering some Sh1.28 billion pending bills and non-performing loans (NPL) amounting Sh7.8 billion as of December 31, 2022. The financially-troubled NOCK has always been dogged with mismanagement, theft, and kickbacks over the years, which has currently left it trailing leading oil marketers such as Rubis, Total, and Vivo Energy.

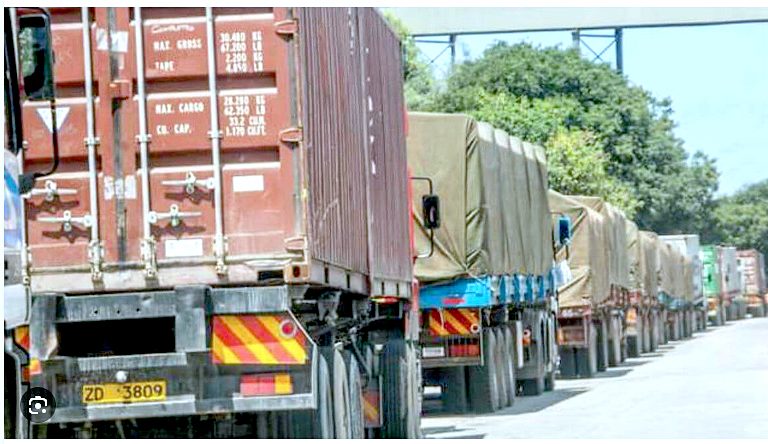

The government is now banking on fastening reforms to enable the firm commence shipping at least 30 per cent of the petroleum imports quota into the country, a strategy viewed by the committee as an alternative to ease pressure on State expenses linked to the fuel stabilisation programme. “There is need for the State Department (Petroleum) to put in place a sound, robust and comprehensive turnaround strategy for the National Oil Corporation of Kenya owing to the strategic importance of the State corporation which is involved in all aspects of the petroleum supply chain,” the Mwala MP told his colleagues.

Importation right

The 30 per cent importation right is enshrined in the Draft Petroleum (Importation) (Quota Allocations) Regulations, 2022, and is expected to maintain the country’s oil reserves to counter possible fuel crisis while boosting NOCK’s cash flow.

While it is clear NOCK is teetering on the edge of bankruptcy, concerns abound whether going forward, the corporation will sustain delivering its core mandate, which includes last-mile distribution of fuel, alongside implementing crucial government projects in the lucrative energy sector.

Last June, the corporation was stripped of the role of directly delivering subsidised gas cylinders to end users in the second attempt by the government to revive the multi-billion project whose first phase ended NOCK’s misappropriation of funds. NOCK was to own the brand and operate refill depots as local dealers do distribution, having paid Sh250 000 each as a non-refundable authorisation fee.

That second distribution attempt, the Mwananchi gas project, is yet to be implemented by NOCK eight months later, despite the programme having a Sh470 million budgetary allocation for the FY2022/23. The current administration has since slashed the project’s budget by 35 per cent to Sh306 million in the first supplementary budget.

Apart from distribution, NOCK’s other critical operations also cover upstream oil and gas exploration and midstream petroleum infrastructure development projects, all of which equally face budget cuts in the mini-budget as President William Ruto’s austerity measures bite.