KRA reassures on likely impact of new global tax reforms

Kenya Revenue Authority (KRA) has allayed fears on possible loss of revenue from multinational firms following the signing of a tax framework that will reform international tax rules.

The concerns follows an announcement from the Organisation for Economic Co-operation and Development (OECD) that significant reforms of the international tax system has been finalised.

In the reforms, Multinational Enterprises (MNEs) will be subjected to a minimum 15 per cent tax rate from 2023.

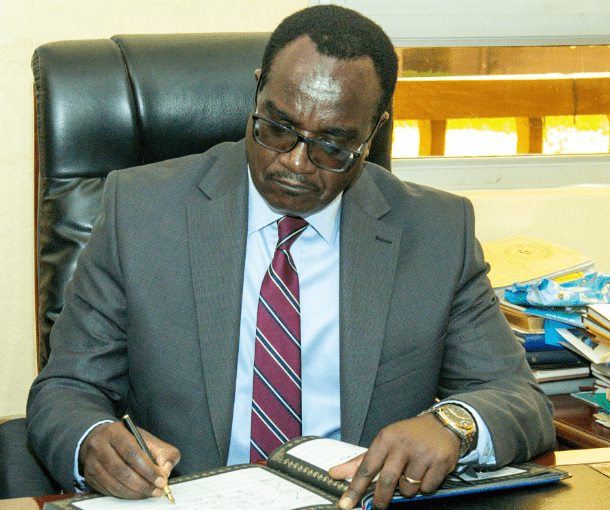

Speaking at the seventh KRA Annual Tax Summit opening, KRA Commissioner General Githii Mburu said Kenya had shared its technical concerns and was party to the ongoing developments spearheaded by the OECD and G20 countries.

“The introduction of the Digital Service Tax in Kenya has helped curb tax avoidance by multinational firms engaged in digital enterprises. With the growing revenues generated from such MNE’s, Kenya will consider the benefits of the Inclusive Framework cautiously,” he said.

The OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (IF) has agreed on a two-pillar solution to address the tax challenges arising from the digitalization of the economy.

Actively consulting

Mburu said he was actively consulting and has shared a detailed technical proposal with the OECD to ensure a win-win outcome in the ongoing global developments focusing on the taxation of digital sector players.

The country, he said, will clinically analyse benefits accruing from the proposed framework and will not rush to forego benefits arising from the implementation of the Digital Service Tax.