Kenyan firms eye regional markets to propel growth

After a slow push, Kenyan manufacturers are gearing up to export more products through the Africa Continental Free Trade Area (AfCFTA) as part of a raft of measures to ignite growth.

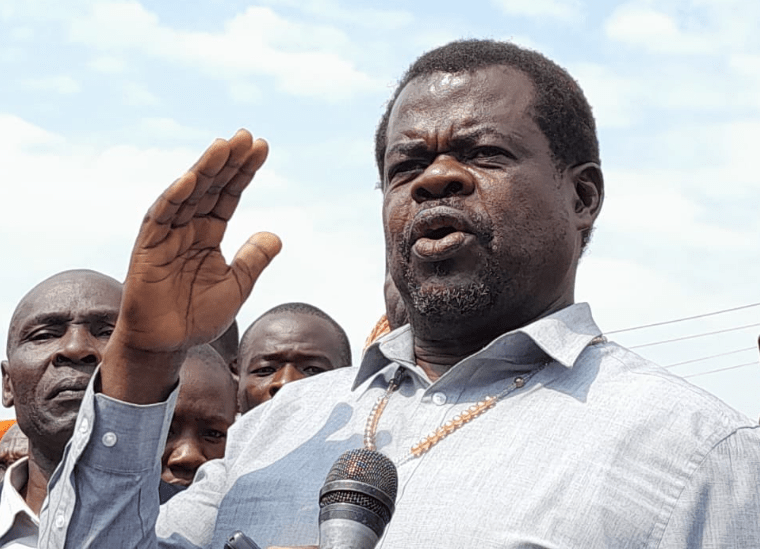

The push for AfCFTA alongside, other intraregional trade deals, is expected to help Kenya cut over-reliance on specific markets, most of which were disrupted by the pandemic shocks. “Manufacturing sector growth will not be achieved by solely relying on domestic markets. This calls on Kenya to leverage products where we have a comparative advantage to grow our exports,” said Kenya Association of Manufacturers CEO Antony Mwangi.

“This will enable us to improve our balance of payments and foreign currency supply and enhance trade within the EAC and the Africa Continental Free Trade Area (AfCFTA),” he added in regards to the sector’s progress. KAM targets increasing the manufacturing sector’s contribution to the gross domestic product (GDP) to 20 per cent by 2030.

Kenya is among the African countries that launched AfCFTA back in 2019, but the implementation of the single continental market has slow, when exports started trickling under this agreement.

Some African nations, including Kenya, Egypt, Rwanda, and Ghana, have companies with registered AfCFTA-certified products. For example, in September 2022, Kenya’s Associated Battery Manufacturers (E.A) Ltd shipped locally-made car and truck batteries to Ghana as it officially started selling its products within Africa on preferential terms.

However, the sluggish start of the pan-African trade deal has been compounded by various factors, including the Covid-19 pandemic, the reluctance of some of the nations to ratify the deal, and disagreement between members on the rules of origin for some product lines. AfCFTA aims to liberalise intra-Africa trade by 2030 by eliminating most cross-border taxes. About 90 per cent of tariff lines are expected to be phased out over the next five to 10 years, while another seven per cent of tax policies viewed as sensitive could get more time for review before elimination.

Bargaining power

It is expected that the successful implementation of AfCFTA could help Africa attract more foreign investments and bolster their bargaining power when seeking the renewal of the Africa Growth and Opportunity Act (Agoa) in 2025 with the United States. The Act offered free trade agreement for Kenya to access the US market of more than 6,000 product lines, but President Joe Biden’s administration froze the agreement, and there have been attempts to initiate fresh talks.

Kenyan manufacturers have found it hard to increase their productivity and export as a series of domestic policies and hurdles continue to exacerbate production costs. The surge in the costs of electricity and fuel in the last couple of months has, for instance, left firms in nearly all the sectors spending more on production alone.

Latest data from Kenya National Bureau of Statistics (KNBS) shows that Kenya’s trade deficit widened by 15.8 per cent to Sh434 billion in the third quarter of 2022.

This was on the back of higher importation of petroleum products and fertiliser that outweighed exports which had, however, increased.

Growth in export was mainly from agricultural products like tea, coffee, avocado, and palm oil. Higher export than import often widens Kenya’s current account, unlocking the demand for the dollar, thus putting pressure on the country’s forex reserves.