Kenya’s trade growth muted by dip in net financial inflows

Despite modest improvements in trade and current account deficits, Kenya grappled with a decline in net financial inflows and a deteriorating international investment position in 2023, the latest Economic Survey shows.

According to the 2024 report released by the Kenya National Bureau of Statistics (KNBS), Kenya’s Net International Investment Position (IIP) — a key barometer of the country’s financial standing in terms of assets and liabilities with the rest of the world — saw a substantial increase. The country’s debt to foreign entities surged by 22.7 per cent, from Sh7,448.3 billion to Sh9,139.9 billion within a year.

The rise was marked by a 34.2 per cent increase in external assets, valued at Sh3,980.7 billion, and a more significant 26.5 per cent hike in external liabilities, which stood at Sh13,174.6 billion by the end of 2023.

Economic expansion

“While the asset growth signals potential economic expansion, it was eclipsed by the surge in liabilities, indicating a heavier financial burden for the nation,” the report says. The period also saw a 21.2 per cent drop in net financial inflows, dwindling to Sh384.7 billion from Sh488.4 billion the previous year. This decline, coupled with the mounting liabilities, led to a worsening of Kenya’s net IIP, resulting in a borrowing position of Sh9,139.9 billion at the close of 2023.

Amid these fiscal challenges, Kenya’s international trade landscape showed resilience, with the total trade value climbing by 7.6 per cent to Sh3.6 trillion.

This growth was spurred in part by the high global prices of imported commodities, especially petroleum products, and exacerbated by the Kenyan shilling’s depreciation against the currencies of major trading partners, making imports more expensive.

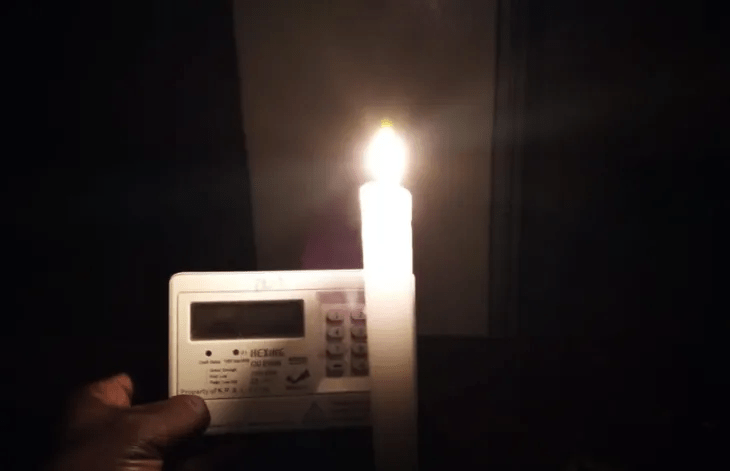

In response to the financial strain on Kenyans from rising fuel costs and the escalating cost of living, the government reintroduced a fuel subsidy aimed at temporarily stabilising retail fuel prices.

Additionally, the Energy and Petroleum Regulatory Authority (Epra) implemented subsidies on kerosene, diesel, and petrol to prevent a spike in pump prices.

Inflationary pressures

To address the shilling’s depreciation and inflationary pressures, the Central Bank of Kenya’s Monetary Policy Committee (MPC) took a bold step by raising the Central Bank Rate (CBR) from 10.50 per cent to 12.50 basis points. Amidst global economic uncertainties and volatile oil prices, this move was a strategic effort to attract investors to the shilling and to moderate the currency’s decline.

The survey also underscored a positive trend in export earnings, which increased by 15.4 per cent to Sh1,007.9 billion, aiding in the slight reduction of the trade deficit from Sh1,617.6 billion in 2022 to Sh1,604.1 billion in 2023. Furthermore, Kenya’s balance of payments, which reflects the nation’s economic transactions with the global market, showed marked improvement as the deficit narrowed to Sh134.8 billion from Sh251.5 billion the previous year.

This was largely driven by a substantial decrease in the current account deficit, supported by a robust increase in export revenues that outpaced import costs.