Kenya targets 5th Eurobond to clear maturing loans

Kenya is in the market for a financial consultant to guide the National Treasury in the process of accessing its fifth Eurobond to help finance its debt and budget deficit for the financial year 2023/24.

National Treasury said yesterday that it needed a consultant who will engage with a wide range of investors from North America, Europe, the Middle East and Asia.

Central Bank of Kenya (CBK) Governor Patrick Njoroge had hinted that Kenya expects to receive at least $1.2 billion (Sh162 billion) between April and May this year.

Out of the amount, $250 million (Sh33.7 billion) is expected in April from syndicated loans, while $1billion (Sh135 billion) is expected from the World Bank in May for budgetary support. Further, the Director-General, Public Debt Management Haron Sirima said Kenya may opt to issue a Eurobond with a different tenor to manage maturity of a $2 billion (Sh270 billion), 10-year bond this year in tranches.

“There is a likelihood that we may issue an instrument that is not of the same tenor,” Sirima told Reuters in an interview, saying it will be structured in two or three tranches, depending on the advice received from bankers.

Huge maturities

“We may not want to see such huge maturities in the future. It poses a risk. $2 billion is significant,” Sirima said at the time.

The consultant will advise National Treasury on the optimal strategy for liability management of Kenya’s outstanding Eurobonds, including but not limited to the Eurobond that matures in 2024, in line with Kenya’s medium-term debt management strategy.

“The National Treasury requests for the Expression of interest (EoL) from reputable financial institutions duly licensed to operate in North America; and/or Europe; and/ or Middle East; and/ or Asia to provide comprehensive lead manager services to successfully accompany Kenya’s return to international capital markets,” Treasury said in the advertisement in part.

Before vacating office last year, immediate former National Treasury Cabinet Secretary Ukur Yatani indicated that the country had a significant budget gap of Sh862 billion that was to be funded through debt.

Soon after the release of the Economic Survey 2022 in May last year, he hinted to journalists of plans to source $1 billion (Sh135 billion), saying, “We will have it before the end of this financial year.”

Last week, the Eurobonds declined, registering a weighted average performance of negative 0.4 per cent with yields trending higher by a weighted average increase of 12.1bps, IC Asset Managers Economist Churchill Ogutu said.

He noted that Eurobonds performance was broad-based across African countries, with the risk-off sentiment that has been prevalent following the banking sector instability last month.

Fiscal concerns

“We think FX, and fiscal concerns will continue driving idiosyncratic risks. For Kenya specifically, it is less clear what’s the strategy towards the upcoming KENINT 6.875 per cent 2024 ($2.0 billion) maturity. It now boils down to the messaging; GoK informing the market that its borrowing needs in the international market in FY 2023/24 will purely be towards refinancing the KENINT 6.875 per cent 2024 (USD 2.0 B),” Ogutu said.

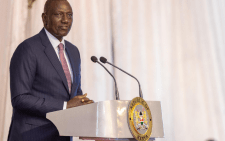

Central bank of Kenya (CBK) Governor Patric Njoroge on his part said: “The government has many options. They are keeping them close to their chest.”

According to Kenya’s 2023 Medium Term Debt Management Strategy, there are heavy maturities of domestic debt in 2023 due to maturing short-term government securities, with a smooth repayment structure except for spikes in 2023, 2024 and 2028 due to maturities of international sovereign bonds, putting the government in a quandary on whether to spend on recurrent expenditure, development projects or re-finance its debt.

Central Bank of Kenya’s data indicates that by January this year, Kenya had a total debt portfolio of Sh9.182 trillion composed of a Sh4.5 trillion stock of domestic debt and Sh4.68 trillion of external debt.

Kenya’s debt burden, compounded by a weakening local currency and international market turmoil, have led some market participants to speculate that Kenya could follow the likes of Zambia and Ghana into default, something the government rejects.