KRA attempts to hold 50pc of disputed taxes to hurt private sector

The National Treasury has proposed that companies that dispute tax claims by Kenya Revenue Authority (KRA) be made to deposit 50 per cent of the disputed amount with the government before a resolution in what could spark court battles with the private sector.

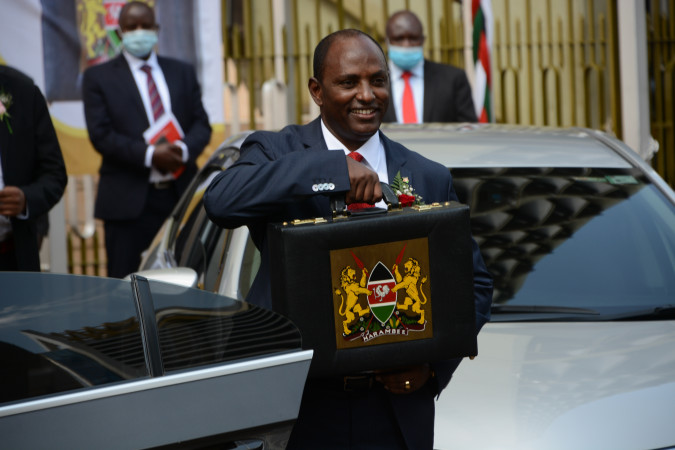

Reading his final budget policy statement under President Uhuru Kenyatta, Treasury Cabinet Secretary Ukur Yattani said depositing half of the disputed funds with the central bank. is meant to reduce the effect of delays in tax disputes

“Mr Speaker, we have noted that tax disputes take too long to conclude, especially after judgement by the Tax Appeals Tribunal. To protect the disputed tax revenue, I propose to amend the Tax Appeals Tribunal Act, 2013 to require a deposit of 50 per cent of the disputed tax revenue in a special account at the Central Bank of Kenya,” Yattani said.

Experts however say this will significantly raise the cost of doing business, especially in the case of companies wrongfully accused of tax evasion.

Ernst and Young Consulting say that such an amendment is likely to impact taxpayers’ cashflows negatively.

“Given historically how long it takes the revenue authority to refund taxpayers, getting back the 50 per cent deposit on time may prove to be an uphill task,” said the consulting firm in a post-budget statement.

Sh150b realisable tax

KRA estimates it currently has over 570 tax disputes tied up in court with realisable revenue standing at Sh150.0 billion.

The company’s aggressive revenue recovery tactics have hit companies hard forcing some to shut down raising concerns in some quarters that the agency is killing businesses instead of helping them to grow.

The latest dispute that hit national news was that of Keroche Breweries in which the taxman went ahead to shut down the company’s operations, sending hundreds of workers home.