Kenyans stare at more taxes as State seeks Sh230 billion

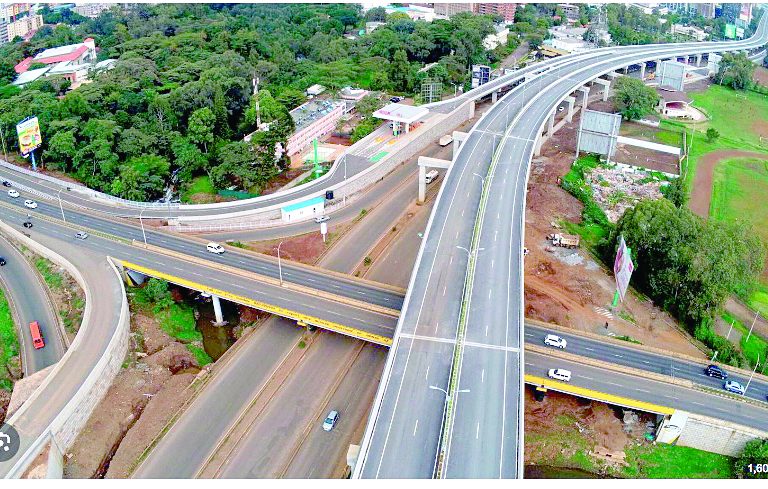

The Kenya Kwanza government is still eyeing more tax avenues from the already suffering Kenyans to finance its projects, but in what feels like double taxation, as consumers will again be charged to use the same utilities.

Casting a blind eye on the financial woes affecting them and businesses in the country, the State mulls raising up to Sh230 billion from road tolling to facilitate road development, maintenance and rehabilitation in a bid to deter avoidable accidents and boost economic growth as a result of enhancing seamless transport services as indicated in a draft line ministry report.

Kenya Road Board (KRB) in a draft report that assessed the state of the country´s road infrastructure, standing under public participation, stated that the current Road Maintenance Levy Fund (RMLF), currently at Sh132 billion is unsustainable, facing potential decline as a result of expected growth of electric vehicles, change in transport models by Kenyans and the inadequate funding by the national government.

Fuel-efficient vehicles

“As discussed herein, the fuel levy collection is reducing due to the emergence of e-mobility, more fuel-efficient vehicles, reduced vehicle registration as reported by NTSA, and the shift to public transport by the general population due to the current economic situation in the country. The rationale for tolling, therefore, is to complement the RMLF to generate revenues for the development, maintenance, and rehabilitation of the road infrastructure,” the report reads in part.

According to KRB, Compared to internal combustion vehicles (ICEs), EVs reduce GreenHouse Gas (GHG) emissions by 41 per cent and a significant growth in EVs is projected in the next 10 years to account for 30 per cent of annual sales or registration of vehicle fleets, fuelled by policy framework awareness, reasonable EV infrastructure, global pressure to transition to green energy, and climate change campaigns.

In terms of the funding, a 2024 road sub-sector analysis projects a budgetary allocation for the development and maintenance of roads based on historical trends for a 5-year and 10-year period.

As such, Sh1.3 trillion was approximated to be allocated over the next five years and a total of Sh65.37 billion was already committed to various projects, which translates to an uncommitted budget of Sh827.9 billion for development and Sh471.0 billion for maintenance for the next 5 years.

For the 10-year period, the uncommitted budget is Sh. 3.0 trillion which comprises Sh1.9 trillion for development and Sh1.1 trillion for maintenance.

The findings from the road sub-sector analysis on the financing gap for development also shows a deficit of Sh4.05 trillion above the available development budget of Sh1.096 trillion over the next 10-year planning period based on their engineering-based method.

“The RMLF alone cannot sustain the maintenance of the expanding road network in the long-term and this unsustainability necessitates the need to adopt strategies to seek alternative and long-term funding solutions for road maintenance; and alternative sources of road financing on the African continent such as tolling have been investigated and are in part being implemented,” the ministry said.

Roads development

The ministry further defends its proposal, saying that the funding from loans and grants extended to the government have to be spread across various sectors of the economy making it difficult to channel sufficient funds to facilitate major roads development.

“The current funding gap for development of new infrastructure and maintenance of the existing ones necessitates additional sources of funding for the development, maintenance, and rehabilitation of the ever-expanding road network which is also constantly facing dilapidation from overloading and the effects of climate change as experienced in the last extensive rains.”

Even though the RMLF Act enacted in 1993 provides a sustainable source of funding for the road network, the proposed fees is seen as untimely as many Kenyans are still trying to adjust with the current high tax obligations which continue to make the cost of living unbearable.

Consequently, their purchasing power has significantly been impacted resulting in a low demand of goods and services ultimately affecting businesses in the country which are also grappling with high operational costs.

Business landscape

This is something that the government seems to be ignoring, a factor that has continuously affected even the business landscape in the country hampering economic growth. With the continued increase in taxes, companies have recently been seen winding up operations in the country with majority of them citing low demand and tough operating environment factored by the high taxation.

The tendency of the government to impose new taxes on Kenyans has also been criticised by stakeholders who have warned that excessive taxation could lead to social unrest, proposing an intense inhouse sweeping by the government as the amount it raises in every financial year, is sufficient to finance development projects without the need to further increase the public debt burden.

To realise the full potential of the revenue collected, they have also